In this month’s conversation with 321gold founder Bob Moriarty we discuss why the US banking system is a giant casino. Bob believes we need to burn it down and begin again with a system of sound money, including gold and silver. In addition, Bob believes that the global financial system in such a precarious state, and the gold market is so tiny, that it wouldn’t take much for gold to move up $200/oz in a single day. We also spend some time discuss several junior mining companies, including one that Bob recently wrote about. Without further ado, Energy & Gold’s May 2023 conversation with Bob Moriarty…

Goldfinger:

Bob, we are having some serious regional banking turmoil in the US. It seems like every day now there’s some new bank in trouble. Today, it’s PacWest and Western Alliance.

Clearly there’s losses in regional banks that have a lot of real estate exposure to places like San Francisco or Phoenix, that have had pretty significant downturns in the last year and a half.

Then, they hold a lot of interest rate risk. I mean, that’s just the nature of banks. What do you make of this? I mean, this seems like it’s really gaining steam but the broader stock market doesn’t seem to think it’s much of a risk.

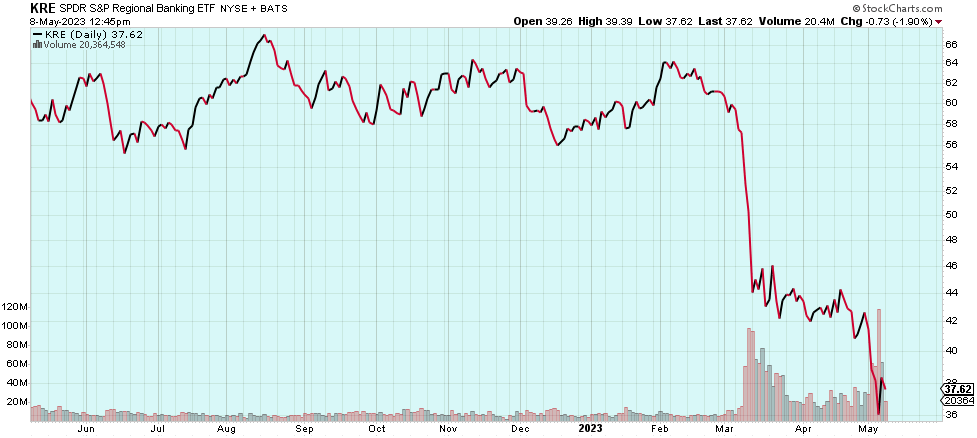

KRE (Regional Banking ETF)

Bob Moriarty:

Yeah, of course it is. Here’s the key. If you go back to March, when the bank failures started, the Wall Street Journal put out an article saying there were 186 banks on the verge of going under. You kind of hinted at it, but this isn’t a perfect storm for banks.

Their vast investments in US government 30-year treasuries were down 29%. That’s supposed to be the safest investment. Commercial real estate is getting killed.

You said regional banks, but I don’t think regional banks are important. I think it’s the entire banking system. It’s bankrupt.

Stanford just came out with study. There were about 4,800 banks. They said 2,300 of them are at risk.

Now, I’m going to ask you dumb question, but I think it’s something you’re aware of. All banks lend long and borrow short. So, no matter how good a bank is, it always has the potential for a bank run.

When Stanford comes out saying 2,300 banks are in danger, they’re really adding fuel to the fire. We need to burn the financial system down.

The debt-based financial system of the west, that goes back to Greek and Roman times has failed and always fails.

We’ve got $300 trillion worth of debt that cannot be paid. The sooner we do something about it, the better. You realize we’re not doing anything to actually solve the real problem.

Goldfinger:

Well, the real problem is debt and…

Bob Moriarty:

Nope. No, it’s not.

Goldfinger:

What’s the real problem then?

Bob Moriarty:

Harvard Business School teaches a four point way of problem determination and solution. The first point is, What’s the apparent problem? The second point is, What’s the real problem? The third point is, What are all possible solutions? The fourth point is Implement the best solution.

Now you said debt is the problem. Let me take you back to 1997 under Bill Clinton’s administration. They repealed Glass-Steagall. Okay. Are you starting to understand what the real problem is?

Goldfinger:

I mean, basically the structure of the US financial system?

Bob Moriarty:

What did Glass-Steagall do?

