“The mood swings of the securities markets resemble the movement of a pendulum. Although the midpoint of its arc best describes the location of the pendulum “on average,” it actually spends very little of its time there. Instead, it is almost always swinging toward or away from the extremes of its arc. But whenever the pendulum is near either extreme, it is inevitable that it will move back toward the midpoint sooner or later. In fact, it is the movement toward the extreme itself that supplies the energy for the swing back.” ~ Howard Marks

This quote from Howard Marks, which likens the financial market to a pendulum, is perhaps my most treasured analogy for financial markets. It should resonate especially well with investors in precious metals, given their apt understanding of the concept of market ‘mood swings.’ After all, few asset classes are as susceptible to the emotional swings of investors as gold and silver.

Specifically, silver is incredibly susceptible to the volatile moods of investors. Despite gold maintaining a roughly 5% gain for the year to date, the so-called ‘poor man’s gold’ has unfortunately found itself deeply in the red for 2023, with a decline of 7%:

Silver (Daily)

Silver is testing its rising 200-day moving average, with major support at $22.00 just below. The $22.00 level has proven to be major support/resistance on numerous occasions in the last several years, and I anticipate it won’t be different this time.

As would be expected following such a drastic reversal of fortune for gold and silver in recent weeks, investor sentiment towards these metals has deteriorated dramatically. According to the Hulbert Gold Newsletter Sentiment Index (HGNSI), the consensus among precious metals newsletters is to currently recommend shorting gold and silver. Furthermore, as of Wednesday’s market close, the Daily Sentiment Index (DSI) for silver reached a reading of 12.

Historically, it has been a very good time to buy gold and silver when the following conditions line up simultaneously:

- DSI reaches single digits

- The HGNSI is showing that newsletter writers are net short

- The silver price is testing a major technical support level

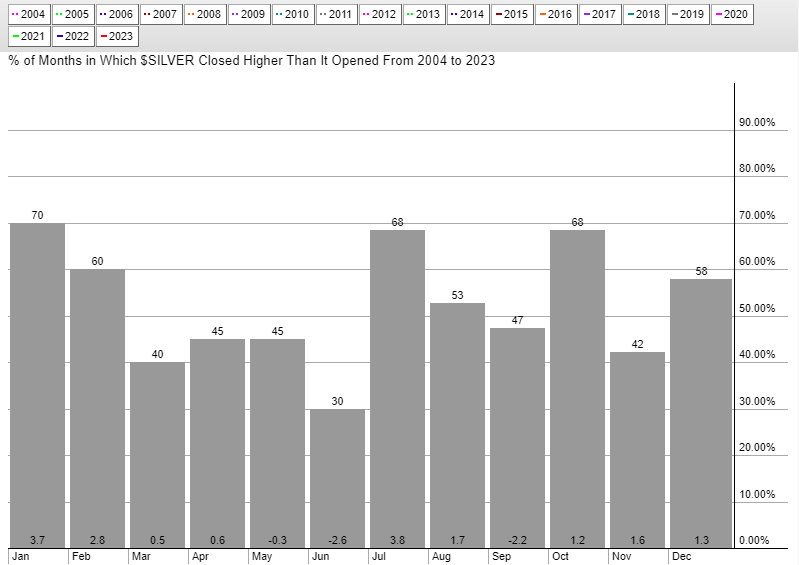

The 2nd and 3rd conditions have been reached, and the first one could be achieved today or tomorrow. Adding a nice touch to an already sweet setup, historical data from the past twenty years reveals that July has typically been the best month of the year for silver with an average gain of nearly 4% for the month:

There is no doubt that June has been a tough month to be a junior mining investor, and frankly May wasn’t any better. However, through all of the illiquidity and painful share price declines I find myself being unusually optimistic. Many of the companies that I own and follow closely are out in the field conducting drilling programs, and we have already heard from a number of them. So far it’s been relatively good news and my spidey sense tells me that there will be more good news coming throughout the summer.

Discovery is the lifeblood of junior mining, and there could be no better time for companies to announce a number of new discoveries. My shopping list begins and ends with junior miners that meet the following set of criteria:

- Enough cash in the treasury to make it into early 2024

- Ongoing drill program(s), or drilling about to commence within weeks

- Share price unfairly punished along with the rest of the sector in recent weeks

- Quality management team with track record of success

The list of companies that meet this criteria today is a very long one, however, I will offer a handful of names that I own today and in which I have added to my positions in recent weeks:

- Kodiak Copper (TSX-V:KDK)

- Endurance Gold (TSX-V:EDG)

- Banyan Gold (TSX-V:BYN)

- American Eagle Gold (TSX-V:AE)

- Eagle Plains Resources (TSX-V:EPL)

As always please do your own due diligence, junior mining stocks are extremely high risk and there are no guarantees of exploration success.

Disclosure: Author has been compensated for marketing services by Eagle Plains Resources and Endurance Gold Corp. Author may buy or sell shares of companies mentioned in this article without notice.

_____________________________________________________________________

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. American Eagle Gold Corp. and Banyan Gold Corp. are high-risk venture stocks and not suitable for most investors. Consult each company’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover American Eagle Gold Corp. and Banyan Gold Corp. and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.