When I spoke with 321gold founder Bob Moriarty in November he was adamant that now is the time to invest in the resource sector. Today, he thinks that investor sentiment in the resource space is worse than it was in 2008 after the Lehman crash. It is this combination of poor sentiment and beaten down share prices that offers investors an opportunity to generate outsized returns once the sector turns.

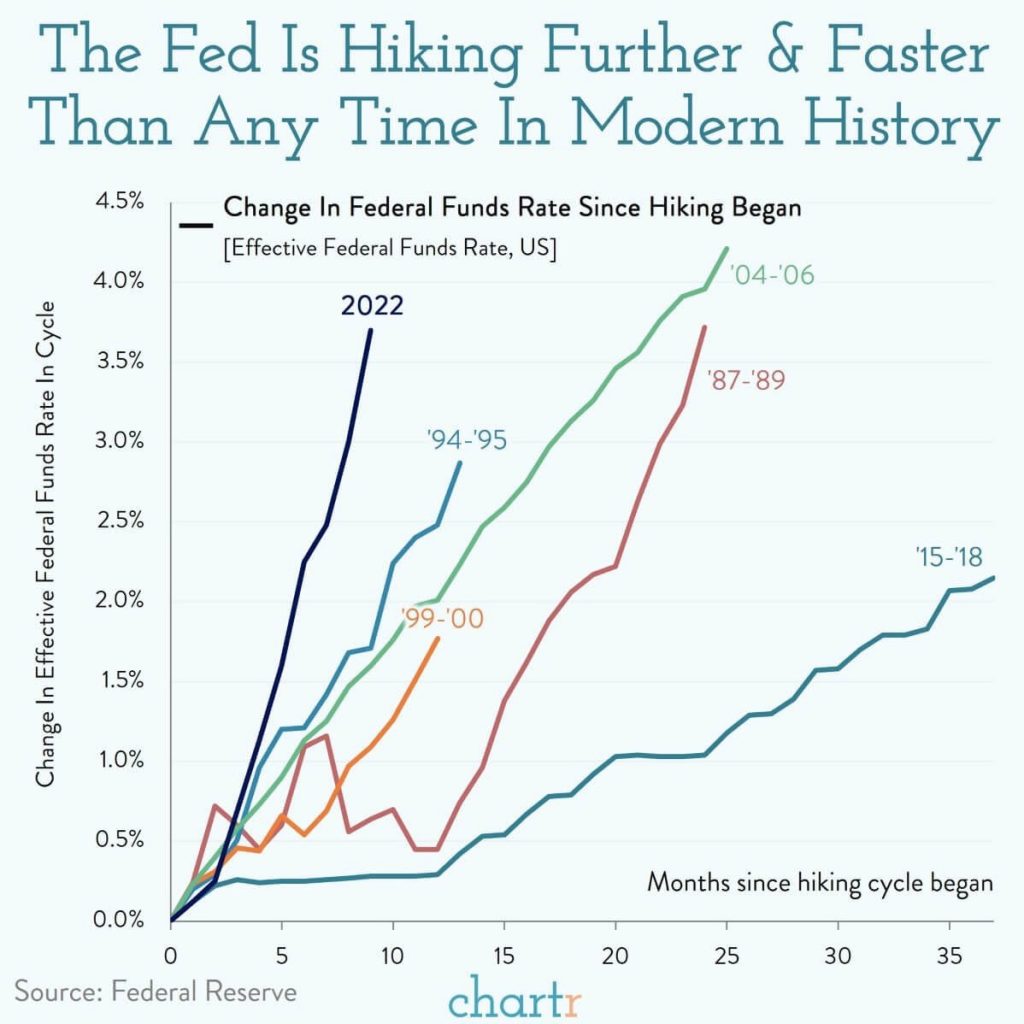

In this month’s conversation Bob and I discuss tightening financial conditions, weak investor sentiment, the cryptocurrency sector implosion, and some tax loss silly season opportunities in the junior mining sector. Without further ado, Energy & Gold’s December 2022 conversation with Bob Moriarty….

