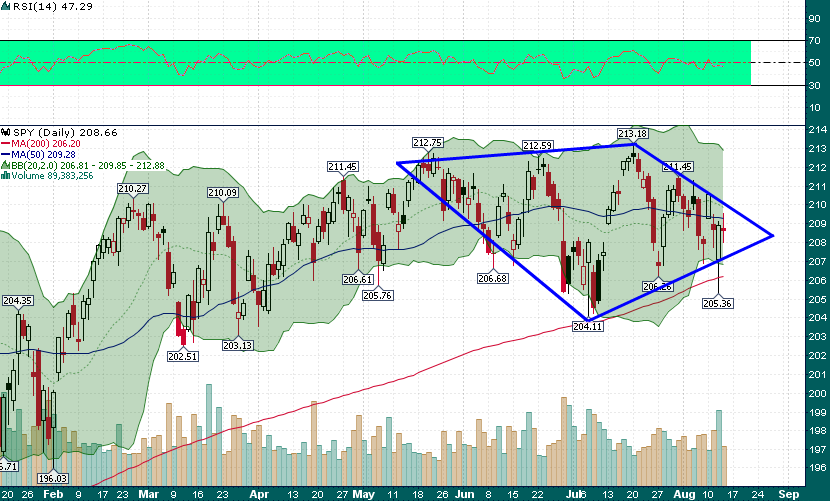

For the last 9 months the S&P 500 has been caught in a messy oscillation with only the faintest hint of an uptrend. However, each time that things began to look dire for equity bulls bids seemed to appear out of no where and propel stocks back to all-time highs. Since May there have been mounting signs that the bulls are exhausted and equities may finally be in for a tumble.

Broader momentum has all but vanished from the US equity indices with frequent day-to-day trend changes and a general overall lack of direction. Twice in the last 2 months the 200-day moving average has been tested and the relative strength index has not tapped overbought (above 70) or oversold (below 30) territory since last November.

The ‘diamond’ pattern which has formed since May is likely to achieve some sort of resolution before the end of the month. With the return of many market participants from summer vacations in early September it makes sense that a big move for stocks could be imminent. If I had to bet I would bet that an outsized move that catches a wide swath of market participants off guard is just over the horizon.