Bob Moriarty, founder of 321gold, does not profess to be a market timer but he sure does have a knack for timing. In my last three conversations with him he gave readers prescient insights into gold, the precious metals mining sector, and a stock called Novo Resources, to name a few. Gold has rallied ~$150/oz in the two months since our July conversation and what Bob has to say about gold and the miners here might surprise some people. Without further ado here is Energy & Gold’s September 2017 conversation with Bob Moriarty…

CEO Technician: The last time we spoke was in early August and you had just returned from a trip to visit Novo Resources (TSX-V: NVO, OTC: NSRPF) in Australia. NVO shares were trading at about C$3.25 on the day we spoke and subsequently shot up to nearly C$6 per share within ten days after our conversation. Since then the shares have pulled back by about ⅓ from their peak. What are your thoughts on Novo shares here and the latest news of the C$56 million strategic investment by Kirkland Lake Gold (NYSE:KL, TSX:KL)?

Bob Moriarty: If you buy into Quinton Hennigh’s theory, which I did in 2012, then you naturally believe there is a lot of gold in the Pilbara Basin. Quinton was initially focused on the east side of the Basin, but then when he figured out there was gold in conglomerates at surface on the west end of the Basin he staked about 10,000 square kilometers. If his theory is correct it will be the biggest gold discovery in history.

Kirkland Lake is now the single biggest shareholder of Novo, but Eric Sprott himself owns a bunch of shares too. The interesting thing there is the potential for someone wanting to take over the company. Eric Sprott does not do hostile takeovers. He wants to hire people smarter than he is. Then he lets them do their job. I think that’s the very best thing that happened to Novo. They’ve got another C$70 million in cash, and another C$30 million in warrants potentially from previous warrants. In addition to another C$80 million potential in warrants if the stock traded above C$12. Basically, Novo is fully financed to production. They can explore the crap out of their 10,000 square kilometers. They can either prove the theory or disprove the theory. It’s going to put a basement underneath the stock at about four bucks a share. I don’t see the stock going to C$3.00 again, but somewhere around C$4 should be the lowest it goes to.

CEO Technician: Are you still a big shareholder? Are you still looking for much higher levels?

Bob Moriarty: Absolutely. There’s two issues. One issue is it’s potentially the biggest gold discovery in history. That obviously would move the stock up a lot. The other is what happens if gold goes to $2,000 or $3,000, or whatever ridiculous number you want to come up with. There’s two main things that could move the stock: One is proving Quinton’s theory and the other is if the price of gold moved higher. Novo has been my biggest shareholding since 2012 when I said it had the potential to go up between 10 and 100-fold. It’s already gone up 10-fold and 100-fold is still possible.

CEO Technician: Is Novo drilling right now?

Bob Moriarty: No. Artemis threw a roadblock in the way. The Artemis Purdy Reward Tenement is permitted and Novo could have worked, but Artemis came in and started literally strip mining the surface with a little toy excavator. Rather than argue the point, Quinton just stopped everything he was doing until Artemis backed off. Artemis has realized it was a mistake on their part. Novo is now in charge of the exploration and Purdy’s Reward is permitted. They’re going to be moving drills in shortly and in the next 6-8 weeks you should see results coming out.

CEO Technician: Turning back to the broader picture, about two months ago in our interview you went bullish on precious metals when gold was around $1210. Now we’re trading north of $1350 this morning as we speak and silver is over $18 an ounce. We’ve seen the senior gold miners rally quite substantially as well (more than 20%). What do you see for gold and the precious metals mining sector right now? Is this a time to be cautious, or do you think we’ve still got a lot more upside left on this move?

Bob Moriarty: Actually, if you go back to the interview we had in June, in June I said that I felt we were in a correction that would end at the end of June or the first week of July. It did end during the first week of July at about $1205 gold. Since then it’s gone substantially higher. Interestingly enough, and it’s Tom McClellan who came up with this indicator; full moons tend to mark either a turning point or an acceleration. I emailed you a couple of days ago after you had come up with a very good article saying that the gold sector could move up or down depending upon the time frame and I pointed out that a full moon was on the sixth (September 6th). We appear to have had an acceleration move from early July until December. I said in July I thought that we were in for an extended bullish wave that could last throughout the second half of the year and I still think it’s true.

