Rob Hanna over at quantifiable edges has an excellent post up this morning which highlights what has historically happened when there are large intraday rallies such as the one we saw on Friday which are followed by tight consolidations like we saw yesterday. The results are decidedly bearish for the next 5 trading days:

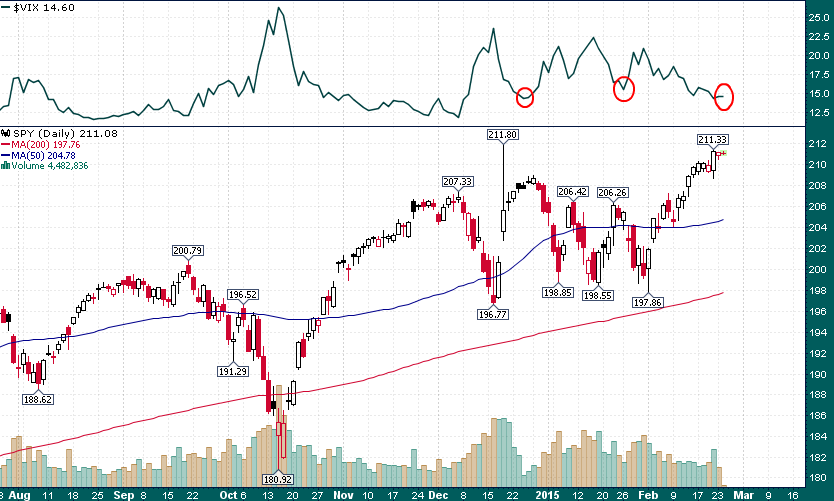

Interestingly enough there are other signs forming that indicate a short-term pullback might be imminent. The VIX is back down to levels which have led to 2 of the last 3 pullbacks in the S&P:

Read the entire post: A Big Move Up Followed By Narrow Range on Light Volume