Great silver districts aren’t discovered, they are consolidated. We recently saw a similar story play out with Vizsla (TSX-V:VZLA) as they consolidated a nearly 10,000 hectare property package (Panuco) with ~80 existing gold/silver bearing epithermal veins.

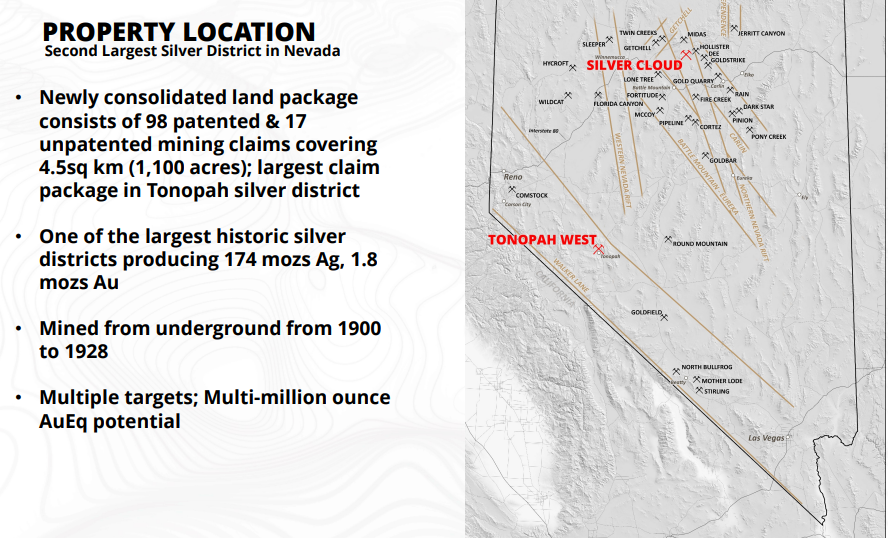

Blackrock Gold (TSX-V:BRC) has just done something very similar to Vizsla except the Tonopah West Project is in Nevada, not Mexico. Blackrock has acquired an option to purchase the Tonapah West Project, consisting of 98 patented and 17 unpatented lode mining claims, making them the leading claimholder in the famed Tonopah Silver District. These claims contributed to the historic production that made Tonapah the second largest silver district in Nevada, behind only the Comstock Lode.

Photo from an old postcard showing the West End Mine in Tonopah, Nevada

The option agreement calls for a total of US$3 million in payments over four years, however, the key aspect of the agreement is that only $650,000 is due within the first 729 days (US$650,000 is due on the 2nd anniversary of closing the agreement). This will allow Blackrock to carry out substantial exploration work in the first two years in order to determine whether it’s worth it to continue to make the option payments at the 2nd, 3rd, and the 4th anniversaries. Upon the completion of all option payments Blackrock Gold will own 100% of the Tonopah West Project, however, Nevada Select Royalty will hold a 3% net smelter royalty in Tonopah West. There is no work commitment involved in this option agreement.

Blackrock now holds two projects located in prolific mining districts in Nevada (Northern Nevada Rift and Walker Lane Trend):

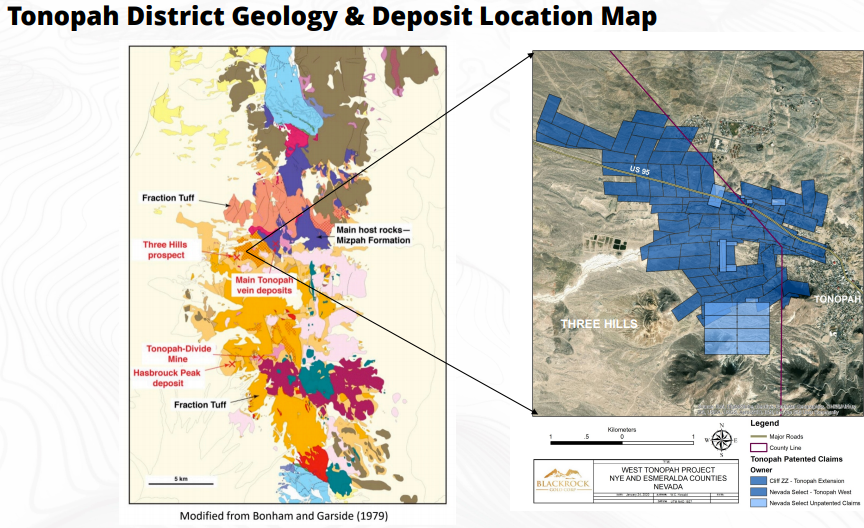

Tonopah West represents a significant landholding within the historic Tonopah silver district located in the Walker Lane trend of western Nevada. The Tonopah District produced over 174 million ounces of silver and 1.8 million ounces of gold from approximately 7.5 million tonnes of high‑grade silver-gold epithermal quartz veins. The main hosts of gold and silver are volcanic rock of the Mizpah andesite and the West End Rhyolite. These host lithologies are present on the Tonopah West Project.

It’s also important to emphasize that Tonopah West is brownfields exploration, which is more about following up on known vein extensions as opposed to high risk/high reward greenfields exploration drilling. Drilling should also be cheap as Blackrock will be able to do most of it with RC (reverse circulation drilling) and the company won’t be slowed down by permits as most of the claims are on patented land.

Before I delve into some of Blackrock’s juicy targets at Tonopah West, I also want to mention Silver Cloud, Blackrock’s other project. A phase two drill program at Silver Cloud is set to commence within a month, and Blackrock will also be conducting geophysics work at Silver Cloud in the near future. We should also be getting back the rest of the assays from the last drill program very soon.

