Lets be honest. The US stock bull market probably should have died a couple years ago. But it hasn’t. In fact, the SPY (S&P 500 ETF) made a new high on Monday while the Nasdaq Composite made yet another all-time high.

The naysayers and skeptics have been proven wrong time and time again. And each time that it appeared the cracks in the market’s foundation were simply too wide to repair, buyers stepped in furiously with an insatiable appetite for risk.

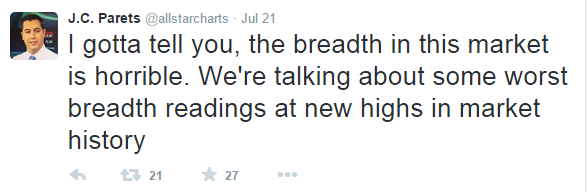

And so we are once again at a moment in which the market appears to be standing on shaky ground with a very poor breadth and volume profile during the recent advance:

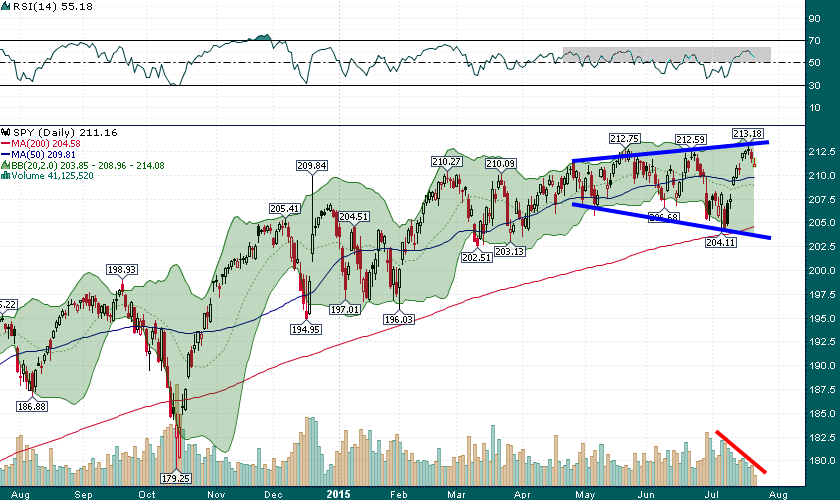

The SPY daily chart shows a broadening top pattern forming in recent months with light and decelerating volume during the July rally. Moreover, relative strength (an important indicator of the strength of a rally) continues to peter out around the 60 level. This is indicative of a market that is losing strength in which buyers lack the conviction to powerfully drive price higher.

Aside from the market’s relatively weak technical structure there are also no shortage of warning signs that we are in the final innings (or extra innings) of the bull run:

Economic Musings: Late inning warning signals?

Bloomberg: A measure of copper demand is at its weakest in more than 2 years

The Economist: The great bear market

Dana Lyons: Even The Stronger Areas of the Market Are Starting to Weaken

One of my favorite chart bloggers, J.C. Parets, pointed out two critical facts during the last couple of days:

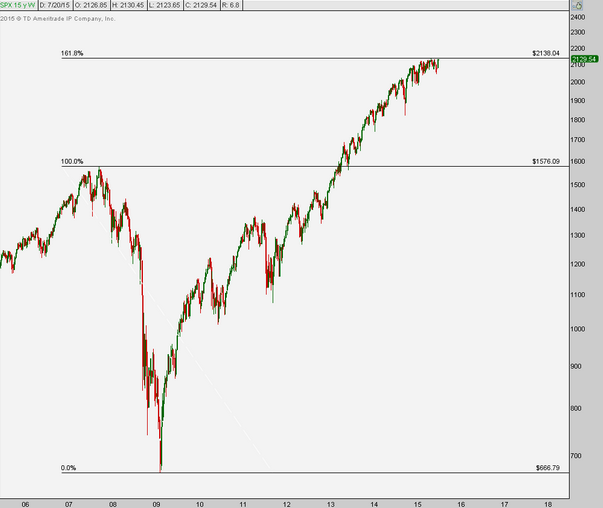

Meanwhile, the S&P 500 has been flirting with the 161.8% Fibonacci extension of the 2007-2009 decline which has clearly become a level of resistance:

However, i’m sure none of this will end up mattering at the end of the day because we are dealing with an unyielding market…