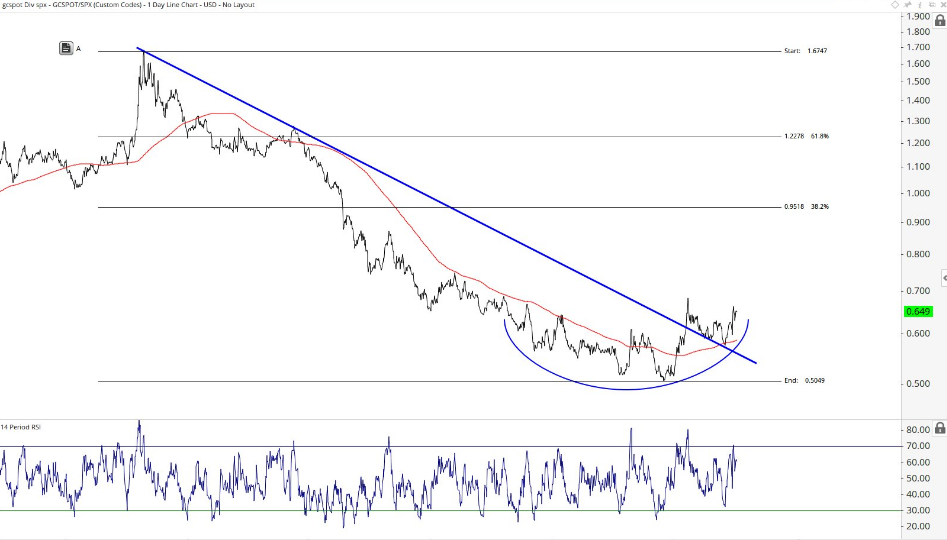

A fascinating note and chart of the gold/S&P 500 ratio from All Star Charts:

Gold/S&P 500 (Weekly – 6 year chart)

“Gold was in a downtrend vs the S&P500 since the highs in 2011 until February when the ratio broke out above the downtrend line from those 2011 highs. At this point with momentum in a bullish range, we want to be long the Gold/S&P500 spread if we’re above that downtrend line with a target up near 0.95 which is the 38.2% retracement of the entire 2011-2015 decline.”

This looks like one of the most compelling trade setups available to investors right now. In addition, the risk/reward is attractive and more importantly the risk is clearly defined. To put this into perspective for the gold/S&P 500 ratio to rise to .95 will mean that gold is about to rise significantly (~$2000) or the S&P is about to drop precipitously. Or, some combination of the two will occur. I like this trade not only from a technical perspective but it also makes a lot of fundamental sense to me. The fact that it is grounded in a clear long-term chart setup makes it compelling.

Check out J.C. at his site www.allstarcharts.com and take advantage of the 30-day free trial of his premium service. I can say that I am a proud subscriber and it’s well worth the price of admission!

DISCLAIMER: The work included in this article is based on technical charts and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.