I have to be honest, It’s not often that I meet someone in the mining sector and say to myself afterwards “well that was refreshing”. In junior mining we often see the same names and faces trotted out over and over again, so it’s refreshing when someone who isn’t as well known comes in and demonstrates that they too have significant knowledge and technical skills.

I met Libero Copper & Gold CEO Ian Harris for the first time a couple months ago and I was immediately impressed. Well first of all, he’s under age 50, he is a normal person who can hold a conversation about a wide variety of subjects, and he really knows mining! I expect that Ian will do great things over the next few decades so I felt it was important to introduce him to readers. Libero is preparing to launch its summer exploration programs in the Golden Triangle so I figured it was a great time to chat with Ian and record the conversation.

Without further ado, Energy & Gold’s first conversation with Ian Harris…

Goldfinger: It’s wonderful to speak with you today Ian. I have been closely following Libero Copper & Gold (TSX-V:LBC, OTC:LBCMF) since December 2020 and we had an opportunity to meet in person for a chat in March. After meeting you I added to my Libero position and I am excited to introduce you to readers. How did you become the CEO of a junior exploration company? And how did you get involved in the mining industry?

Ian Harris: So to start from the beginning, I’m a mining engineer. I’ve been working 25 years in the industry, 15 of those years in South America, and about 12 of those living in South America. I think that a big part of the story was that opportunity to work overseas at a young age, it obviously exposed me to a lot more opportunities than if I would have been working in the United States or Canada. And it also opens you up to being highly involved in the success of a project.

And so that’s where I think it’s a strong fit with running a junior company, right? You really got to have your hands on almost all pieces of it, but it is odd to see a mining engineer running a junior mining company. I know that sounds strange. So, I have thought about what was the significant reason? And in a past life, I was senior vice president and country manager of Corriente Resources. I went down post discovery to take the project through feasibility and to help assist in building that mine, the Mirador mine, in Ecuador. And then there was a new mining law, a new constitution. The next thing I know I was thrown into leading that project and doing about 200 different interviews on TV, radio, newspaper, trying to build the political will and national support to get mining moving forward.

That was that lesson by fire. I was forced to learn how to become a better communicator. And I think that’s where a lot of technical people have a significant weakness is in the ability to communicate. So, being a mining engineer that had a minimal ability to talk in front of people, I think was a big part, of course, so was the success of Mirador becoming the first large scale mining operation in the history of Ecuador – that was the start of the next jumps and the next career moves in executive positions within mining companies. And it’s also that success that drove me and brought me to Libero today because of the similarities of the projects in Colombia.

Goldfinger: It makes a lot of sense that Libero was attracted to bringing you in as CEO, especially with all of your experience in Colombia. Tell us about your education and where you received your degree in mining engineering.

Ian Harris: I’m an oddball, I went to Virginia Tech. Virginia Tech, most people do not know this, is the biggest mining engineering program in the United States, but just very few of those engineers get out west, right? Most historically were in the coal industry and now are very heavy into the aggregate’s industry, but a very few of us escaped. When I was in school, I worked in underground coal mines about half the time. So it took 5 years because I was going to school for 6 months and then working for 6 months. By the end I missed sunshine. And so I said, where’s the sunniest place I could go. So after graduating, I turned down a lot of offers from a lot of coal companies and started working for Asarco in Phoenix, at the Ray Mine, and I’ve never turned back since.

Goldfinger: So you’re a Hokie, that’s where Michael Vick played college football. Were you there when Vick was quarterback?

Ian Harris: I graduated right before Michael Vick started quarterbacking for Virginia Tech. After graduating I moved to Arizona and started working at a copper project.

Which was also a great project to start my career. It was a great operation because it had both sulfide and oxide ore. It had traditional plants for flotation concentration both an old plant with ball and rod mills, and a new plant with a giant SAG mill, and a smelter to produce anode. On the other side for oxide ore, acid heap leach, and SX-EW to produce cathode.

