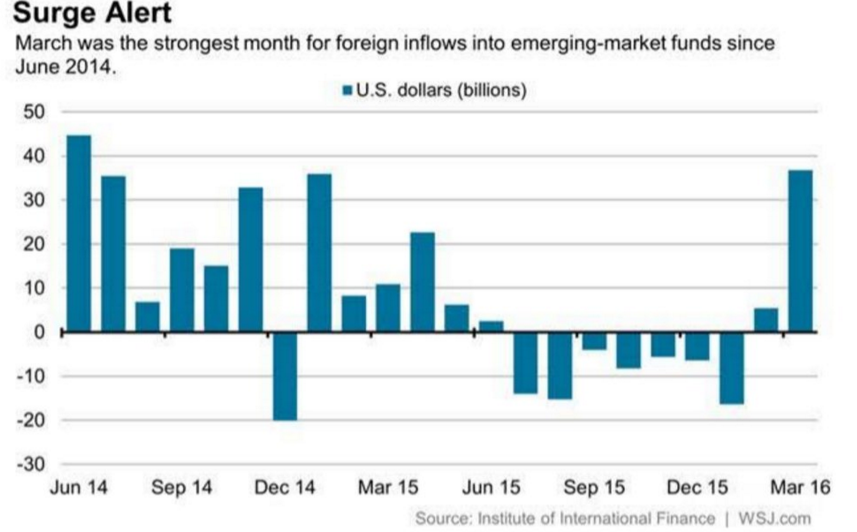

In March we witnessed the largest monthly inflows to emerging markets since June 2014:

This is a very bullish chart because it bodes well for commodities and global growth. The emerging markets unwind has been one of the biggest threat to global growth for the last couple of years and emerging markets have held an increasingly positive correlation to commodities:

EEM (Weekly) with EEM/CRB 20-day rolling correlation below

The simple takeaway is that investors piling money back into emerging markets is a positive for the global economy and global equities/debt. However, the big zone of previous support (overhead supply) is likely to lead to some digestion of the recent rally over the next couple of months.