Goldfinger:

Bob, it’s good to speak with you again, what’s your take on the market action of the last week? We’ve had some impressive gyrations across equities but precious metals have remained relatively resilient. It seems the market has no memory from day to day. I know you’re not a Fed commentator or a Fed fan, but did you make anything of Powell in his press conference last week? He seemed pretty uncertain.

Bob Moriarty:

They painted themselves into a corner. They have no good options at this point. I think long term the Federal Reserve is pretty meaningless.

Goldfinger:

Painted themselves into a corner in the sense that they can’t cut rates very easily because of inflation or because of something else?

Bob Moriarty:

Well, not because of inflation, but because of hyperinflation. If they back down now, we would absolutely go into hyperinflation and the problem is jacking up the interest rates. They just killed the automobile industry and real estate. I mean, here’s the deal, and you’re young enough to know this, but you’ve been around markets long enough to know it. We’ve got an entire generation that has never faced positive real interest rates. When I was 25 or 30, you were paying 8, 9, 10% for real estate and the idea of it going down to 5 or 6%, I mean, it’s just crazy. And for the last, Jesus, 10 years it’s been utterly irrational. The purpose of interest is to give savers a return on their investment. There hasn’t been a return on investment. So there will be a return on investment now, which is good for retirees, but it’s going to kill the real estate market.

Goldfinger:

We’re definitely seeing some of these hikes. The tightening of financial conditions feeds through to the real economy. The data points that we’ve received today, the retail sales, numbers missed to the downside. The Empire State Manufacturing missed to the downside. The Philadelphia Fed Manufacturing missed the downside and the trend throughout the economy is clearly one of slowing. And the housing market is absolutely affected by the rise in mortgage rates, just tighter money. So people are less able, they’re less willing and they’re less able to make high ticket purchases.

Bob Moriarty:

Well, we’ve had free money pretty much for at least five years in reality, 10 years, and people have gotten used to it and I think that’s a new norm. But you cannot have a situation in a rational economy where interest rates, real or nominal, go negative. We still have negative interest rates. Okay, we’ve got 6, 7 to 8, 10% depending on how you want to define it and 5% interest.

Goldfinger:

That’s an interesting point. Yeah, I mean technically the CPI is 7% even according to the data we got last week. And obviously, the Fed funds is 4.5%, but you could also make an argument that inflation is falling fast now because of the Fed tightening, and interest rates could be in positive territory very soon if the economy continues to weaken.

Bob Moriarty:

It’s just my opinion, but I think energy has bottomed, but food has not bottomed and I think they’re going to go up. So I think that a decline has certainly happened, but the risk is to the upsides, not to the downside. I mean, I’ve seen some really good stuff lately with people saying you cannot get inflation below 10% without 5 or 10 years of high interest. Everything that I see that I believe in is very negative and it’s just my opinion, but I think we’re in a very precarious position.

Goldfinger:

So as far as precious metals go, we saw a very nice move up in gold and silver in November, and we were talking offline. That sentiment got a bit overheated earlier this week with the daily sentiment index for silver getting into the high 80s. We’ve seen a nice little pullback since then. What do you make of this? And are we going to see a Santa rally in mining stocks this year?

Bob Moriarty:

Yes. Here is what I make of it. And while I give the most credibility to the Daily Sentiment Indicator, the DSI, because I just happen to think it’s the most valuable tool I’ve ever seen, I follow a number of other sentiment indicators. Do you follow PSLV?

Goldfinger:

Not closely. I prefer the DSI and some other proprietary sentiment indicators I’ve developed.

Bob Moriarty:

If you go back and you look at the charts, excuse me, on November 24th, the discount to the net asset value was 5.12%, which is the highest discount in two and a half years. Likewise, the open interest is at 122,000 contracts. A lot of people are contacting me and saying something is going on with silvers. And while I agree, I just don’t have any idea of what it is or what the magnitude is. But I happen to think, and I think we’ve discussed this before, we’re in for at least a seven month rally, a big rally, big numbers and a momentary pause would be very healthy.