Goldfinger:

It created a separation between retail banking and investment banking.

Bob Moriarty:

Exactly. So when you repeal it, what did we turn the banking system into?

Goldfinger:

A big hedge fund?

Bob Moriarty:

Nope, a giant casino. It’s not even hedge funds. Okay. Hedge funds take losses. But the beauty about the system now is that if the banks make a profit, they get to keep it. But if they make a loss, it’s socialized and taxpayers have to pay it.

Glass-Steagall was one of the first things that Roosevelt insisted on in 1933 as soon as he took office and it literally solved the bank problem. If the FDIC and the Treasury and Congress came out and said, “Look, we’re going to attack the real problem,” the banking problem would go away overnight because a large part of the banks collapsing is because people think they’re going to collapse. And they are. Because they are nothing but corrupt casinos.

The greatest and best run bank in the world can be subject to the bank run. So, the bank runs are going to continue until some idiot at the top says, “We need to stop having the banks operate as casinos.”

They shouldn’t be casinos. We shouldn’t have 33% of our economy based on shuffling pieces of paper.

Goldfinger:

So at this point we have all these regional banks of varying sizes in trouble, $40 billion in assets, $100 billion in assets, etc. They’re all having bank runs, essentially. The depositors are taking their money out.

We have a major problem in the US banking system because J.P. Morgan and Citi and Goldman Sachs are so big that they have an implicit government backstop for all their deposits, their entire balance sheet.

But PacWest Bancorp or Paradise Bank in Fort Lauderdale are not big enough for anybody to really care about. So, they can go under, they can fail and the system goes on.

What’s the solution to this problem? I mean, are we going to be Canada, where there’s only going to be five or six banks soon?

Bob Moriarty:

Yes.

Goldfinger:

Is that a good thing?

Bob Moriarty:

No.

Goldfinger:

So what’s the solution?

Bob Moriarty:

You need to go back in and you need to pass the Glass-Steagall. It is going to be obvious if the system has failed. If we have a thousand banks or 1,500 banks or 2,000 banks collapse and they’re going to, somebody’s going to say, “Hey, we need to do something else. The system is broken.”

You mentioned J.P. Morgan. I just loved the deal they cut on First Republic. I mean that was really funny. J.P. Morgan went to the Fed, they pointed a gun at the Fed’s head. They said, “Give me all your money,” and Janet Yellen said, “Oh, okay. I’ll do that.”

I just went, damn. I wish I could rob a bank like that.

We need to solve the real problem, not the apparent problem. And it does go back to debt. Frankly, I mean we need to admit to the world that we have a debt problem. And at some point you have to balance the books.

Now, I’ve talked for months about this being a basic conflict between the Western debt-based system and the resource-based system of the BRICS.

The BRICS are about to come up with some kind of gold money of their own. And when they do, the people of the West are going to realize, hey, wait a minute, we’re holding Monopoly money.

Now, did you happen to see today, India and Russia had an issue over exchanging their national currencies? Did you see that?

Goldfinger:

I did not see that. Tell me about that.

Bob Moriarty:

You get imbalances in trade all the time. So, Russia actually sells more to India because they’re selling more oil to them than the goods Indians sell to Russia.

So the Russians had said prior to today, “You could pay us in rupees.” And then one of their economists said, “Rupees are like toilet paper. It’s like used toilet paper. What the hell do we want with a bunch of used toilet paper?”

Russia and India agreed that they would not conduct trade in national currencies. Now what does that infer for gold?

Goldfinger:

It infers that gold is desirable as a reserve asset, it’s necessary to support the value of fiat currency.

Bob Moriarty:

No, it does not. It doesn’t have anything to do with fiat currency. Gold makes a good currency. Gold is money.

If they decide their fiat currencies don’t work, one really wonderful alternative is go back to real money.

I argue, you cannot have an honest financial system without honest money. The Russians and Indians looked at it and said, “We just cannot do what we thought was going to be easy to do, which is use our domestic currencies.”

It was some ridiculous number, like India was going to print 50 billion in rupees to give to the Russians.

I’ll give the Russians credit for this. You have to remember, because of the sanctions the EU can’t buy Russian oil. So Russia sells the oil to India and India sells the Russian oil to the EU at a 50% markup.