I got to see a little bit of everything related to open pit copper mining and processing at that location. It was a really good introduction. The only bad part was that it was in 1999. I graduated in ’97 and copper decided to go to 59 cents. So how things have changed since then, right?

Goldfinger: Wow! So, you started basically at the bottom of a cycle in the mining sector. I mean, that was a pretty rough time. And now I don’t think we’re at the top of a cycle, but we’re certainly not at the bottom with copper trading at $4.60 today. Right. So, you started basically in the poor house and now things are a little bit different.

Ian Harris: Yeah, it was because of 59 cents that I said, “I’m too young in my career to be having salary freezes and all these other things.” And I started looking for opportunities and that’s when I got the opportunity to work and live in Venezuela. And that was an amazing experience. I was around 25 and working with a group of veterans with 30 to 40 years of experience, in engineering, operations, maintenance, and general management. It was a management contract over mines there. Being the young member of the team, I used to call getting on the morning management bus, running the gauntlet, but I learned so much from really experienced professionals.

Goldfinger: Let’s transition to another topic. You’ve been in the sector for over 20 years. So what have you learned both as an executive and working for companies, and then as an investor as well? What are some of the things that you would tell a relatively novice investor to junior mining, in terms of company management or projects? Like what are some things that are positive? And then what are some red flags that you’d say, “yeah, I wouldn’t want to invest in that.”

Ian Harris: Yeah, that is a loaded question, so I’ll divide it into a couple of sections. I came from the trenches. I was a mine supervisor, drill and blast supervisor, heap leach and SX/EW supervisor, and then eventually superintendent, mine manager, general manager. So I worked learning operations.

And so when I look at companies, the first thing that I do, especially in the mining space, is don’t get starry-eyed just on the big names for the big companies, and take a deeper dive if they have the people to execute the strategy. Team is the most important component of any mining company, even if they don’t have an asset, if they have an incredible team, they will attract assets.

But don’t stop just at the highest levels. There are basically three components that are very important in terms of a management team for a junior mining company to advance, and right now, it’s probably the scarcest asset. We think, oh, there’s not a lot of copper projects out there. That is true, but there’s even less people that can actually advance those projects.

So first you need to be able to finance, and I think that’s where you need some name recognition, the ability of raising money. Somebody who has had a series of successes and a good track record behind them that can actually help maintain the fuel in the tanks. These projects can require 10 years from discovery to production. For example, to go from inferred to measured and indicated, four times more drilling is required to convert those. So that’s a big dollar item. And so does the company have the ability to bring in the money to get it to those steps or whatever it takes to create value? Does the company have the capacity and the ability to be able to keep the fuel in the tank to create value for its shareholders?

Next, is evaluation of the technical team to guide the direction of the company and develop that strategy to guide the company in value creation. The final part is the team on the ground, that is often overlooked and not even included on the corporate presentation. However, without that team on the ground to execute the work all the fund raising and strategy is useless.

LBC.V (Daily)

Goldfinger: So then let’s talk about Libero Copper and Gold (TSX-V:LBC, OTC:LBCMF). So, you’ve stated some really important things there to look forward or to look for in a junior mining company, in terms of management, track record, the ability to raise capital, the technical expertise and then the asset portfolio. So tell us about what you guys have in terms of management and assets.

Ian Harris: Yeah, and it’s probably a nice way to continue the same conversation. As I said in the beginning, I’m a mining engineer. So the strategy that Libero has is basically, we want to invest exploration dollars into projects that have a chance of becoming large scale, open pittable copper mines. That’s the optic. We don’t want to waste our time drilling a great deposit if it’s 500 meters under the ground and has little chance of and no chance of becoming an open pit or has other obstacles such as metallurgy, or the grade isn’t very well disseminated, or it’s only going to be 10 million tons, even if it’s at the best grade of the world, right?

