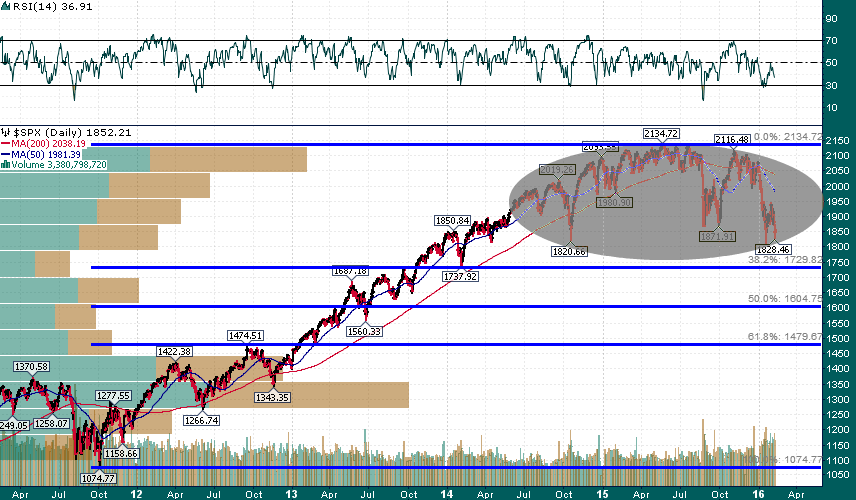

There’s no doubt that the S&P 500 has formed a mature topping pattern during the last ~18 months:

S&P 500 (5-year)

Below 1820 there isn’t much support for another 80-90 points, with the 38.2% Fibonacci retracement of the 2011-2015 rally representing the next level of interest.

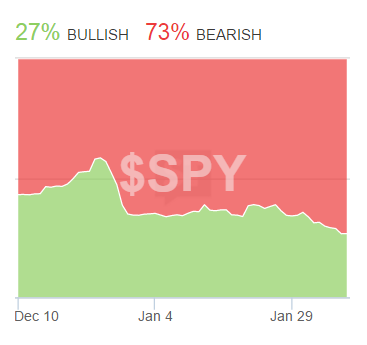

With support near 1820 already tested twice in the last month (the 3rd time is often the charm) and bearish sentiment reaching a fever pitch it seems quite likely that another sizable leg lower is imminent:

StockTwits SPY social sentiment is at multi-month lows

However, it seems to me that with so much fear in the air the odds greatly favor a short-term short covering rally which will inevitably set up the real move below SPX 1820 weeks or months from now. While i’m not adding long equity exposure here I certainly wouldn’t be shorting ‘in the hole’ here.