Somebody said, “Do we really want 50 billion in Indian rupees?” Of course ,the answer was hell no.

So it infers what they thought they could do at first, what’s impractical. It also infers, why don’t we look around and see if there’s an alternative that would serve as money?

I’ve said for years, we’re going to go back to a gold standard. We’re not going to go back to a gold standard because anybody wants to. We’re going to go back to a gold standard because we have to.

Whatever country goes to a gold standard first is going to be the richest country in the world.

Goldfinger:

Some people say the same thing about Bitcoin, a Bitcoin standard.

Bob Moriarty:

Some people say the same thing about Tesla. And Beanie Babies.

Goldfinger:

I mean, gold is obviously a store of value. I think we can all agree, gold is a store of value that has stood the test of time. We have a tremendous sample size, all of human history. I mean, even in the last hundred years, gold was $20 an ounce. Now it’s $2,000 an ounce. It’s stood the test of time as a store of value. But is it really a currency that is practical for transactions?

Bob Moriarty:

Well, it was for 5,000 years. Why wouldn’t it be now?

Goldfinger:

That’s true, that’s a good point. So gold has gone up $270 an ounce since the beginning of March. It rose from about $1,815 to a high of $2,085 last week. What is this big move higher in gold telling us?

The Fed tightened again. The Fed has raised the Fed Funds Rate to 5.25%. The banking system is in turmoil. Supposedly Ukraine tried to attack the Kremlin with drones, even though I feel like that’s a false flag. There’s a lot going on in the world. What is this gold rally telling us?

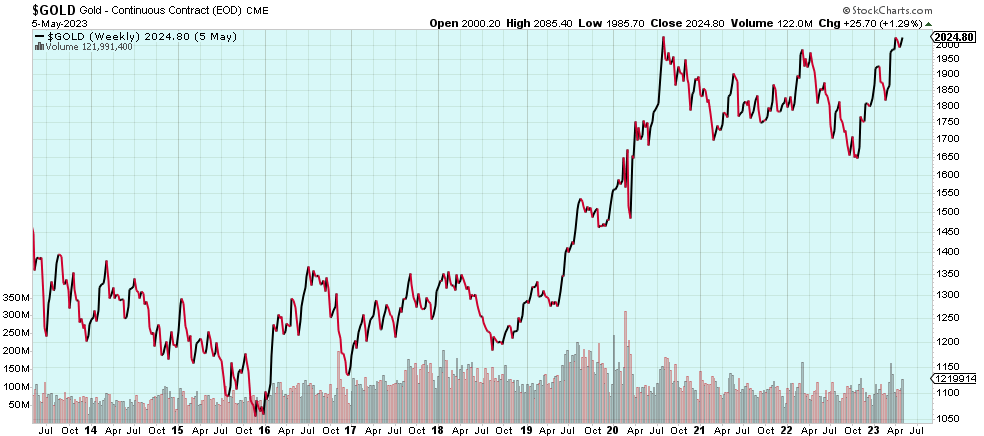

Gold (Weekly – Ten Year)

Bob Moriarty:

The gold rally is telling us people want safety. When they extract their money from a bank, they’ve got to put it somewhere. Most of the money that, say, comes out of First Republic ends up going into some other bank.

Much of the money stays within the banking system. But at the same time, people have gone to treasury bills. Now have you looked at the spread between one month and two month T-Bills?

Goldfinger:

Yes. It’s bizarre. I’ve never seen anything like it.

Bob Moriarty:

Thank you. That’s exactly the point that I wanted to make. What that’s saying is we’re okay being in T-Bills for a month. We’re just not okay with being at T-Bills for two months.

The world is waking up to the fact that the financial system is in an exceptionally precarious position right now and they’re headed for safety.

Now, all it would take for it to make headlines would be if gold went up $200 or $300 in a day. I think it could easily do that.

We are going to have a panic about gold at some point. Now, whether that happens now or whether it happens six months in the future, I cannot predict that. However, gold is money and it keeps its value.

The idea that you buy gold to invest is bullshit. You buy gold to protect your money. How many times have I said gold is an insurance policy against financial chaos?

You don’t give a damn what you pay for insurance. That’s because, actually, you don’t want to collect on it.