While it was possible that we had a turn lower on the sixth, I think we’re having an acceleration higher. The bottom of the bear market was in January of 2016 then we had a big rally until July 2016. Everybody got on board, everybody got bullish, and then we had a correction that pretty much lasted for a year. That’s always a good thing. I mean these guys who are always whining about gold being manipulated, they never use the word correction. Everything, every commodity, goes up and it goes down. A correction is an absolutely perfectly normal and desirable aspect of the market. This concept that gold is supposed to go up every single day, and if it doesn’t go up every single day, it’s proof it’s being manipulated is absolute rubbish. We’ve had a year long correction and we have, I think, a stealth bull market in progress. I think we could easily go up until December.

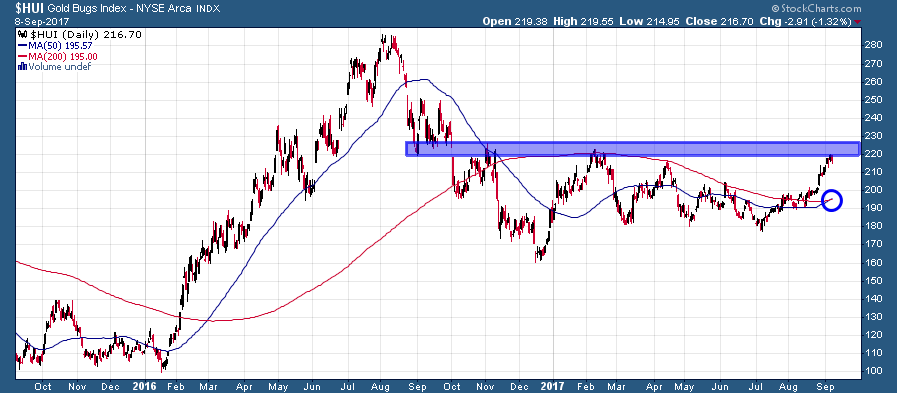

HUI (Gold Bugs Index – 2 Year)

The HUI is testing key support/resistance near 220 as the first ‘golden cross’ (50-day moving average crossing above 200-day moving average) since March 2016 takes place.

CEO Technician: Fair enough. Actually it’s interesting that on the 6th, the gold miners had a down day but then yesterday (September 7th) they retook all those losses and then actually closed at a new high, which is characteristic of a bull market. A bull market is going to have down days, and sometimes very sharp down days to keep everybody on their toes and shake some people out along the way. But usually in a bull market move, we won’t get three or four down days in a row if it’s a really strong move. This is acting like it’s got more upside, so I agree with you. What about copper and nickel and zinc? Copper is at $3.15/lb this morning, zinc is $1.40 or so. These are pretty high levels in the base metals, we haven’t been at these levels in years. Do you think that copper is at risk of being a little too high here, or is this part of something much bigger in terms of a new bull market in base metals?

Bob Moriarty: Well, in my book, Nobody Knows Anything, I make a point that markets are very unpredictable, and the mob is always wrong. They never quite get it. In January of 2016, we had the lowest commodity prices in 5,000 years. It’s a very safe bet when anything is at a 5,000 year low, that prices are going to go higher. You can argue technically, you can argue fundamentally, but if you’re at a 5,000 year low mathematically things should go up. Everything goes up, everything goes down. It’s really that simple. We had 12 years of gold going up (1999-2011), and everybody was saying, “Well, it should go up forever”. We had a correction. Okay, it’s a correction, live with it. Well, the correction’s over. We had 5,000 year lows in commodities. I was pointing out in January and February of 2016 that actually measured against other commodities, such as oil, copper, zinc and nickel, gold was actually very high. This year gold’s only gone up maybe 20% and everything else has gone up far more than that. That’s perfectly normal.

But if you look at the chart of zinc, and if you look at the chart of copper, and if you look at the chart of nickel, you have to conclude they are in a bull market. Nobody wants to believe gold’s in a bull market because they’re only paying attention to gold, but if you want to see where gold is going to go, look at copper and look at zinc. I think we’re in a bull market. One of the things we hadn’t actually discussed is, South Florida is about to get hit with a major hurricane, and the really strange thing is there is an excellent chance it could bankrupt a lot of insurance companies if not all of them. Harvey hit Houston about 10 days ago and it was the biggest natural disaster in US history. It looks like Irma is going to just totally rake the entire state of Florida.

