After a period of relative calm precious metals and markets as a whole are entering a potentially intriguing phase. Here’s what I mean:

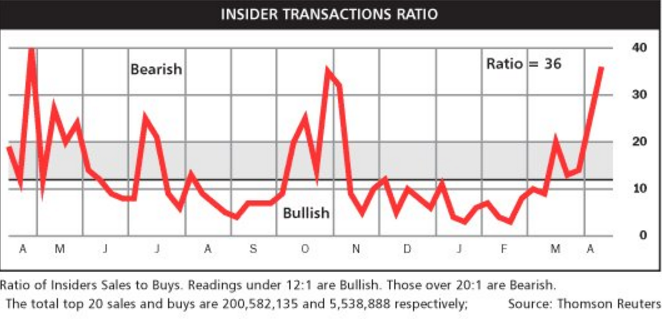

- After moving higher in nearly a straight line for the last two months U.S. equities are at major resistance with a growing number of bearish divergences accumulating; insider selling, for example, has reached levels that have previously coincided with short/intermediate term market peaks:

- There is a major macro event looming in late-June: A BREXIT is a very real possibility.

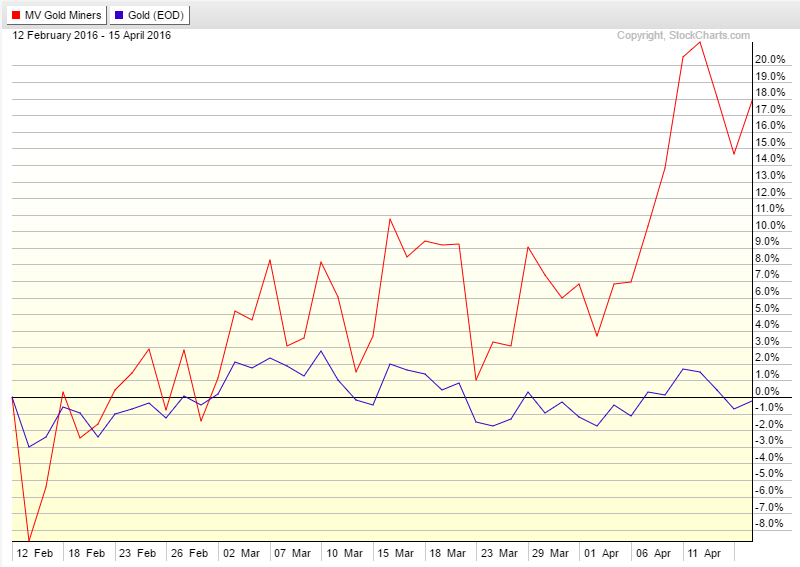

- Gold miners continue to outperform gold in a sign that investors are becoming more comfortable with the idea that the gold bull market has resumed and short term gold price fluctuations are less important than the long term trend:

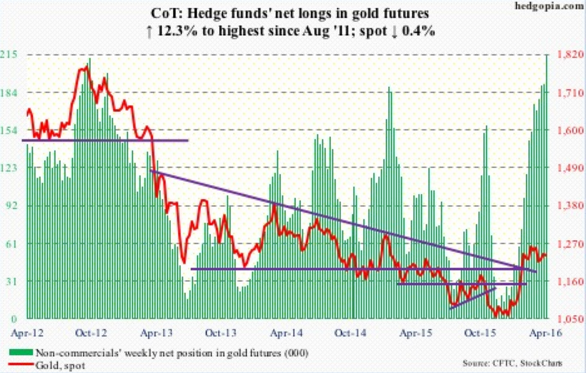

- Speculative positioning in gold futures is at the highest level since late 2012 and hedge funds are at their heaviest net long exposure since August 2011 (the month that gold made its all-time high)

Hedge fund positioning is important because hedge funds represent the marginal buyers/sellers in virtually every market. Hedge funds are also quite fickle, they can turn from buyers to sellers in a moment’s notice. When hedge fund positioning reaches abnormally high levels it becomes a concern because there is much less upside potential energy, the potential energy shifts to selling and in turn lower prices.

- While the gold miners have continued to see strong inflows and strong price action, gold itself has experienced choppy price action and some early signs of distribution despite continued hedge fund/speculative buying

Money Flow and Force Index have been negative for much of the last month.

With the above factors, among others, very much in play with summer right around the corner it’s hard not to take a cautious stance regarding risk. Too many times investors have gone into the end of April and chosen to not pare back any risk exposure only to regret this decision a few weeks later.

I can’t recall a time when I have been as ‘neutral’ across markets and asset classes as I am right now. However, I also know that periods of relative calm, oscillating prices, and neutrality plant the seeds for strong trends and times of market turmoil. I wouldn’t be surprised if a storm or two are brewing just over the horizon and it’s always better to be as flexible as possible when the storm rolls in.