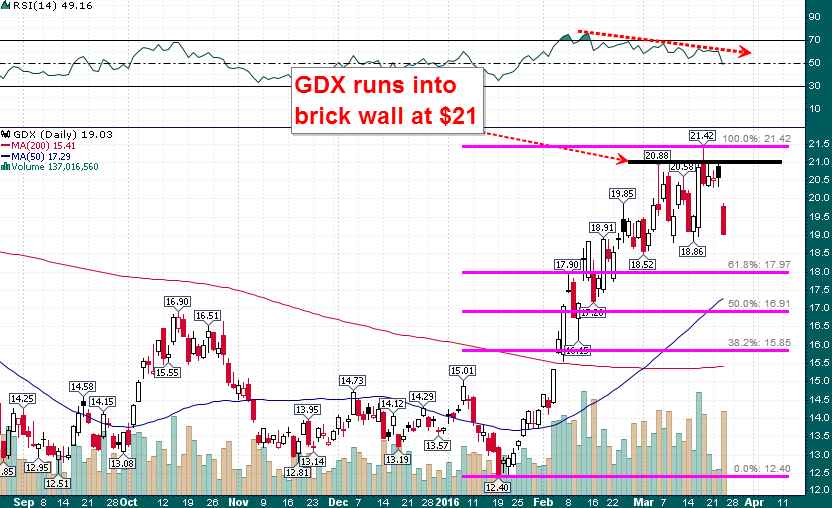

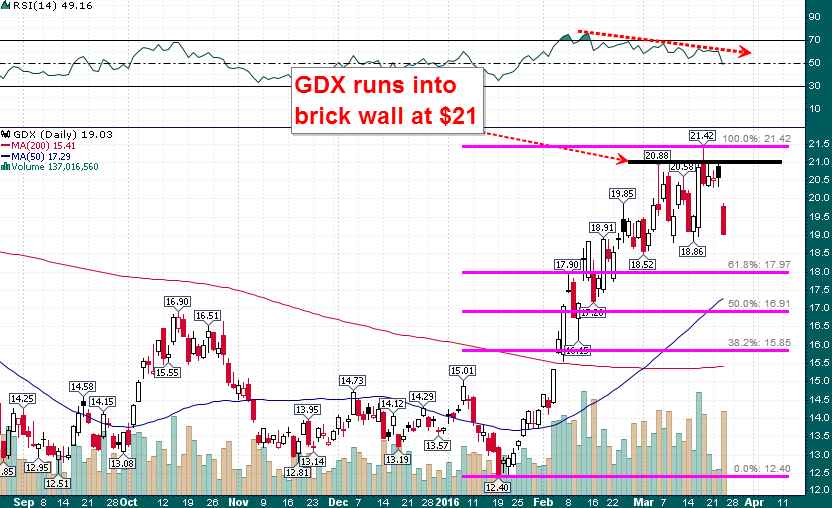

The gold miners took a beating today as gold tumbled nearly $30/ounce. The GDX has been bumping its head up against resistance ($21) for a couple of weeks as bearish divergences accumulated; with today’s heavy volume ‘gap & go’ 7.53% decline a deeper correction down to at least the $18 level (another 5-6% lower) in GDX appears likely:

GDX (Daily)

We have not made it a secret that we have had a negative short term view on gold and the gold miners for a couple of weeks. Despite a tremendous amount of noise, volatility, and even a couple of large single day rallies the goldies haven’t gone anywhere. In this morning’s premium market email We pointed out the likelihood of a large down day in the gold miners as well as the massive falling wedge in the ERY (3x Energy Bear ETF) that was about to trigger:

“I’m primarily focused on two charts this morning:

On verge of breakout from massive multi-week falling wedge with imminent MACD bull cross

Oil has risen from $26 on February 11th to nearly $42 at yesterday’s high, that’s an impressive move by any measure. There are a lot of fundamental factors which makes it difficult to believe that this rally will continue much longer before sustaining a sizable pullback. One of those factors is market participant sentiment:

In addition, I find it curious that sentiment would be so bullish against a considerably bearish backdrop. A break back below $40 should open the door to a deeper pullback into the mid-$30s.

The ERY chart shows an epic falling wedge chart pattern with mounting signs that a turn may be at hand. It wouldn’t take much to see a rally up to the $27-$28 area and risk/reward propositions don’t get much more attractive with a stop loss just below $20. We are long ERY in the Trading Lab over at

CEO.CA.

The 2nd chart is GDX:

The fact is that despite quite a few large one day moves GDX hasn’t gone anywhere in a couple of weeks. Price has stalled at a major resistance level ($21) and the range has begun to narrow considerably amid growing momentum divergences. Typically this means that a large directional move is close at hand, the question is which direction?

With gold testing major support at $1230 this morning the odds favor a resolution to the downside in GDX which could mean a correction as deep as the $17-$18 area. $19.85 is the level I am watching in GDX, if price breaks below this level on a closing basis the door is open for a further 10-15% of downside.”

Today we got both the breakdown in GDX and the breakout in ERY (sell-off in energy stocks). We are trading both ETFs among other stocks in the premium Trading Lab at CEO.CA – if you are interested in following our analysis and trading sign up today by clicking the button below and receive the daily morning market email (sent out before the market open with actionable trading setups and market analysis) in addition to access to the Trading Lab with real time trade signals, analysis, and alerts!