When Energy & Gold published our first interview with Bob Moriarty, founder & editor of 321gold, more than two years ago we didn’t realize it would become a regular thing that would happen every couple of months. However, these chats have become one of my favorites and something which I look forward to having periodically when it’s time to get caught up and update readers on Bob’s market and geopolitical thoughts. Bob has a practical wisdom and knowledge which comes from decades of experience both as an investor and as a human being who flew 832 missions as a marine pilot during the Vietnam War. Without further ado here is Energy & Gold’s March 2017 conversation with Bob Moriarty:

CEO Tech: What do you think about Northern Dynasty (NYSE: NAK, TSX:NDM) and some of the recent stuff which has been in the news involving short selling fund Kerrisdale Capital?

Bob Moriarty: Here’s the deal and I need to give your readers some background. I was the first writer to talk about Northern Dynasty back in 2003, I think the shares were $.50 or so and it was an extraordinary deal back then. Back in 2003 Pebble was a work in progress and since then there has been hundreds of millions of dollars invested in outlining the resource.

We didn’t know the story then but we do know the story now. There was a PEA released recently which showed that at current day’s metal prices the return on investment (ROI) would be 14% and that’s on a project which will cost US$15 billion to put into production. The length of time it will take from when it’s fully permitted to when it’s pouring gold and copper is probably 5-10 years, and that’s AFTER it’s fully permitted, which of course it is not right now. With a 14% return and given the timeline you’re going to go through an entire mining cycle. I don’t think there’s a chance in hell it will ever be put into production.

Everybody gets way too optimistic or way too pessimistic about that project, they either love it or they hate it and they change their point of view. Given the information that we have today and given that it is a very important watershed project in Alaska I don’t think it will ever go into production. Now it would be a different story if it had a 40% ROI, in that case it would be put into production regardless of everything else. But the money just isn’t there, there are too many other projects with 25%, 30%, 40% returns which will go into production first. Pebble is too big, and it’s the big projects that take the longest and have the most trouble moving into production. Novagold has been screwing around up in Alaska since 2001 and it’s sixteen years later and they have yet to pour an ounce of gold.

Northern Dynasty Minerals (NAK – Monthly)

CEO Technician: So the Trump factor is being overplayed by certain prominent Northern Dynasty bulls?

Bob Moriarty: What Trump does is help to open 50-100 other more viable projects. Trump’s anti-regulation EPA doesn’t increase the demand for Pebble to be put into production, it actually decreases it.

CEO Technician: We have seen energy metals continue to climb higher, especially cobalt and zinc. What are your thoughts on cobalt, graphite, nickel, zinc, etc.? Are there any specific exploration plays in this sector that you would like to mention?

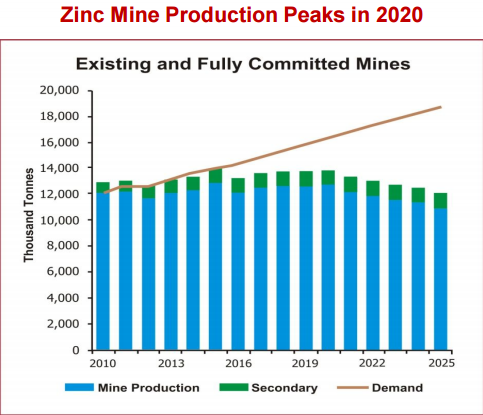

Bob Moriarty: Cobalt, graphite, lithium, zinc are all in tremendous demand. We had a 5,000 year low in commodities in January 2016. Commodities are in the process of correcting right now and it’s not a big deal. Commodities in general are cheap, energy metals are especially cheap. One energy metal company I am familiar with is Canada Zinc (TSX-V:CZX), they are sitting on $60/share of metal in the ground in one of the best projects in Northern BC and they’ve got a C$.37 stock. Zinc is in shortage and it’s going to be in more shortage in the near future.

Zinc Supply/Demand – production peaks in 2020 as demand is forecast to steadily trend higher

Source: Canadian Zinc

Graphite is also a very interesting metal that will be in much more demand in the near future. You need 8x as much graphite as lithium in a lithium-ion battery. Graphite producers who actually get into production should do very well. Ceylon Graphite (TSX-V:CYL) is a graphite explorer that looks really good to me. If they have the grade of graphite they say they have I think it could be a home run.