That’s our strategy. We see what’s happening in the copper market space. We realize that majors are not green-lighting greenfields projects, nor do they have them in their portfolios that can cover the coming demand. But there will be a moment of reckoning where projects that are well-advanced and have scale are going to be critical assets in the future. Junior mining is all about timing, right? And so that is what our strategy is. So how do I determine that if it’s an early stage exploration project, if it has sufficient legs to have a possibility of becoming a future mine? A big part is scale. There is a classic curve. If you look at the operating costs of open pit mines, there’s a turning point of about 30,000 tons per day. At 30,000 tons per day is the apex and when you go from 30,000 to 60,000, the incremental operating cost savings is not significant. It’s there, but it’s not huge. But going from 15 to 30, it’s a massive difference. It’s sort of like, that’s the point where that’s the biggest trucks we’ve got, those are the biggest SAG mills we’ve got. So any incremental size is just more of the same big trucks and more of the big gigantic SAG mills. And so it just seems to be a critical point, and as a rule of thumb for me is 30,000 tons per day. And you want 20 years. So back of the napkin, then you’re going to need about 150 million tons. Let’s call it 200 million tons because you’re going to lose some between resource and going to reserves when you may optimize plans. So let me go, “we need a project that has the size and scale that has the potential to have a minimum of a 200 million ton resource.”

And then it’s basic math, right? It’s a cube, average density is 2.4. It’s a 500 meter by 500 meter by 300 meter cube of dirt in the ground. So you then compare that size. You’re looking for anomalies that are at least a half a kilometer wide and have some depth potential that could make that resource. So if it’s a very small strike length, or it doesn’t have the anomaly size, then we know that it’s never going to have the potential to become a large-scale mine. So that’s the first checkbox.

The next one is, to become an open pit mine you don’t want to be too deep. The industry is very capital sensitive, so you don’t want to dig 5 trillion tons of dirt to be able to get to that first pound of copper coming out of the ground. You want to look for deposits that are near surface. That helps with your strip ratio, but it also helps with your pre-stripping. But what is the amount of work that needs to be done before that mine even starts? And the last one is that it is also disseminated.

You want to make sure that the grade is evenly distributed, because pits, when you go down, you still have to take down everything. So everything goes, so you don’t really want to be chasing little small bits and pieces to be able to get your ore flow to your mill. So those are the very high level, looking for 200 million tons means a large size anomaly, looking for near surface and looking for disseminated. Of course, grade is also critical so I can pass over that really, really quick. Grade pays for a lot.

But we know in the industry based on copper prices, even at $2 a pound for copper prices, you’re still going to be, want to be above that .45% copper equivalent, if it’s a large-scale mining operation. So these are all rules of thumbs that say, “Does this project have the chance of becoming a future mine?” Because the truth is that if it doesn’t have the chance to become a future mine, it might make you some money over a short term because of some great holes or some great marketing, but over a sustained period of time? It’s going to go to zero, at least on a project level.

Goldfinger: That was a really good explanation. So let’s talk about the Libero project portfolio. Maybe choose one project in the portfolio and talk about all of what you just said is relevant to that project and why the company chose to acquire it.