But at some point there will be a rush into gold. The gold market’s still absolutely tiny. It wouldn’t take much for gold to go up two or 300 bucks in a day.

Goldfinger:

Yeah, that’s a good point. The gold market is extremely tiny. Even though gold has had an impressive move in the last two months, I would say 95% of people don’t have any gold exposure at all. Most of the ones who do just own some gold jewelry. They don’t really own any appreciable amount of gold, relative to let’s say real estate or their stock portfolios or even their checking account deposits. So, we’ve just scratched the surface in terms of what could be possible for gold.

Before we get into some junior mining stocks, I want to ask you, with all of this there is to worry about in the world to today, whether it’s China/Taiwan, the global economy, interest rates, banking turmoil, World War III, how is the stock market holding up as well as it is? What do you think is propping up stocks here?

Bob Moriarty:

Helium.

Goldfinger:

Did you know that helium is in a bull market? I’m serious. But I digress, Bob, the S&P is at 4,150, which is a relatively high level when you look at history. It’s not an all-time high, but it’s pretty high. The stocks that are holding it up are Apple and Walmart and Meta.

There’s 450 stocks that are going down and there’s 20 or 30 that are holding it up. It kind of reminds me of the early seventies, where you had IBM and a handful of other stocks. And then the market went into a real bear market in ’73, ’74 I think.

Bob Moriarty:

Well, it actually crashed in 1970. It started to decline in 1966 and made a big low in early 1970. You were talking about the NIFTY 50. That’s a great analogy, because literally right up until March or April of 1970 when it just took a nosedive, people were saying AT&T, Avon, IT&T, etc. these stocks are never going to go down.

They’re saying the same thing now. But when I say the only thing holding the market up is helium, I wasn’t kidding. I was telling the truth. Have you seen the advertisements for, take this test for MENSA for $9.95? Have you seen any of those ads?

Goldfinger:

I believe I have in the past, but not recently.

Bob Moriarty:

Yeah, but you’ve got an idea of what I’m talking about.

Goldfinger:

Yes.

Bob Moriarty:

This is absolutely identical to that. People who are investing in the Dow, the S&P and the 250 stocks are going down. It’s a Mensa exam, but it’s a reverse MENSA exam. They’re not trying to see how smart people are. They’re trying to see how dumb people are.

We got a dead cat bounce. You predicted it. You were absolutely correct. However, it was a dead cat bounce and no more.

If you’ve ever had a helium balloon at a child’s party, in a day or two, that helium leaks out. When helium leaks out from underneath the market, we’re going to have a market crash like few people have seen. Anybody under the age of 70 has never seen a real crash.

Goldfinger:

Yeah. Well, 2008 was a pretty good crash, Bob.

Bob Moriarty:

Well, 2000 was. I mean, the NASDAQ in 2000, that was really cool, but it was just as absurd. In March of 2000, the NASDAQ had been up 19 days in a row.

Now if you look at that mathematically, that means once every 300 billion years you can expect the market to go up or down 19 days in a row. That was unbelievable.

Goldfinger:

Let’s talk about junior mining. Obviously, gold and silver have had big moves. They’re in strong uptrends.

I was thinking last night about some stocks we haven’t talked about in a while. I was listening to, I guess a podcast. It got me thinking about the juniors that haven’t participated yet. The ones that are still waiting at the train station, waiting for the train to leave.

It made me think of Novo Resources (TSX-V:NVO). Novo is focused on Australia and NVO has a lot of cash relative to its market cap.

They pivoted recently to an orogenic gold deposit exploration model. It just got me thinking that if this gold bull market is for real, a stock like Novo could go up 3x or 4x based upon the enormous exploration potential of its property package in Western Australia. Most people have given up on Novo after Beatons Creek so it’s a bit of a contrarian bet at this point.

What do you have to say about that? Is Novo a good opportunity here or is this one a fallen angel that isn’t coming back?

Bob Moriarty:

Have you tracked De Grey?

Goldfinger:

It’s done well, that’s for sure.

De Grey Mining (2016 to 2020)

Bob Moriarty:

De Grey went down to below 5 cents a share. It looked as if they had a couple of million ounces in an orogenic gold system.

I bought a million shares of it at a nickel and just sat on that for months and months and months and then it caught fire. I think it’s about $1.75 today. It was up 35x

You’re going to see that across the board. Certainly, Novo is positioned to be one of those companies.

