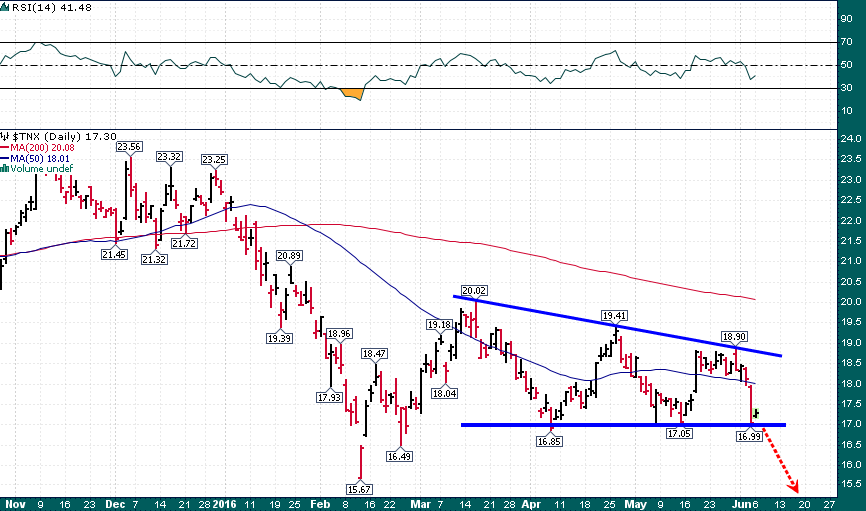

This is the chart to watch right now:

10-year Treasury Note Yield

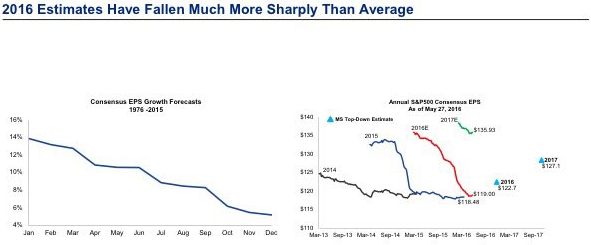

The yield on the 10-year Treasury Note has been wedging its way lower for the last few months and is once again knocking on the door of important support near the 1.70% yield level. A breakdown below 1.70% would target a retest of the all-time low yield of 1.394% from 2012. The implications of another leg lower in long rates are far reaching and serve to further confirm the disappointing growth in both GDP and earnings that we have witnessed for the last couple of years:

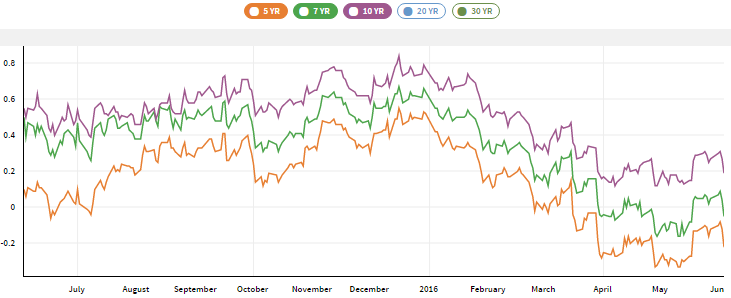

Precious metals are likely to be a big beneficiary from a further decline in yields as real yields move back into negative territory:

Treasury Real Yield Curve Rates (Via Quandl)

DISCLAIMER: The work included in this article is based on SEDAR filings, current events, interviews, and corporate press releases. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.