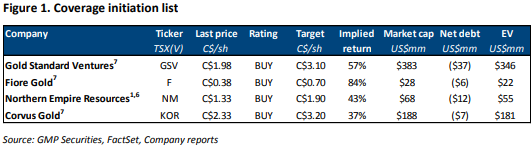

In an extensive research note titled “Going all-in on Nevada” GMP Securities highlights three Nevada-based gold explorers (Corvus Gold, Gold Standard Ventures, and Northern Empire Resources) and one Nevada junior producer (Fiore Gold). GMP places buy ratings on all four stocks with various price targets implying returns between 37% and 84%:

The 3 explorers highlighted by GMP have all significantly outperformed the junior sector in the last month with Northern Empire (TSX-V:NM) rising nearly 35% while GDXJ is flat over the same time frame:

The market appears to be rewarding Nevada junior explorers/developers while punishing junior producers such as Fiore, Northern Vertex, and Pershing Gold (to name a few). With that being said GMP takes a positive view of Fiore Gold (TSX-V:F) and places a C$.70 price target on the stock citing operational improvements at its flagship Pan Mine, and Fiore’s Gold Rock Project which is “years ahead of similar properties as it nears federal permits.”

I hope GMP is right as Fiore has been my worst pick of 2018 and it has been painful to be a shareholder in recent months. Despite trading at a mere 2x cash flow there has been a relentless offer in the shares which has continued to pressure the share price lower despite production growth at Pan:

F.V (Daily)

Corvus (TSX:KOR) and Northern Empire both saw aggressive buying during today’s session, presumably as a result of the GMP report:

KOR.TO (Daily )

KOR shares rose nearly 10% during Wednesday’s trading session – a breakout above C$2.70 would target fresh all-time highs (above C$3.20) for KOR.

NM.V (Daily )

During Wednesday’s trading Northern Empire reached levels it hasn’t seen since early May on record trading volume. NM remains in a strong long term uptrend despite the steep April-June correction which saw NM shares shed more than 40% from high to low.

The most interesting aspect of the GMP note on Northern Empire is that they outline a path to production both for the Sterling Mine and the Crown Block of deposits; GMP sees production at Sterling beginning in 2020 followed by development at the Crown Block beginning in 2021 (with the benefit of cash flow from Sterling) followed by initial production in 2022.

The key theme here here is that analysts/investors are foreseeing significant gold sector M&A in Nevada over the next couple of years. This is primarily due to the simple fact that there are a scarcity of good projects in premier jurisdictions and it doesn’t get much better than Nevada if you’re a gold mining company.

To add a little bit more to the M&A intrigue John Kaiser recently mentioned that Northern Empire did not attend the Sprott Conference in Vancouver last week due to a ‘site visit’ by what was potentially a senior mining company. I have no further insights into this speculation other than the fact that Northern Empire did confirm that they had to pull out of Sprott at the last minute and they didn’t think it was fair to ask for a refund.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Northern Empire Resources is a high-risk venture stock and not suitable for most investors. Consult Northern Empire Resources’ SEDAR profile for important risk disclosures.

EnergyandGold has been compensated to cover Northern Empire Resources and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.