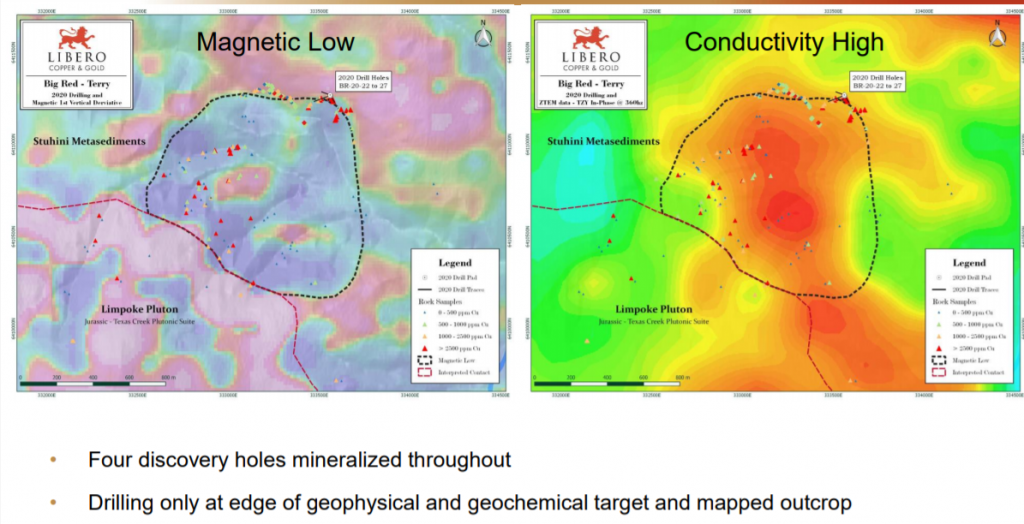

Ian Harris: Okay. I won’t cheat and use Mocoa because it’s too easy. It’s already sitting over 600 million tons so it’s already three times that threshold. So let’s talk about Big Red and Esperanza. If I was doing the 30 second check of a project, because a lot comes across the desk, and say it’s Big Red. There’s a discovery hole. So, you know you have copper. It’s got decent grades, it’s around 0.45%, and then you look across the street and you see GT Gold just sold to Newmont for C$450 million and it also had a very similar grade. So obviously a major would be interested at that grade. Mineralization starts at surface. There’s mineralization throughout the hole. Good, check box. Near surface disseminated looking good. And then you look at the anomaly size and it’s over a kilometer in diameter, and it’s a classic geophysics signature for a porphyry. Another checkbox.

So that is where Big Red is checking the boxes and we will continue because it is worth investing money into that project to be able to advance it and answer those compelling questions. Does Big Red have the chance of becoming a future open pit copper mine? And right now everything is saying, “Yes.”