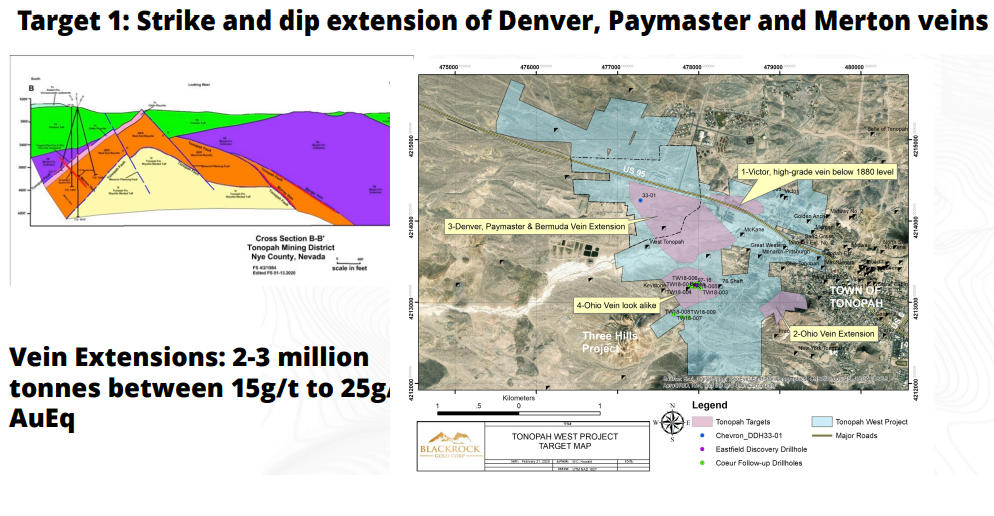

Blackrock has identified four target areas with the potential ranging from 2.5 million to 6 million tonnes averaging 13 to 21 g/t gold and gold equivalent. There are two targets in particular that stand out:

Target 1 involves extending known veins (Denver, Paymaster, and Merton) along strike and down-dip (at depth).

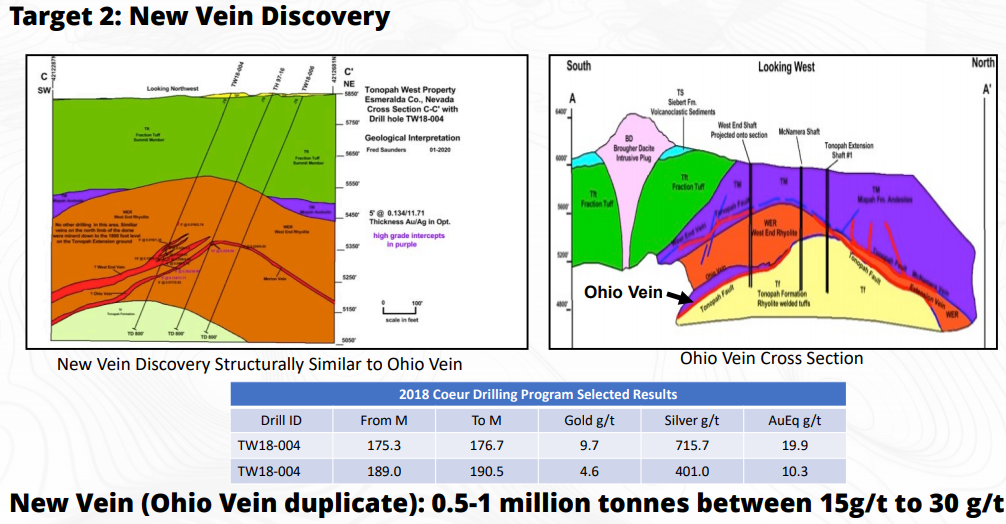

Several companies conducted exploration in the 1980’s and 90’s at Tonopah West, the most active being Eastfield Resources Ltd. They completed several drill campaigns with the bulk of their exploration work on the nearby Three Hills project. In 1997, Eastfield drilled an exploration hole on the southwest portion of the Tonopah West Project. They intersected a new zone with values of 7.5 g/t gold and 288 g/t silver over 3 metres. In 2018, Coeur Mining followed up the drill intercept and cut two, 1.5 metres zones grading 9.7 g/t gold, 715 g/t silver and 4.6 g/t gold, 401 g/t silver. In November 2019, Coeur left the district to focus on their Sterling mine acquisition near Beatty, NV. This new vein discovery represents target 2 at Tonopah West:

There are more than 4 million C$.20 warrants outstanding that expire within a few weeks, Blackrock CEO Andrew Pollard told me yesterday that he expects these warrants to get driven in over the next couple weeks and the company can use the proceeds to make the initial US$350,000 payment on the Tonopah West option agreement. Blackrock is fully funded for what the company has plans for at this point in time.

This is an aggressive move by Blackrock CEO Andrew Pollard, but I like it. Being a single project junior explorer seriously limits ones options, by getting Tonopah West under option suddenly Blackrock becomes a much bigger story and one that does not live or die by a single drill hole at Silver Cloud.

Pollard is a visionary storyteller and now he has a much bigger story to tell.

Disclosure: Author owns Blackrock Gold shares (BRC.V) and Blackrock Gold is an Energy & Gold sponsor company.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Blackrock Gold Corp. is a high-risk venture stock and not suitable for most investors. Consult Blackrock Gold Corp’s SEDAR profile for important risk disclosures.EnergyandGold has been compensated for marketing & promotional services by Blackrock Gold Corp. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.