CEO Technician: Moving to gold, we are in the midst of a correction and gold has briefly dipped below $1200. Where are we at and is it the time to load up again?

Bob Moriarty: In early February we had a conversation and I said we were going to go into a correction soon. You agreed but thought it might happen a bit later (March/April). We absolutely did go into a correction, it’s been a normal correction and I think we will see $1300 before we see $1150. (Update: Gold is Tapping Around Looking For A Tradable Bottom)

Gold (Daily – 1 Year)

CEO Technician: What’s your gauge on sentiment here? Have investors turned too pessimistic on gold?

Bob Moriarty: Sentiment is great at key turning points, but it’s not of much use in the middle. I believe the market has turned pessimistic on gold, not as pessimistic as in December when we reached a 29 year extreme in bearish sentiment but investors are pessimistic nonetheless. We are still in a bull market so sentiment shouldn’t have to fall through the floor for it to be a buying opportunity.

CEO Technician: We’ve seen some of your favorite gold explorers get cheaper in recent weeks, do you have any updates on some of the stocks you’ve mentioned in recent months?

Bob Moriarty: I still like Bonterra (TSX-V: BTR), I commented on it when it was C$.22 and it went to almost C$.40 – anywhere below C$.30 and Bonterra is a very good deal. The most exciting gold stock right now, and one which I believe has the potential to ignite the entire sector is Keith Barron’s Aurania Resources (TSX-V:ARU) in Ecuador. Keith has done 20 years of research into finding two of the biggest and richest gold mines which the Spanish ‘lost.’ The Spanish conquistadors were terrible people who abused the Native American tribes and the natives revolted killing the Spaniards off from these two Lost Cities of Gold. Keith believes he knows where these two lost mines are and if he can even find one of them the rewards for shareholders of Aurania will be 10x-50x.

CEO Technician: You’re a shareholder of ARU?

Bob Moriarty: I am definitely a shareholder. It’s a project I’ve known about for six years. The government went through a lot of socialistic nonsense for a while and recently they’ve come around and made some good decisions which are pro-mining and positive for foreign investors. I think that Ecuador has the potential, given responsible government, for being the biggest and most profitable mining country in the world. Chile (#1 copper producer) and Peru (#1 silver producer) both face water shortages so it will be increasingly difficult to operate in those two countries. Ecuador doesn’t have the same water problem. A vibrant mining industry would really help the citizens of Ecuador and improve their standard of living.

CEO Technician: So you have no concerns for Ecuador as a country?

Bob Moriarty: It’s been very difficult but as of right now they seem to be taking a sane approach. All real wealth is created either in agriculture, manufacturing, or mining. We need to go back and start creating some real wealth. We have confused shuffling pieces of paper with the creation of wealth. One day all these people sitting on $650 trillion of derivatives are going to wake up poor.

CEO Technician: I know you’re not a market timer but you do have a pretty good feel for key market turning points. What’s your sense for where we are at with US large cap equities? Are we close to a major top and a real correction (10%+)?

Bob Moriarty: We reached a bullish extreme in sentiment on equities a couple weeks ago and we have since seen equities pull back a bit. I don’t think anyone is going to call the exact top in the market because the market is so irrational. The US stock market and US bond market are catastrophic bubbles and they will burst eventually. Who knows whether March 1st was the absolute top? It could be.

CEO Technician: Speaking of potential bubbles we’ve recently seen the price of one bitcoin vault above the price of an ounce of gold, what are your thoughts on bitcoin?

Bob Moriarty: Bitcoin is an idea searching desperately for a bigger fool. It’s nothing more than a pseudo currency with no value at all. The people pumping it are the same guys pumping every tin foil hat conspiracy and scam. A lot of people are going to lose a lot of money with Bitcoin.

CEO Technician: Do you see any major risks to the market? Any potential black swan events brewing?