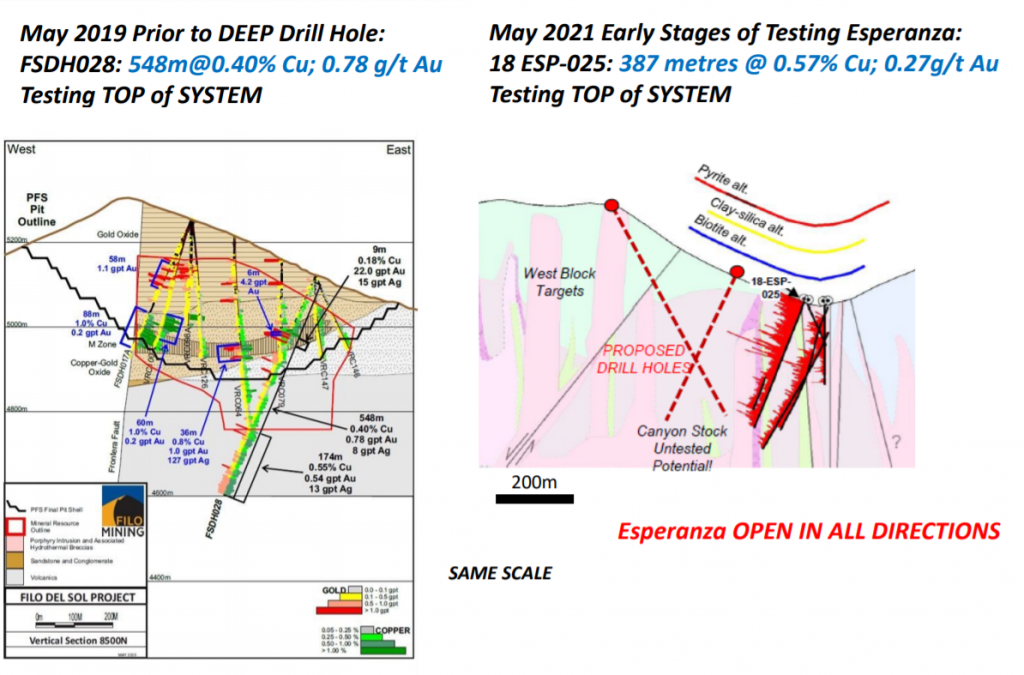

The same is true in Argentina, where we have an incredible discovery hole at 380 meters at about 0.75% copper-equivalent, completely mineralized from surface to depth. It’s got a 1.8 kilometer strike length, and it’s got an extremely strong geochemical alteration footprint of about 600, 700 meters wide. So again, it’s saying the same things. You have mineralization from surface. You have mineralization throughout the entire hole, meaning it has opportunities to be even deeper. And it’s got the size and scale that has a chance to become a future mine.

The last thing that I didn’t talk about is jurisdiction. We’re focused in the Americas. All the projects are within the Americas based on the experience that the management of Libero has operating successfully in the Americas. And that also makes it a whole lot easier to manage multiple projects because you’re in similar time zones. So Big Red in British Columbia, Canada, solid, and Esperanza is in San Juan, which is the classic mining jurisdiction of Argentina. What a lot of people don’t know is there’s a lot of autonomy in the provinces for mining in Argentina. So it’s kind of isolated a little bit from what’s happening on our national level politics, which helps a lot.

44% of all investment in exploration in Argentina is in San Juan. So that makes us feel good. And the Fraser report that comes out every year also confirms that, a great source for people that are new to the mining space is the annual mining report by the Fraser Institute that helps say, “What are the good jurisdictions and what are the bad jurisdictions?” Look how they rank this year and look how they ranked over the last five years. The other one is Colombia. Mocoa is in Colombia and it’s for the first time ever ranked number one in Latin America for attractiveness. This means Colombia beat out Chile and Peru, because it is focused on attracting investment and doing the right things, which is very encouraging.

Goldfinger: Again, that’s a really good explanation. What are the key milestones that shareholders can expect from Libero for the rest of 2021? Basic question, how much cash do you guys have on hand? How much do you think the summer program in the Golden Triangle or programs in the Golden Triangle are going to cost you, and is there the potential to drill all three projects this year? Or are you mainly just focused on the Golden Triangle right now?

Ian Harris: Yeah. Your article was a great summary of the company, because we basically have three separate projects, any one of the three could create tremendous value for the company. And they’re easy to understand how that value could be created, because they have very easy comparables. Big Red as GT sold for C$450 million. Esperanza has an analog to Filo del Sol, which is now worth a billion dollars. With Mocoa, you have Solaris’ Warintza Project, which is also worth a billion dollars. The projects can follow in those footsteps, doing very similar things that those companies did. You can see where the value can be created, since today, we’re at a C$30 million market cap, a week ago, we were C$25 million. We have C$7 million in the bank and the focus right now is in the Golden Triangle, between Big Red which will be a 5,000 meter drill program, and Big Bulk which will be 2,000 meters. The total summer exploration program is budgeted at about $5 million.

Libero’s Esperanza Project has numerous similarities to Filo Mining’s Filo Del Sol Project located in the same province of Argentina

Libero’s Esperanza Project has numerous similarities to Filo Mining’s Filo Del Sol Project located in the same province of Argentina

That is the majority of the money that we have in the bank. We’ll be focusing on those projects. We’re currently getting boots on the ground. And right now, we’re working on mobilizing camps and drills and et cetera, to be drilling probably the first week in July. That’s probably the most important thing for investors to know right now. Previously we were talking that there’s a lot of excitement for Libero because of the management team that has been put together and also the quality of the assets that we have in the ground. But in the market there has been a lot of short-term focus, there’s a lot going on in markets, there’s a lot of uncertainty. Now that we’re mobilizing and we’ll be drilling at Big Red, I think a lot of people are coming off the fence because they know now is the time.

And we’ve seen a really nice improvement in share price over the last two weeks, and hope that that trend continues. I think people are saying, “This is as low as it’s going to get. We better get on board now.” We’re seeing a lot of new investment into the company. So Big Red is now on that path of creating value. Mocoa, we submitted for permits to reactivate and start exploring again at Mocoa. It’s a process, but the good news is that the government is working with us to assist. We’re paralleling and combining forces for social work and communication locally, and also working with the environmental agencies through the permitting process, because it’s a priority project for the government.