Here’s what you need to think about. Nobody ever points this out, and they really should. It’s something I was trying to point out in the book. Things are a lot simpler than people want you to believe. When you build a house on the beach in South Florida, or Turks and Caicos, or Grand Cayman, or Puerto Rico, every 50 years or 100 years, it’s going to get totally blown away. We pretend, “Well, we’ve got government insurance, and we’ve got insurance companies and they’re going to protect us against that”. But if Miami gets flattened, it will bankrupt almost every insurance company in the world. The funny thing is, it’s not the hurricane that does the damage, it’s the counter-party risk that nobody takes into account. Now eventually, the 600 trillion dollars of counter-party risk in derivatives is going to bring the financial system to its knees. Everybody that passed Economics 101 knows that if they just think about it. These hurricanes could be the icing on the cake. They could be the straw that breaks the camel’s back.

We’re doing this discussion Friday morning Central European time, and if that thing hits Florida and hits Miami head on in 24-36 hours, it could cause $200 billion in damage. That’s going to have an impact.

CEO Technician: Yeah, if it does rip up the East coast at a category three or four, the damage could easily be north of $200 billion just because you have all those million dollar condos in very high concentration throughout Dade, Broward and Palm Beach Counties. Then toss that in with Harvey, and total it up, and you’re looking at easily a $400-$500 billion total for the insurance industry in just a few weeks.

There could be a substantial rebuilding play here in terms of rebuilding houses and buildings in Texas and Florida, and rebuilding cars that obviously people will need. All of that is going to require a lot of raw materials; think steel, copper, lumber etc. Overall it should definitely be a positive for the metals industry. Do you have any juniors that we don’t know about yet that you are particularly fond of here Bob?

Bob Moriarty: I do have a silver stock that I think is quite a sleeper. The stock is Metallic Minerals (TSX-V:MMG), and they’re in the Yukon. Metallic is in an area that has produced hundreds of millions of ounces of silver and base metals. It’s run by Greg Johnson. They’re in Keno Hill, but there’s two companies up there that I think are going to do very well in silver. Silver is really cheap compared to gold. Silver is cheap, platinum is cheap, palladium is expensive, gold is expensive.

MMG.V (June 2016 – September 2017)

One of the things that I’d like to point out that we haven’t mentioned is that investing in resources is like dancing. Sometimes you lead and sometimes you follow. While everybody is focusing on gold, they’re ignoring how cheap silver is and they’re ignoring how cheap platinum is and rhodium, and zinc, and copper. Zinc, and copper, and nickel are leading and I think that it’s going to drag silver and gold and platinum along with it soon. The really funny thing to me is we had a great move in gold and silver yesterday, and my small stocks were down pretty much across the board.

CEO Technician: That is interesting. Yeah, it was not a strong day in the junior sector. The seniors were fairly strong, but the juniors didn’t really move much at all. I think that, in my estimation, for us to really get the retail crowd into the junior sector to pay attention to gold in a big way, we probably need a print above $1,400 in gold and probably above $20 in silver, and maybe a decline in bitcoin and other virtual currencies. We might need to see a shakeout in that space as well to dampen the enthusiasm there and get the crowd, the much bigger crowd, chasing the metals sector.

Bob Moriarty: That’s absolutely true. China just put the writing on the wall. Whatever advantage that people think bitcoin has as far as being anonymous and not being under the control of government, China has pointed out that is absolutely not true. Whatever the phantom advantages are, are strictly phantom advantages. Bitcoin is the same as Beanie Babies and tulip bulbs. The mere fact that it has gone up doesn’t mean that it’s desirable, it just means that it’s the flavor of the day. But it absolutely taking money away from resources, and it’s no big deal. If anybody thinks that they’re going to outsmart the United States government by owning bitcoins, I can assure you that all they have to do is flip a switch and bitcoin is history. I wouldn’t touch any of them with a 10 foot pole. The fact that people think that they’ve made money in it, they’re going to be really surprised at the end of the day. There are over six hundred variations of bitcoins and that is hardly something you would call limited.

CEO Technician: I think that some people were definitely misled or intoxicated by their own good fortune in the sector recently, but anybody who has profits, has traded and bought and sold any of these virtual currencies, they can expect to pay taxes to the IRS. I don’t think that anybody’s going to avoid any of that stuff. If they do try to, they’ll probably get caught. It’s already been proven that the government can track these transactions.

Bob Moriarty: Correct.

