Legendary hedge fund manager Stan Druckenmiller gave a presentation at the Ira Sohn Conference last week entitled “The Endgame”. It has been a while since an investment presentation had such an impact upon me so I decided to highlight some choice excerpts and add some of my own color to his key points:

“When I started Duquesne in February of 1981, the risk free rate of return, 5 year treasuries, was 15%. Real rates were close to 5%. We were setting up for one of the greatest bull markets in financial history as assets were priced incredibly cheaply to compete with risk free rates and Volcker’s brutal monetary squeeze forced much needed restructuring at the macro and micro level. It is not a coincidence that strange bedfellows Tip O’Neill and Ronald Reagan produced the last major reforms in social security and taxes shortly thereafter. Moreover, the 15% hurdle rate forced corporations to invest their capital wisely and engage in their own structural reform. If this led to one of the greatest investment environments ever, how can the mirror of it, which is where we are today, also be a great investment environment?“

“The Fed’s objective seems to be getting by another 6 months without a 20% decline in the S and P and avoiding a recession over the near term. In doing so, they are enabling the opposite of needed reform and increasing, not lowering, the odds of the economic tail risk they are trying to avoid. At the government level, the impeding of market signals has allowed politicians to continue to ignore badly needed entitlement and tax reform.”

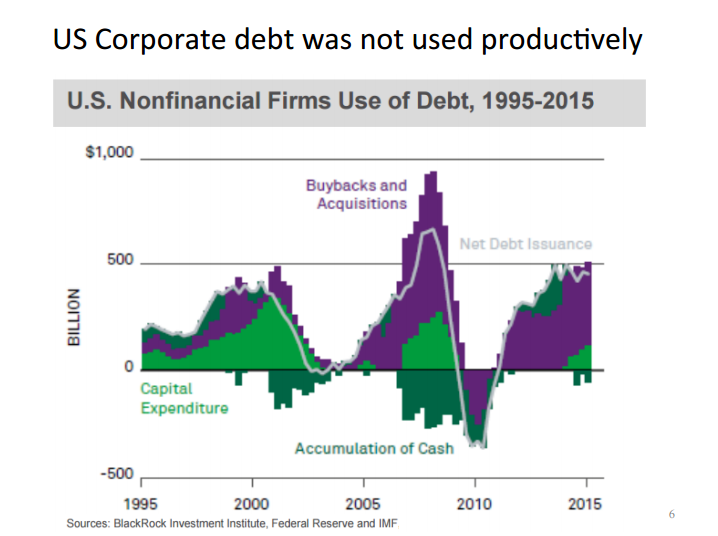

“The corporate sector today is stuck in a vicious cycle of earnings management, questionable allocation of capital, low productivity, declining margins, and growing indebtedness. And we are paying 18X for the asset class.”

Druckenmiller has quite an impressive track record and he has been one of the few macro minds to listen to during the last 30 years. While his timing hasn’t always been perfect (see 2000 tech bubble implosion) he has consistently gotten the bigger investment themes and trends right on the money. In fact, despite laying out an extremely bearish outlook for the global economy and equities Druckenmiller admits that Duquesne has been long equities for the past several years and even mentioned the “bullish intermediate conclusion” he drew at the Ira Sohn Conference three years ago.

It speaks volumes that Druckenmiller has now turned so vocal regarding the scarcity of redeeming qualities he sees in Fed monetary policy, equity valuations, corporate debt, and economic growth potential. This is a presentation that cannot be ignored.

And the one asset which he spoke favorably of? Gold.

“On a final note, what was the one asset you did not want to own when I started Duquesne in 1981? Hint…it has traded for 5000 years and for the first time has a positive carry in many parts of the globe as bankers are now experimenting with the absurd notion of negative interest rates. Some regard it as a metal, we regard it as a currency and it remains our largest currency allocation.”

Duquesne Capital has 30% of its portfolio in the GLD exchange-traded fund.