Goldfinger:

As far as sentiment goes in junior mining. In your experience as a veteran investor in this sector, where are we at in terms of sentiment relative to past cycles? In some ways it has felt worse than late 2015.

Bob Moriarty:

This is going to surprise you and again, it’s just my opinion. I think it’s worse. I think it’s worse than 2008 and I think worse than 2015 and both of those were opportunities to make your retirement. I saw a lot of stocks up tenfold, and I think we’re going to see it again. I saw one stock go from $.05 to $5.00 and it was a piece of crap stock.

TSX-Venture Composite (Monthly – 20 Year)

Goldfinger:

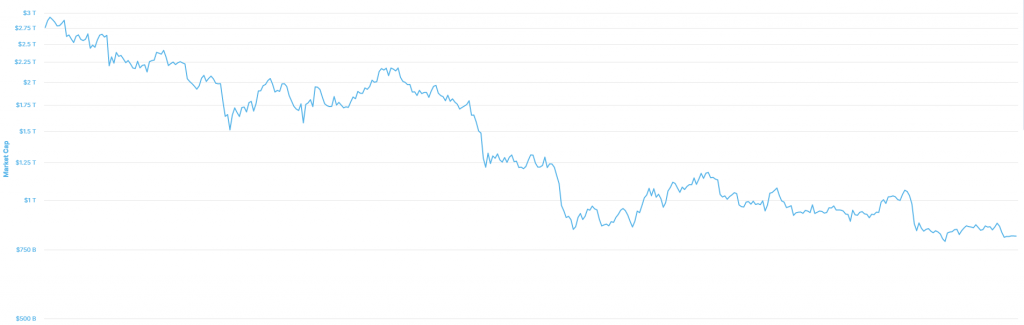

So we’ve had a lot of news around the cryptocurrency sector in the last six weeks. This FTX thing has unwound spectacularly. And some of the things we saw in 2020 and 2021 were straight out of the madness of crowds, incredible bubbles and now those bubbles have popped. How does that affect gold? How does it affect mining stocks? Where does this go with all this money going to money heaven?

Bob Moriarty:

Have you ever heard Marc Faber speak?

Goldfinger:

Yes.

Bob Moriarty:

He uses an analysis of there being a bowl that is on the head of a pin, and when you pour money into the bowl, it goes one direction or another direction or another direction. I think certainly, the $3 trillion that went into Bitcon took a lot of money out of the resource sector. And I think it’s really clear now that central banks and governments want to go to Central Bank digital currencies, and I’m dead set against them, however, nobody ever asked me. But I think the Central Bank digital currencies conflict with Bitcon and the thousands of crypto variants are nothing but digital beanie babies. But with the Beanie Baby at the end of the day, you still have a $.79 toy to play with even if you pay $1,500 for it, but with the cryptocurrencies, you’ve got a bunch of numbers that are relatively meaningless. So it’s an accounting system, it’s not money. And people, the guys who talk about it being money, it’s absolutely a perfect example of extraordinary popular delusions and madness of the crowd in textbook fashion.

Total cryptocurrency market cap

Goldfinger:

Do stupid things and get stupid results, in many ways cryptocurrencies are a solution searching for a problem. The altcoins, the NFTs, all of the meme stocks were enormous bubbles that were fueled by negative real interest rates.

Bob Moriarty:

I think the NFTs really bothered me. Do you remember the NFT of a fart? I thought I was in the money. Unfortunately, when you get older, your digestive system doesn’t work quite as well. And when I saw somebody get $700 for a fart I figured I had made a fortune. But that blew up as well.

Goldfinger:

As often happens in financial markets, people take a good idea and they take it to an extreme excess. So we definitely reached the point of extreme excess in cryptocurrencies, NFTs, meme stocks, all of it.