We’re getting a lot of assistance and that helps to break through the bureaucracy. Our expectation is by the end of the year, we’ll have those permits in place. And the same is true in Argentina. Argentina, it’s an election year. We believe that right after elections are finished in November, we’ll be getting our permit for Esperanza. Those are end of the year events. The ball on the hand right now is Big Red, but we believe that drilling will be starting, we’re getting results in, it could take a month or two months, we’ll have news coming out on drill results. At the same time, hopefully then Esperanza and Mocoa will also be coming into play.

2020 drilling at Big Red clipped the edge of the geochemical/geophysical anomaly, drilling in summer 2021 will begin by targeting the center of the magnetic-low feature above

Goldfinger: Excellent. The way I see it is Mocoa and Esperanza are the icing on the cake at this point, Big Red is a very attractive project with significant discovery potential that can really drive the value higher as drill results start coming in.

Final question pertains to Big Red and Big Bulk, because this is something that happens every single year, it seems, with Golden Triangle explorers. I just want to get your thoughts and set investor expectations for this. Companies go out, they mobilize, they start to drill at the end of June. They drill through the end of August and then we wait for the assays to come in. And sometimes you get a company that does a rush on the assays and we get results in August. And it’s like 30 grams of gold over 10 meters. And everybody’s ecstatic. And then other times we’re waiting until January to get the results in from summer. So what should we expect from the drilling that you guys are going to do? What sort of timeline can we expect? You’re probably going to drill 10 to 12 holes, I’m guessing. So how will you put those results out? And when do you think we can expect to get those?

Ian Harris: So it is an enormous question mark. It was obvious last year. Wonderful season in the Golden Triangle, but combined with COVID, while I believe the exploration companies managed very well COVID protocols and keeping people safe, there were very few incidents in the industry, in the area and managed very well. I’m not sure we could say the same about the ability of the laboratories to take on both ramp-ups due to the amount of work and finding the people and keeping everybody in good working conditions to process that. What we saw, the reason why you saw some go in early and then come right out, wasn’t necessarily because of rushing. What we saw was there was a massive bottleneck in the ability to do sample preparation, which takes that core, smashes it up, splits it, it makes a fine powder of a representative piece of that core that then goes in for assay, whether fire essay or AA or whatever other processes are being used for taking the result.

It was in that sample prep, there just was not the ability to prepare and process the amount of core that was coming in. So once it was prepared, you get the assay result really quick, but if you’re in the back of the line, you just have to wait until your core could be crushed. So what are we doing? First of all, we have a little bit of a luxury of having a team that has massive years of experience of working in the Golden Triangle. We have directors and management that have long-term incredible relationships established with the communities, with the first nations, with the drillers, with the pad builders, with the suppliers. We also did our financing in February. So we had a high level of confidence. We knew what we were going to do, and we could make commitments to secure the drills, the helicopters, the pad builders, everything that we needed to do, because we want to be first in line.

We want to be out first with our news because we want to be ahead of the pack and we don’t want to get lost in the noise. The last is, will the laboratories be able to take on that new onslaught? So conversations with ALS, they have done a lot. They realized we don’t want to have the same mistakes we had last year. They are adding new prep, sample preparation locations throughout the Golden Triangle, to be able to process more of that material faster, they’re talking about 30 day lead times, fingers crossed that they can maintain those timelines.

Goldfinger: Thank you Ian, this was a very productive conversation and I look forward to speaking with you on a regular basis going forward.

Disclosure: Author owns LBC.V shares at the time of publishing and may choose to buy or sell at any time without notice.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Libero Copper & Gold Corp. is a high-risk venture stock and not suitable for most investors. Consult Libero Copper & Gold Corp’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover Libero Copper & Gold Corp. and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.