Bob Moriarty: Even before the election, the Deep State was starting what amounts to a coup d’état against the eventual winner of the election. The entire recount fiasco was an attempt to derail the votes for Trump. The results of illegal wire taps were not only released to Hillary Clinton’s campaign but also to the mouth pieces for the Deep State, the New York Times and the Washington Post. The MSM has turned into nothing more than the propaganda arm of the Deep State. This campaign to undermine democracy moved into high gear after the inauguration with the media and Hollywood mocking and questioning every decision or appointment made by the Trump administration.

In what might be the ultimate in absurdity of audacity, the NYT mocked Trump questioning the issue of Obama wiretapping him when the NYT suggested he had no proof such an event had taken place. The same NYT posted an article in October referring to comments by HRC about information coming from the Trump campaign that clearly required wiretapping by the Obama administration. The NYT didn’t feel that they needed proof of illegal activities when HRC referred to it but needed proof by Trump over exactly the same issue.

A coup d’état by the deep state will be the ultimate Black Swan event and the biggest event in US political history. And it’s in progress as we speak. Gold will react.

CEO Technician: For investors new to the resource sector, particularly the junior resource arena, what are some red flags that investors should watch out for?

Bob Moriarty: In 2001 it was very difficult to go back and check people’s track record because the bear market had been so vicious and prolonged there were very few management teams who had substantive experience in the industry. However, we’ve now gone through several bull market cycles and there are lots of track records out there. You want to invest alongside people who have been successful. There are people out there who have created failed companies over and over again, you want to steer clear of these guys. Also, if every time a company hits a new low the insiders are handing out options to one another that’s another bad sign you want to avoid.

I highly suggest everyone read my book and in my book I talk about how everyone has an agenda, everyone has a bias, everyone has self interest. The guys that run these companies are trying to get rich and I don’t have any problem with that, what I have a problem with is are these management teams who are trying to get rich at shareholders’ expense. Find the management teams who have consistently made money for shareholders, they’re out there and these are the guys you want to be investing alongside.

Another thing which is important for new investors to understand is that they need to curate their content, the stuff they read. I have a great site with top notch content, CEO.ca is another good site with lots of good information and value added content. To take responsibility for your own investment decisions you have to do some due diligence, and you have to do some thinking on your own.

CEO Technician: Since track record is so crucial can you name a company or management team that have consistently kept their word with investors and done what they said they were going to do?

Bob Moriarty: That’s easy. Gold Standard Ventures (GSV.V) has consistently executed upon what they said they were going to do and I am a shareholder of GSV. Keith Barron is also one of the best managers in the junior mining sector, he is a guy who does what he says he’s going to do and he does it well.

CEO Technician: Do you look at shares outstanding in a company as a clue to how well managed it is and does shares outstanding have any influence in your investing decision?

Bob Moriarty: Yes and no. When I got started it used to be that 15 million or 20 million shares was a lot of shares to have out in the market. There are some good companies that I know now that have 300 million shares outstanding. Now I think it’s foolish and I wish they would to do a share rollback but management always hates to do rollbacks because they think it’s an admission of failure.

The key thing is that I look to see if the share structure is appropriate for where they are. Quite bluntly the pie is the same size, it doesn’t matter how many slices you cut. The pie is the exact same. Does the market cap reflect the value of what they have? That’s the most important question.

Canadian Zinc is a really good example; with $60/share of metal in the ground and having the best zinc projects in Northern B.C. along with 3 JVs with major zinc producers I think C$.37/share is cheap. It’s cheap enough that I put my money in by going out in the open market and buying some shares.

What I look for in every company and every market is value. Is it cheap? When it’s cheap I invest.

CEO Technician: I think that’s a good place to stop, all this talk of pie is getting me hungry Bob.

As always we would like to thank Bob for his insights and astute commentary. Bob mentioned a couple of stocks which I believe are below most people’s radar and also brought up a couple of points including Trump vs. Deep State which I don’t think most people are aware of, in addition to some priceless investment wisdom. We would like to thank Mr. Moriarty for sharing his time and wisdom, until next time.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Some of the stocks mentioned are high-risk venture stocks and not suitable for most investors. Consult the companies’ SEDAR profile for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.