And one of the things that happened in 2008 was Madoff was uncovered literally the final weeks of 2008, that whole thing came to light, and now we have FTX. A very similar, albeit more modern, Ponzi scheme.

Bob Moriarty:

I think that’s not the end of the fraud. That’s just ripping off the first band aid.

Goldfinger:

Yeah, I think that’s right. So I made a video last month about the long term bull case for gold, and I think you linked to it on 321gold. And I’m looking at my bullet points from this video, and there’s many bullet points. Some of the key points are that the world is becoming multipolar instead of unipolar. With the US dollar as the reserve currency, it’s going to be multipolar. Russia, China, Turkey, Saudi Arabia, these countries are wanting to usurp the dollar’s role and the US prominence and dominance in the world.

And so, gold is a natural underpinning backstop to their currencies and their emergence as powers in the global financial system. And then I also wrote, once the Fed realizes it cannot raise rates further, so a pause which is coming in 2023 as the economy begins to break and markets begin to break, the Fed will do what it always has done, which is to cut rates, do QE, maybe control the yield curve so that interest rates at the long end don’t go any higher. And it’ll be this scenario that sends gold to the new all-time highs above that 2089 high. And I feel like all of this is starting to take shape. Do you see it in a similar way or do you have a different opinion on this, Bob?

Bob Moriarty:

Let me find a piece. Are you familiar with Zoltan Poszar?

Goldfinger:

Yes.

Bob Moriarty:

He just came out with a research note that was talking about Russia and their reaction to the attempt by the EU and the US to cap their oil. Now, I think from an economics point of view, it’s the most irrational thing I’ve ever heard because they’re saying we want oil that we’re not going to buy or sell to be capped at $60. And regardless of what anyone feels about Russia, I don’t think any country has the power to do that. They may believe they have the power, but I don’t. And Zoltan said all Russia would have to do is sell a barrel of oil for a gram of gold, which is about 60 bucks. And alternatively, they could say, “Well, we’ll give you two barrels.” And of course, that would cause immediate doubling in the price of gold. There’s some things potentially in the works that could be extraordinary for gold and Pozsar is easily one of the three or four smartest people I’ve ever heard in my life.

Goldfinger:

Yeah, I mean, so that is brilliant and that is definitely a black swan. I don’t think Russia pegging a gram of gold to two barrels of Russian crude oil is a probable event, but it could happen. And if it does or anything like that happens, it’s going to ignite gold because one of the things that’s been missing for gold since the 1930s is its role as a transactional currency, as a transactional metal. Prior to the Great Depression, the dollar had been pegged to gold at $20 an ounce and you could get a $20 Saint-Gaudens gold piece. And back in the early 1900s, that was a lot of money and that ounce of gold was really valuable. Now, gold trades on a futures exchange, which is obviously manipulated by various financial interests.

Bob Moriarty:

Well, you’re very close now. One thing I think is crucial, I see the NATO, US, EU conflict with the BRICS in the form of a fake war in Ukraine has actually been a conflict between financial systems and the United States is doing everything it can to maintain the dollar system and the debt based system. The BRICS want to go to a resource based economic system which, in my opinion, makes more sense. Now, that is not a political statement, that’s an economic statement. I think what the BRICS want to do makes sense. And I think the debt based system is on its way out.

Goldfinger:

Yeah, so the resource based system favors the BRICS because they have more natural resources and they’ve been stockpiling them. But for example, a country like Canada is resource rich. The problem is, they have very incompetent leadership that is not effectively harnessing their resource wealth. And so, in many ways we in the West are our own worst enemies. We have enemies attacking us from within.