CEO Technician: Before the hurricanes and everything started a couple weeks ago, we had Trump and Kim Jung Un bashing heads. Trump first saying that North Korea is going to be met with fire and fury that’s never been seen before and then North Korea tests a 140 kiloton hydrogen bomb, which is by far the biggest weapon they’ve ever tested. And then of course they shot a missile over Northern Japan. Then Trump’s meeting with all of his generals and acting very tough, but it seems like a couple of adult men who are like big children trying to act like who has the larger gun. But, so far it’s just a lot of words. Is there something to actually really worry about here, or is Trump just all talk?

Bob Moriarty: First of all, Trump is all talk. I am not a big fan of Steve Bannon, however, even fools come up with good thoughts periodically. Steve Bannon came out and he pointed out that in the first 30 minutes of a conflict between North Korea and the US/South Korea, 10 million residents of Seoul would die. If you believe there’s a military solution, you have to be willing to accept 10 million dead in the first 30 minutes. I think that it would be utterly irrational for Trump to pretend that there is a military solution. The only military solution is World War III. Only idiots talk about World War III being a good idea. There is no rational military solution. None.

Trump really disappoints me because Trump as a candidate had some things I totally supported. Trump is not as political as any politician. As a President he is a total buffoon. And while I’m totally against the media, 95% of the articles written about Trump are negative, but he feeds them. I mean if I had a 13 year old daughter that spent as much time on Twitter as he does, I would take her phone away and throw it in the lake. We’ve got a Presidency by Twitter. If that isn’t end of empire stuff, I don’t know what the end of empire would look like.

You’ve got two choices with North Korea. You either accept the fact that they’re nuclear armed and you live with it and try to avoid pissing them off, or you say, “Look, here’s a conference table and we’re pretty much going to give you whatever you feel like”. There are some issues that are non-negotiable. There is no way that China is going to let Korea reunite under the control of the United States. It’s not going to happen. China is not going to allow the United States to be on their border. We pretty much have to live with the fat little toad in North Korea. The only issue is can we stop him from producing nuclear weapons.

One of the things I’d like to point out is I grew up in Texas. In Texas, they understand intuitively that an armed society is a polite society. The reason that we invaded Iraq was because they didn’t have nuclear weapons. The reason we invaded Libya was because they didn’t have nuclear weapons. The reason we threaten Iran is because they don’t even have a nuclear weapons program. To the extent that what the fat little toad in North Korea is doing, is utterly rational. We have to accept the fact that he feels threatened by the United States because he IS threatened by the United States. South Korea and the United States right now are holding war games on his doorstep and nobody talks about it in the American press. But of course we’re threatening him.

CEO Technician: Yeah, I mean that’s true. If you look at the situation between North Korea and South Korea, and the Japanese, from an international perspective, it’s not quite as crazy as it’s viewed in the US. Obviously North Korea is an absurd regime run by a 33 year old kid who was given the whole thing from his father. The people are brainwashed of course, and still at the same time it’s a sovereign nation and they have been threatened by a military superpower for 60 years. In some ways, the way they behave is logical because they want to survive and continue their regime and their country. I think that if Trump actually shut his mouth and stopped threatening them, things would actually probably calm down quite a bit.

Pakistan has nukes, and India has nukes, and Israel has nukes, and France has nukes, so there’s nuclear weapons all around the world. This is not new. In my mind Pakistan is probably the one that would be the most worrying nuclear power because of how unstable that region is, and the country is. But we don’t hear anything about Pakistan anymore. It’s very interesting how things are covered in the media.

