It doesn’t take a master technical analyst to be able to discern that the S&P 500 has been forming a top for the last couple of years. Support in the low 1800s (SPX) has been tested a couple of times in the last six months and the recent 11% rally tagged an important area of confluence yesterday:

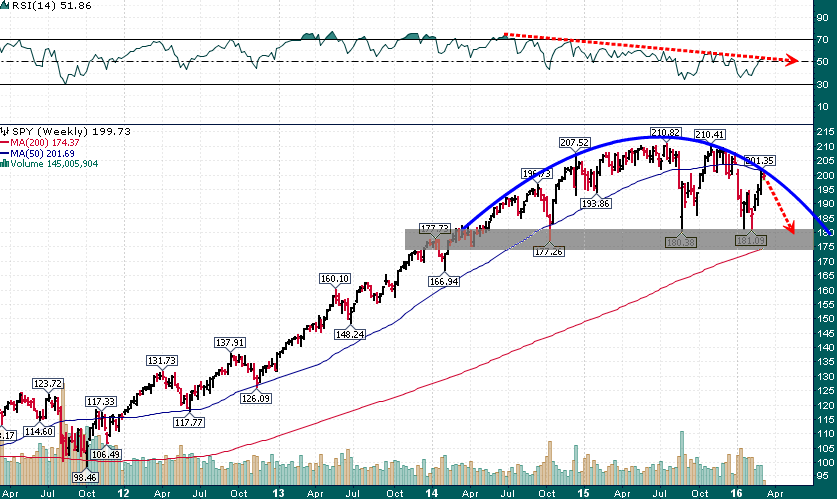

SPY (Weekly)

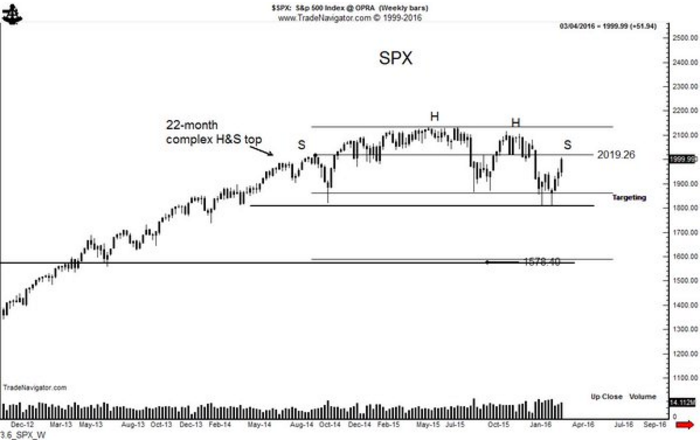

The S&P 500 has formed a potential complex H&S top and this formation can also be interpreted as a rounding top. Yesterday’s high at 2009 on the SPX lines up with the 61.8% Fibonacci retracement of the May 2015-February 2016 decline. The 50-week and 200-day simple moving averages also line up pretty closely with yesterday’s high. That’s a lot of confluence with very attractive risk relative to the potential reward of a 22-month+ topping pattern resolving to the downside.

Renowned chart pattern expert Peter L. Brandt highlighted the potential of this complex H&S top in his weekend note to subscribers:

There is no doubt that this is an interesting market moment; a break back below the 1970-1980 in the S&P would offer the strong possibility that yesterday was a short/medium term peak, whereas a further advance above 2025 would negate many of the bearish chart pattern interpretations.