Of course, I got beat up, everybody saying, “Oh my god, Moriarty said Novo was a good stock. It went from nine bucks and 30 cents.” All of which was true.

But my basic argument that the Pilbara is loaded with gold, nobody has ever debated that. And actually De Gray’s ten million ounce gold deposit runs right onto Novo’s ground.

I believe… and it’s just my opinion, it’s not based on any inside information, but actually most of the issues in Australia are political issues with labor.

They were so stupid in their response to Covid that they literally shut the country down for over two years, that it just totally creamed their labor system.

Now, as long as China is buying iron and coal with both hands, there’s going to be a labor shortage in Australia. That has crippled the Australian gold stocks, including Novo.

I think Novo is okay. But at the same time, I’ll tell you, there’s a hundred or 200 or 500 other stocks that are going to do just as well.

If you look at how much gold has gone up and how much the resource stocks, primarily gold and silver have gone up, gold has gone up more than the gold stocks, which is patently absurd.

If you compare gold stocks to the S&P 500 or if you compare gold stocks to commodities or if you compare gold stocks to gold, they are absurdly cheap.

I am buying stocks on a daily basis. Every time I do that, before I push the button, I look around to see if anyone is watching because I feel like I’m stealing.

Goldfinger:

Yeah, that’s a good point. Another stock that we’ve talked about before, Lion One, they’re actually building a mine. The stock was doing well up until a couple days ago. They announced the financing and it got whacked.

I wonder what your thoughts are on Lion One (TSX-V:LIO, OTC:LOMLF). Is this an opportunity to get in before they complete the construction?

Bob Moriarty:

Funny thing you’d say that. I am writing an article right now… other than the fact that I’m talking to you, before and after our conversation, about Lion One. The title of the article is Lion One on Sale and Near Production.

Here’s the deal, and it has to do with financing. Obviously you need X bucks to build a mine. Wally knew that. Wally went out and lined up a loan facility to complete the mine.

However, everybody that’s loaning money puts all these covenants in there. You can’t do this. You can’t do this. You can’t do this. You can’t do this. It literally tied his hands.

He realized, okay, I either go out in the market and I raise some money from investors or I allow myself to be handcuffed.

Lion One is my biggest position. I am going to go into the placement because absolutely, if you’re buying Lion One at these prices, you’re stealing.

There’s a lot of issue over the fact they’ve had lots and lots and lots of drilling, but they haven’t come out with an updated 43-101.

But what everybody’s missing… and it’s so obvious, it’s like having a giant pimple on your tongue, is there’s an identical mine 40 miles to the northeast that’s been in production since 1932, that I think adds a resource of 11 million ounces. They produce 7 million ounces, and I think they’ve got a reserve of 4 million ounces.

Lion One is going to be a 10 to 15 million ounce deposit. Okay. I know that to be true because I’ve got a dart board. I took a dart and I threw it at the dart, and it came up and said 10 million ounces.

It’s the only independent alkaline deposit in the world owned by a junior. Lion One’s got so many good things going for it, if you buy Lion One for 80 cents, you should put your mask back on. You should sneak in. You should put your gun out and say, “Okay. Give me a bunch of shares,” because you’re stealing.

Goldfinger:

I want to ask you a question. If a junior has drilled the following gold intercepts, 135 meters averaging 3.63 grams per tonne in one intercept, 11.6 meters averaging 7.31 grams per tonne, 24.8 meters averaging 15.7 grams per tonne…

Those are just three drill intersections, and there’s a lot more like those. If they’ve drilled all these intercepts over a strike extent of 550 meters, to depths of 300 meters, width of 150 meters, would you say that’s probably a pretty valuable gold deposit?

Bob Moriarty:

It would depend on where it is, which is always an issue. If it’s in Chile or Peru, that might be a bad thing. If it’s Nicaragua it’s a disaster If it’s in Canada, again, it’s probably like stealing.

But it’s an issue of, what’s the state of the market? Quite luckily, if you look at the volume of gold shares, people are just not buying or selling anything now. I’ve said for years that if you look at it when there’s no volume, that’s the time to buy.