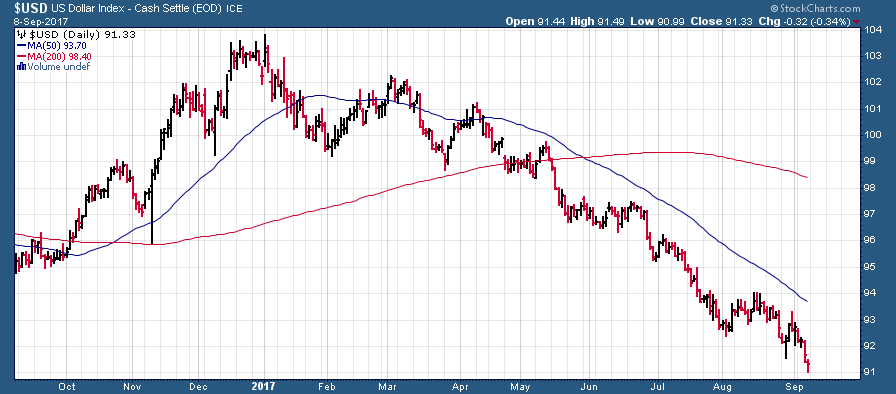

Turning to the US dollar, is this the end of the dollar? Some of the things that have happened in the last month would fit in my perfect scenario for the downfall of the dollar as the global reserve currency. We have a new nuclear power evidently being born and one-upping the US and Asia. We have Hong Kong Gold Futures which have started trading two months ago in yuan, so you can settle in renminbi, the Chinese currency. We don’t even need to use the US dollar for anything to transact gold futures. You could buy gold bars in Hong Kong and pay in the Chinese currency, which is a new thing.

Now yesterday we hear that the debt ceiling could be permanently lifted. The Democratic Senate leader Schumer was having a buddy-buddy session with Trump at the White House and they agreed that they should just get rid of the debt ceiling altogether. So the powers that be in Washington are agreeing that the US Treasury should have no limits in terms of the debt it can run up. We’re seeing the dollar fall like a rock, basically on a daily basis. Is this the end of the dollar as the global reserve currency?

Bob Moriarty: It’s not the end, but it’s the end of the beginning to the extent that all reserve currencies last for about 70-80 years. That’s true of everybody, it was true of France, it was true of Holland, it was true of England, it was true of Spain, and it’s true of the United States. Now, I think the single most significant thing was pricing oil in terms of gold. When you do that essentially you’ve made the renminbi gold backed. That’s absolutely giant.

There’s a fallacy. People believe that because oil is priced in dollars, people need to trade in dollars. That’s not true. If you go to Europe and it’s priced in euros, okay, you can pay with an American credit card in dollars. Because something that’s priced in dollars, and the benchmark is in dollars doesn’t mean you need dollars. You use the local currency.

But China has taken action that absolutely is turning the renminbi into a gold backed currency. When Russia announces something like that, you’re going to see the US Dollar Index go from 92 to 80 in a matter of weeks. The long answer to your simple question is this, the end of the dollar, yes. Maybe not today, but certainly it’s a work in progress.

US Dollar Index (1 Year)

CEO Technician: The fact that China and Russia have been net buyers of gold for more than a decade now only adds to that. Obviously they realized sometime around the early 2000s that they needed to increase their gold reserves to add credibility to their currencies in order to challenge the dollar as the reserve currency globally.

My final question would be give us some of your best ideas. Which stocks are on your radar here and where would you be putting capital to work right now?

Bob Moriarty: I’ll answer that in a different way. When the wind is at your back, you can invest in the biggest piece of crap stocks in the known universe and make money. When the wind is in your face, you can invest in the very best, highest quality, best managed stocks and you’re going to lose money. I believe we’re in a bull market for resources. I think that when the paper market crashes, and that’s not the paper market for gold, but the paper market for bonds and insurance companies and stocks, I think there’s a very real chance that between now and the end of October we could have a crash in the general stock market. I don’t care what they blame it on, it’s coming and it’s coming soon. A lot of people recognize it.

The world is changing financially and I would rather be in something that I can hold and touch and see and know that it has value, rather than something that has some nebulous value. I wouldn’t touch an insurance stock right now for all the tea in China. I think they’re all going to go down, should Miami take a $200 billion hit. Any of the resource stocks, including the crap stocks, it’s the crap stocks that are two cents a share now, they’re going to go to 30 cents. Novo’s going to go up 15-fold, but it’s going to take a year to do it. Novo is my favorite stock. It’s been my favorite stock since 2012, but it’s in a correction right now and it’s two to three months before there’s anything of significance that’s going to happen with them.

But across the board, there are some great results coming out of the gold sector; GT Gold (GTT.V) is going up, and Garibaldi (GGI.V) is going up. There’s some fabulous stocks out there. If people would do a little bit of research and think for themselves and stop listening to “gurus”. I’m not a guru; I’m just a guy that reads a lot and learned to think for myself.

It’s tough to be a guru these days, perhaps because the idea of being a market guru is an oxymoron. MMG is a new name to put on our radar and I learned a couple things about NVO (a stock I have traded a few times in the last couple of months) which I did not know. We would like to thank Bob for his time and insights. Once again he didn’t pull any punches and called things like he sees them.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Some of the stocks mentioned are high-risk venture stocks and not suitable for most investors. Consult the companies’ SEDAR profile for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.