The yield on the 30-year Treasury Bond has rallied more than 35 basis points since late-August:

However, there is good reason to believe there isn’t much risk of more upside in bond yields regardless of what the Federal Reserve announces tomorrow:

“Long [duration] bonds want the Fed to tighten. The long bond wants there to be deflation. Why else would you buy a long bond yielding 3 percent, other than there’s a strong likelihood of zero inflation or negative inflation? If you think inflation is going to be 2 percent, you probably have no interest in a 2.75-percent-yielding 30-year Treasury bond, and certainly have no interest in a 2-percent-yielding 10-year Treasury bond.

The long end of the bond market—perversely, versus the way people think about it—rallies when the Fed is about to tighten, or is perceived to be more likely to tighten. And it struggles even in the face of high-stock-market volatility, when they think the Fed is less likely to tighten. That’s the Rosetta Stone right now to figuring out how the markets are behaving. Most people don’t get this.” ~ Jeffrey Gundlach

Get that? According to Gundlach if the Fed raises the Fed funds rate, a short term rate that banks charge one another for overnight loans, it is likely to put downward pressure on long duration interest rates (10-year and 30-year Treasury yields, the bond yields which affect mortgage rates). Such a scenario will result in a flattening yield curve and further disinflationary/deflationary pressures. In fact, it seems that the more hawkish the Fed is (aggressive in raising rates or talking about raising rates) the more bullish it could be for Treasuries (bearish for yields).

Given that rising interest rates (long duration yields, mortgage rates, etc.) are perhaps one of the biggest threats to equity valuations and the economy as a whole, the fact that a rate-hike would actually be more likely to put downward pressure on the long end of the yield curve is a welcome reprieve to investors.

Perhaps the most interesting outcome of tomorrow’s Fed announcement would be a very dovish Fed that does not raise and pushes back the possibility of a rate hike for at least another 6 months. Here’s what Credit Suisse has to say about such a scenario:

“A clearly dovish Fed that takes the idea of rate hikes off the table for at least 6 months: This would prove a material shock to the market and should result in material losses for the USD on a TWI basis of at least 5% in the remainder of 2015. This scenario would stress our existing USD-bullish forecast profile unless we were to expect relatively rapid dovish tilts in response by other central banks.”

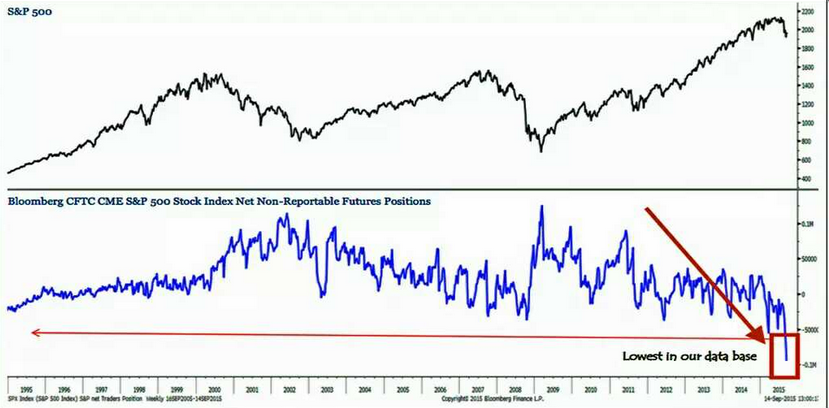

In this case we are likely to see equities rally aggressively, the US dollar sell-off, and Treasuries also sell-off (yields rally). Therefore, as paradoxical as it may be, a rate-hike is not bearish for risk assets. Yesterday’s 240 point rally in the Dow Jones Industrials and big sell-off in Treasuries may have been a precursor to a dovish Fed announcement on Thursday. Given the current bearish sentiment backdrop and heavy futures hedging , equities in particular could be a coiled spring in the event of a dovish Fed announcement:

Small (non-reportable) futures speculators have taken a massive short position in stock index futures!