Goldfinger:

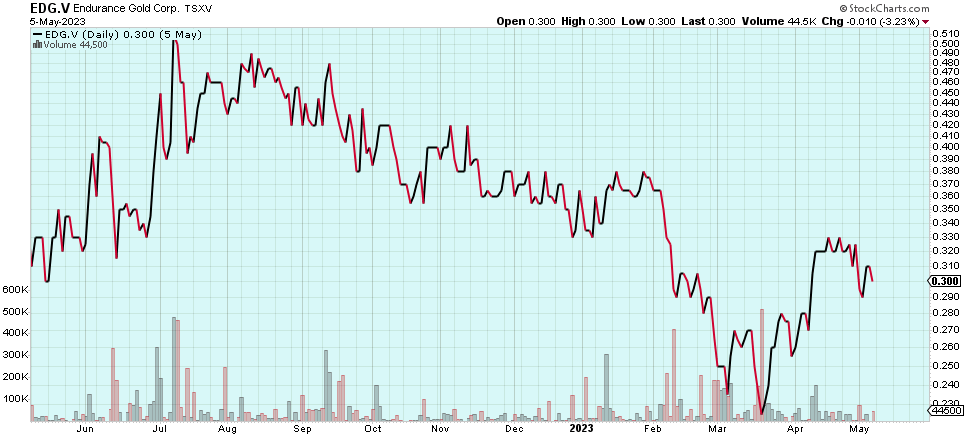

So yeah, that’s in BC, Canada. Those drill results are from Endurance Gold (TSX-V;EDG, OTC:ENDGF). The stock is down about 35% in the last six months. I’ve been buying, and I’m definitely biased on this one. However, I think this is a great opportunity because it’s been so quiet. There’s not been much trading volume, and the company has been quietly preparing its summer drilling program at Reliance.

EDG.V (Daily)

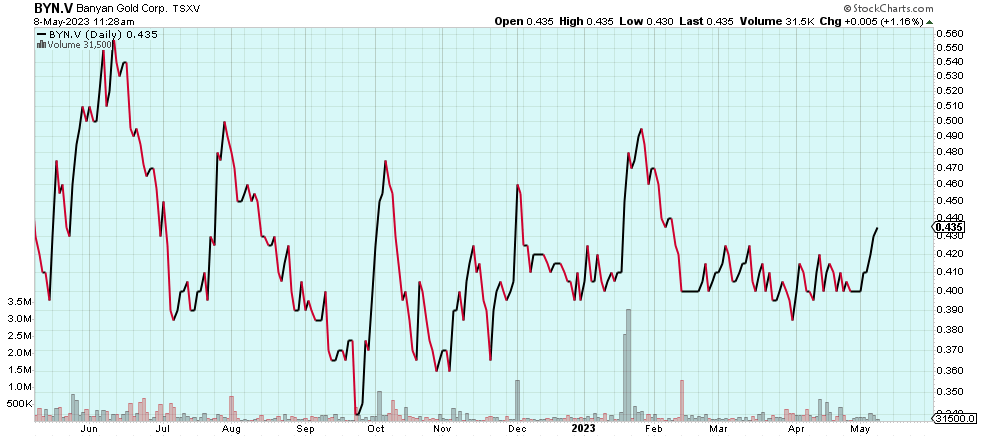

This is Banyan Gold (TSX-V:BYN, OTC:BYAGF). Banyan has been drilling since March. They’re going to come out with a resource update in the next couple of months, that should be a significant increase in the total ounces they have at the AurMac project in the Mayo District of the Yukon.

So, this is another one that I’ve been accumulating where the volume has trailed off, the stock has gone sideways, completely ignoring the rise in the gold price.

BYN.V (Daily)

Bob Moriarty:

Yeah. Well, if you buy things when they’re cheap, you can make a lot of money. Endurance Gold has a Canadian market cap of $45 million.

I happen to know Tara Christie really well. I love Tara Christie. She’s wonderful and she’s doing a great job at Banyan. The fact that people don’t see it yet, that’s a communication glitch. That’s all that is.

Goldfinger:

Both Endurance and Banyan have been relatively quiet for the last two to three months. The share prices have, I guess suffered as a result of it, but these companies are not going to be quiet forever.

