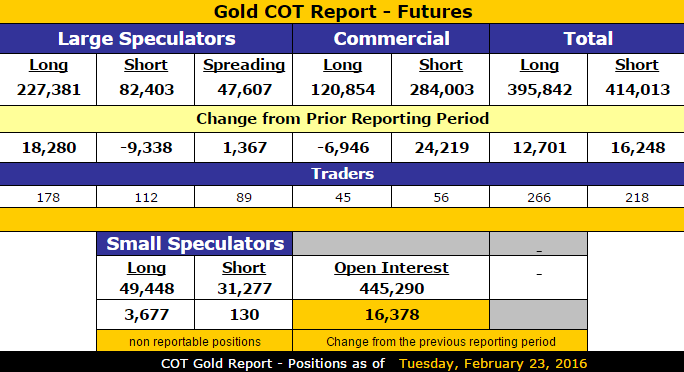

Despite a ~$70/ounce pullback since trading up to $1263.90 a couple of weeks ago gold futures speculators continued to pile on bullish bets, reaching the highest levels of net speculative length since last October:

Large & small speculators combined have accumulated a roughly $20 billion notional net length as of the market close on Tuesday, February 23rd. In terms of total notional dollar amount, the current speculative net length slightly exceeds last October’s peak which coincided with a major selling opportunity in gold (before a 10%+ drop over the next 6 weeks):

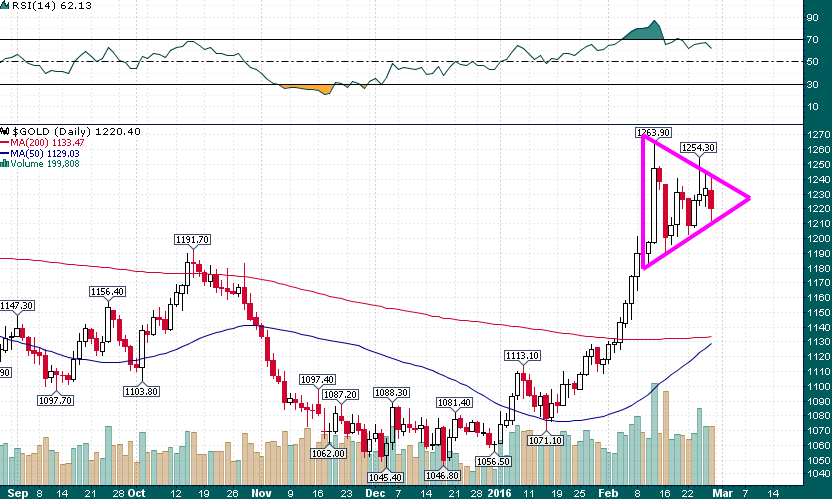

Gold (Daily)

Perhaps the most notable aspects of the latest CoT (Commitments of Traders) data is that small speculators have clearly moved to the largest net length in slightly more than a year (February 2015, which coincided with a major top) and each time that managed money net length has moved over 100,000 contracts (see blue line at bottom) a major top hasn’t been far away:

Meanwhile, it wasn’t a pretty finish to the week for gold with a string of lower highs in place. However, price is still within a larger pennant pattern and it would take a decisive break below ~$1210 to confirm a downside resolution to this pattern: