We live in interesting times. The S&P 500 has undergone a garden variety pullback in the last few days after reaching a fresh all-time high on a total return basis (including dividends) last week. Meanwhile, the VIX has rocketed higher as S&P 500 options SKEW (premium that options traders are paying for out of the money puts relative to out of the money calls) is the highest it has been in years:

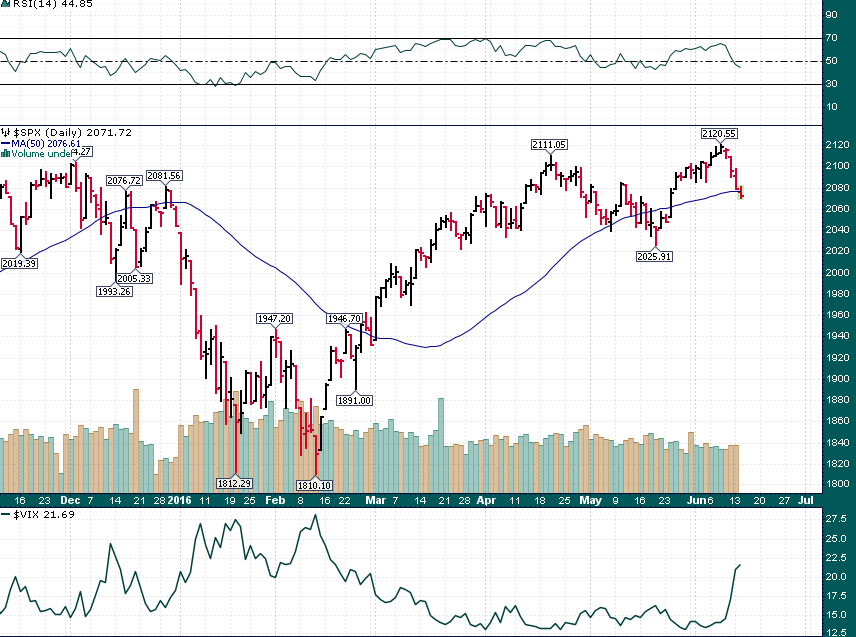

S&P 500 (Daily)

The VIX (at bottom of chart above) has rocketed higher amid a relatively standard pullback in equities.

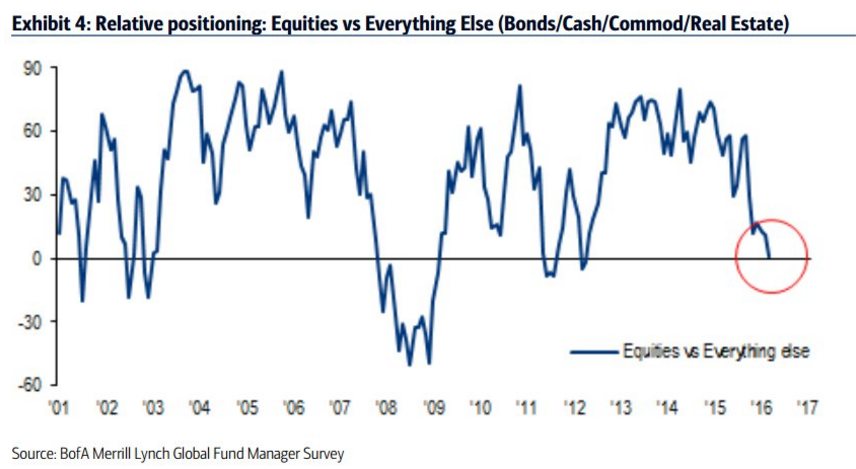

Equities are also the most out of favor they have been relative to other asset classes since 2012:

The surge in options SKEW, the surge in the VIX, and equities being the most out of favor they have been since 2012 makes for a curious combination of bearishness given that the major indices remain at lofty levels. The question now becomes whether investors and options traders have smartly hedged themselves and reduced exposure ahead of a major correction, or is this morning’s pullback to test the rising 50-day moving average in the S&P 500 an opportunity to buy a pullback within the context of an uptrend?

One thing is for certain: The wall of worry is tall and formidable in this market.