In fact, Banyan’s been drilling in the Yukon, completing more than 10,000 meters of drilling so far in 2023. They’re probably going to have a lot of news very soon. Endurance just announced drilling is beginning at Reliance.

So, it’s an opportunity for people to take advantage of the relative quiet. These share prices just haven’t been paying attention or caught up to the fundamental progress out there.

Another one that you talked about in the Yukon was Gladiator Metals, GLAD. This is a copper explorer near Whitehorse. Can you give us an update on GLAD?

Bob Moriarty:

Well, here’s what’s ironic. They’re not explorers. That’s one of the greatest stories that I’ve ever seen if you like copper.

In Whitehorse, there is a copper belt that was mined for years and years and it’s very high grade. When the price of copper dropped… and I’m going to pull this out of the air, in the eighties, they shut everything down.

There was an introduction between the company that controlled the bulk of the claims and a guy running a mining company. They almost did a deal back then. They’d shut it down because of the price of copper.. A local First Nations family literally has been accumulating claims and possessions in the belt, pretty much for 30 years.

They did a deal with someone they knew from 30 years ago, and they’re starting to release results.

The results are extraordinary. They’ve got 10,000 meters of drill core that was never assayed before, but you can look at it and see that it’s high-grade copper.

The only legitimate bitch about not buying it as well, a lot of it’s literally within the city limits of Whitehorse. That’s such a stupid comment to make.

The family that partners with GLAD is First Nations. Let’s be candid. They run Yukon and BC. If they want to stop a project, the project stops. If they want a project to go forward, the project goes forward.

GLAD is absolutely going to go back into production. They have partnered with the most important people in Yukon. They’ve got extraordinary numbers, extraordinary grades. They’ve got a wonderful project and the market just hasn’t caught on yet.

Goldfinger:

So final question, what is one mistake that investors should be wary of making right now? What’s the worst thing that somebody could do right now, either personal finance or junior mining investing? What comes to your mind as a big mistake that somebody could make right now?

Bob Moriarty:

That’s a really difficult question because there’s actually about 50 things that you could do that are dangerous. Investing in the Dow and the S&P would certainly be one. Going into debt would certainly be one. Buying cryptocurrencies would be another.

I’m going to get proven absolutely correct on that at some point. You cannot have 10,000 ice cream parlors in a town with 50,000 people living in it. That’s what cryptocurrencies essentially are.

The guys who believe that Bitcoin says, “Well, yeah, the other 9,998, they’re all going to fail, but we’re not going to,” believing in cryptocurrencies means that you believe the Federal Reserve and the Treasury and the EU are going to allow competition to their banking system.

That isn’t going to happen in my lifetime or your lifetime or your grandchildren’s lifetime. It is nothing but electronic Beanie Babies. People have lost $2 trillion already and they’re going to lose another $1.2 trillion.

Goldfinger:

There’s a theory that some of this regional banking crisis in the US is actually orchestrated to crush the crypto banks, the banks that were helping the cryptocurrency industry. What do you think about that, that this is actually intentional?

Bob Moriarty:

It could be. There’s another theory, saying that the government’s doing it deliberately so they can bring in Central Bank digital currencies.

This is very important for everybody to understand. Cryptocurrencies and Central Bank digital currencies are absolutely, totally different.

Cryptocurrencies use blockchain technology. Central Bank digital currencies are not blockchain. If you believe the government’s going to go to Central Bank digital currencies, and there seems to be every indication that they plan doing that, they could be crashing the system to bring in cryptocurrencies. But they could crash the system to bring in Central Bank digital currencies. Either one of those, it’s possible. Both of them will fail.

Goldfinger:

We live in interesting times, and there is a lot of change going on in the world. One thing is that every crisis is used as an excuse for more government control.

Just look at China. They used the Covid pandemic to get full control over their people through basically facial recognition technology. They can literally turn on and off your ability to use public transport or use your credit cards, based upon how they feel about you as a citizen.

Scary times and artificial intelligence is only accelerating further. Thanks a lot for your time and insights, Bob.

____________________________________________________________________________

Disclosure: Author owns shares of BYN.V and EDG.V at the time of publishing and may buy or sell at any time without notice.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Banyan Gold Corp. is a high-risk venture stock and not suitable for most investors. Consult Banyan Gold Corp’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover Banyan Gold Corp. and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.