Bob Moriarty:

They’re doing exactly the opposite of what they should be doing. California is a perfect example. If you look at a map of the globe, Chile and California are at opposite ends of the spectrum, but in terms of wealth, Chile has the same kind of mineral wealth that California does, and the governor of California is literally trying to destroy their economy. So far he is succeeding. And I cannot say enough bad things about Justin Castro. It’s just staggering to me that anyone saw him as any kind of leader and he was selected twice. He is destroying the economy of Canada and I’ve got a lot of respect for Canadians and I have talked to a lot of Canadians. They’re like Americans except they’re sane.

Goldfinger:

Yeah, it’s true. And Canadians are generally kinder people than Americans.

Bob Moriarty:

No, I totally think so. If you go back to the trucker’s convoy, that was one of the bravest things I’ve ever seen. And when you see the support of tens of thousands or hundreds of thousands of Canadians, okay, protesting against government overreach and that this idiot running the country starts talking about China, and he supports civil disorder in China, he just doesn’t support it in Canada. And I have to think of the truckers’ revolution as it were, there was nobody behind it. It was just that a lot of people agreed that they needed to do something.

And I think clearly, we now know the vaccines were a horrible mistake. The government reaction to Covid, they lied to us about everything. And somebody wrote to me today and said, “I read your site. I’ve been reading you for 20 years and I think you got a great site and as a result of you writing about the vaccine, I refuse to have it and I think I owe you my life.” And to a certain extent, he’s absolutely correct. I mean, hundreds of thousands and millions of people have died from a vaccine that doesn’t work, doesn’t stop transmission and causes enormous physical damage, and they’re still trying to give it to kids. In Denmark you’re not allowed to give the vaccine to anybody under 50. In the United States they’re trying to give it to five month old children. Now, somebody’s right and somebody’s wrong, and I’ll be candid that the American approach is criminal. It is a crime against humanity to force that untested, failed “vaccine” on children who were never at risk from Covid in the first place.

Goldfinger:

Yeah, I think you’re spot on there. And obviously, there’s a lot of lessons that have been learned in the last couple of years about media brainwashing. A lot of things have come to light in terms of the concerted effort in which governments and media push messages on the masses. The vaccines were probably one of the most prominent examples, and forced citizens to comply some government order and follow like sheep, including with some misinformation that didn’t fully disclose the risks of side effects for some people. And also the fact that just frankly they weren’t terribly effective. Everybody said, “Oh, I’m vaccinated. I can’t get Covid.” Well, of course you can get Covid still.

Bob Moriarty:

Actually, chances of getting covid are greater if you’ve been vaccinated.

Goldfinger:

Exactly. So let’s finish up with junior mining, it’s tax loss selling season. I remember the last time we spoke you said you thought tax loss season was pretty much done and you gave me a list of 10 penny dreadfuls and then I also mentioned Snowline Gold (CSE:SGD) and Amex (TSX-V:AMX). It looks like Amex has mostly been moving sideways since our last chat, but Snowline moved up almost 50%.

Bob Moriarty:

Snowline is a great stock. I think we’re in a short term correction. I think we’re going to have a repeat of December of 2015, January of 2016. And it seemed to me that shares bottomed in mid-December and the price of gold actually bottomed in mid-January and then it shot to the moon. A lot of people have woken up lately that silver and gold offer real alternatives. And as far as the list of 10, one of them is down, NuLegacy (TSX-V:NUG) because they just frankly said, “Okay, we’re not going to do anything.” Which is a good way to kill your stock, but the rest of them are up with some of them up 100% or more.

Goldfinger:

For Canadians, this week is really the final week for tax loss selling because next Monday and Tuesday are market holidays. So we have probably seen the last of tax loss selling, and I’ve noticed some notable insider buying in some stocks I own and follow.

Bob Moriarty:

Tax loss season is done and people have the opportunity to literally make their retirement right now.

Goldfinger:

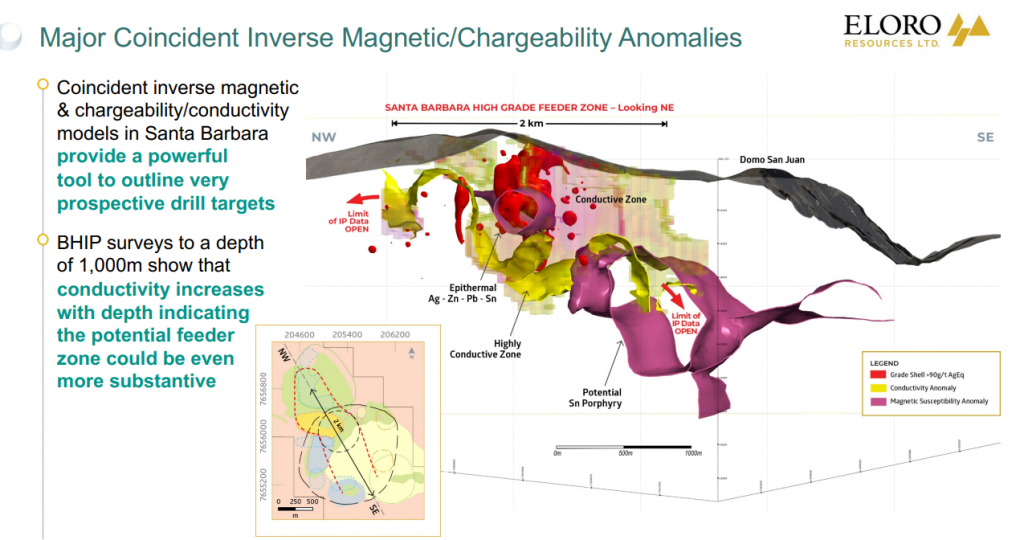

So let’s talk about some specific names that we’ve discussed before. So Eloro Resources (TSX-V:ELO) on the venture is down today. ELO shares have pulled back from nearly $4.00 to an important support level near $3.30. So this has had a significant pullback and could be a good tax loss opportunity.

Bob Moriarty:

Yes, as a matter of fact, I just exercised some warrants today. I think it’s a license to steal. Eloro has a resource that’s a lot bigger than they think. The entire Iska Iska Caldera is mineralized and the only question is whether it’s a billion tons or 2 billion tons or 3 billion tons, and I think you’re going to end up with 2 or 3 billion tons of $100/tonne rock. I take it’s an extraordinary opportunity. And they just picked out another important land position and there’s a company very closely related to them called Cartier Silver (CSE:CFE) that has 2.2 million shares of Eloro, and they picked up a similar project very nearby. But I think both companies are extraordinary and I think oblivious is going to be the place to go.

Goldfinger:

The interesting thing about Eloro now you mentioned the property acquisition. So the interpretation on the geophysics and based upon the drilling to date is that this higher grade feeder system extends to the south at depth. And if they’re trying to drill it from further north, they have to drill much deeper holes to target this potential tin feeder, this tin porphyry. And so, the property acquisition allows them much better access and much, it’s much easier for them to drill this target and drill 300-400 meter holes instead of drilling 1000 meter holes, which obviously saves money, saves time, and allows you much more effective targeting.

The interesting thing about this potential tin porphyry is that borehole IP (BHIP) surveys to a depth of 1,000 meters show that conductivity is increasing at depth. Furthermore, some of the deeper holes that Eloro has drilled ended in much higher grade tin mineralization (including .68% tin over 1.51 at 930 meters downhole in hole DSB-36).

Bob Moriarty:

That’s exactly right. It’s an extremely well run company. Three years ago it was $.17 and they have several hundred billion dollars worth of rock – I think somebody’s going to take them out in the next year or two.

Goldfinger:

Cartier Silver is a cousin of Eloro. Tom Larsen is involved with both companies as CEO and Cartier is targeting silver in the same region of Bolivia (Potosi).

Bob Moriarty:

Yes, Eloro started out exploring for silver and then realized it had an enormous polymetallic deposit on its hands. So Eloro is multidimensional, and Cartier is strictly going after silver and the base metals.

Goldfinger:

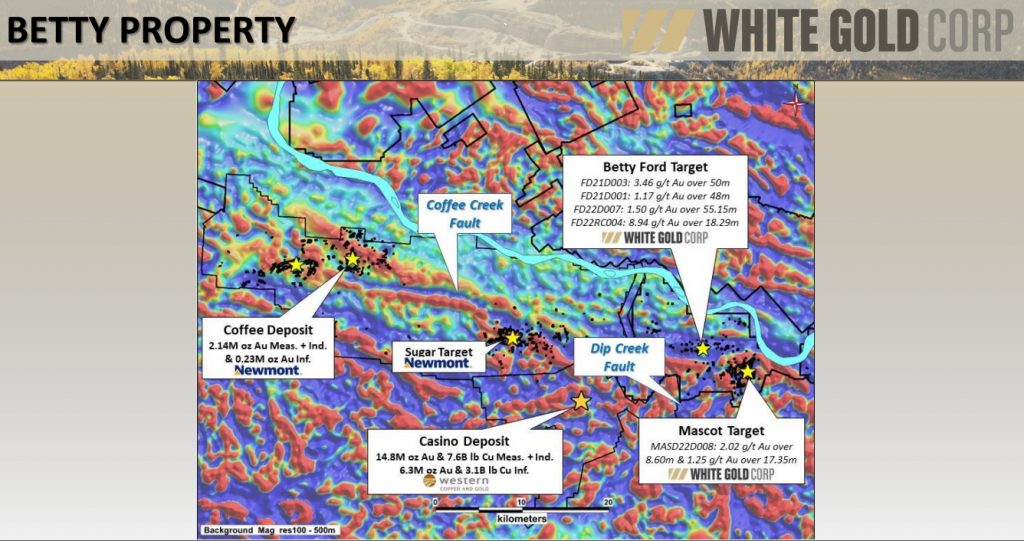

Another company that we’ve talked about in the past is in the Yukon called White Gold (TSX-V:WGO). White Gold just announced two things. They announced more results from summer drilling, which included a pretty nice intercept of about 9 g/t gold over 18 meters at one of their Yukon projects near the Coffee Gold deposit that’s owned by Newmont. This discovery called Betty Ford is really interesting because the company has now had several impressive drill intercepts here. This target is also on trend from Coffee along the Coffee Creek Fault. And then Agnico, which is a 19.8% owner in White Gold, participated in the recent financing to maintain its ownership interest. Do you have any thoughts on White Gold? That one is also down big year to date and could be a good tax loss candidate.

Bob Moriarty:

You’re absolutely correct. The stock’s been cut in half, but the results were extraordinary. It’s a well run company. They’ve got serious companies who own 40% of the shares. They’re well cashed up and it’s on sale. I mean, how can you beat a company like that? It actually got down 30 cents, so it was down, let’s say 30 a cent. I gotta figure this out. It was down about 65%. And there’s absolutely nothing from a technical point of view that justifies they’re in home run country. They got cash in the bank, they’ve got good partners, are around 40% of stock and it’s a well run company. So it has started up, but I don’t think I see any problem saying in the next six months it will be setting a new all-time high.

Goldfinger:

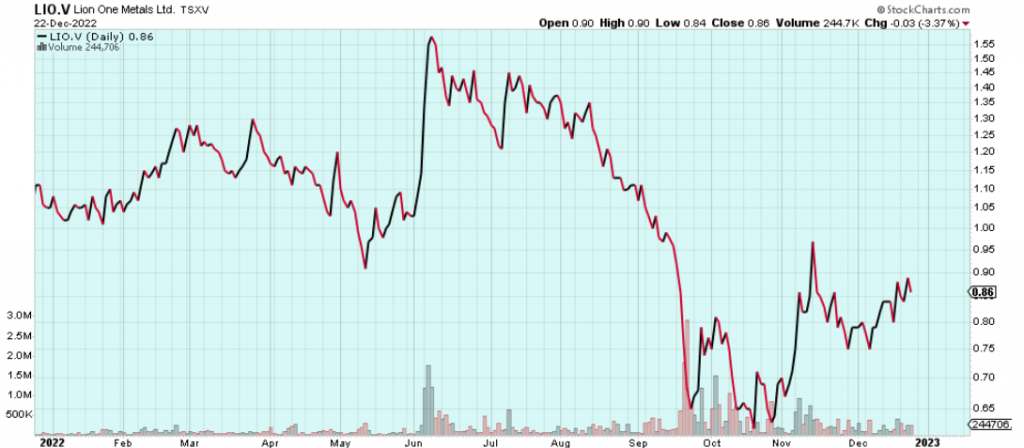

And then one final one, I remember a few months ago you said that Lion One (TSX-V:LIO) was your largest portfolio holding. I don’t know if it still is Lion one trading a little bit lower today, but pretty much sideways for the last month between $.75 and $.90.

LIO.V (Daily)

Bob Moriarty:

Lion One is still my largest holding. The company got mouse trapped. They’re going into production. They’re going to be in production in Q3 or Q4 of 2023. You’ve got to have money to do that. And they did a placement, announced a placement, I think when the stock was a dollar 5 cents share, and it just creamed the stock. Everybody sold it off to get into the placement. From a technical point of view, they’ve got extraordinary results. You’ve got 12.9 meters of 12.9 grams. You got one meter and 29 grams a hit. There is an identical mine, 40 kilometers on trend, that has mined 7 million ounces since 1930 and has 4 million ounces in a resource. And it’s the same exact kind of deposit. So these guys are going to come up with five or 10 million ounces. Yeah, of course they are. And they’re going to go into production any year, and when they go into production, actually start pouring dore bars, people are going to realize Jesus, that they were giving this stock away. If I have a lot of cash right now, I would be throwing it at Lion one.

Goldfinger:

Lion One, White Gold, Eloro resources, Cartier silver, all good opportunities here as we end up 2022. Is there anything else you’d like to mention? Is there any other company you think is a really attractive opportunity?

Bob Moriarty:

I think you could throw money at just about anything now, and even the companies that are poorly run are going to do a lot better than what people realize. Do you remember what doggy coin (Dogecoin) got up to at the top?

Goldfinger:

The price or the market cap?

Bob Moriarty:

The market cap.

Goldfinger:

I don’t know, I think it was like $25 billion or something.

Bob Moriarty:

It got to $90 billion. That is proof of insanity. Doggy coin was started as a joke, and it is still a joke and it’s still got an 8 billion dollar market cap. It’s lost over 90% of its value, but it’s still $8 billion. So what can these companies do if gold reenters the financial sphere? And the answer is there’s a lot of stocks that are going to go up a hundred fold.

Goldfinger:

That’s a big statement. It has definitely been an interesting year with plenty of twists and turns that started out with Russia invasion of Ukraine in February and all of the market volatility that was generated in commodities as a result. We discussed that many times, and now things seem a bit quieter today, but maybe it’s just an illusion. The quiet before the storm so to speak.

Bob Moriarty:

I think you live in Hurricane Alley. And I think it’s not the quiet before the storm, it’s the interlude, the eye of the storm when half of it has passed you already and you’re in the core. Peru is having a revolution. There’s a revolution of sorts in Italy. The UK booted out their people. Poland wants to build a giant army. There’s a lot of scary things in progress now, and I think my prediction of the world’s first worldwide revolution. I think it’s taking place right now. There are big and unreported protests in Paris and in Belgium. I think we’re going to see some really massive changes in the next year.

Goldfinger:

Well that’s a good place to conclude this chat. Thanks a lot again for your time and insights Bob. Happy holidays and we’ll speak again in the New Year.

Disclosure: Author owns AMX.V ELO.V and WGO.V shares at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Eloro Resources Ltd.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.