There is certainly no shortage of noise out there for investors to get confused by right now. From China to Greece to speculation about when the Fed will hike rates, it’s seems as though there is an endless barrage of noise surrounding markets. However, we know that simpler is always more effective and noise is an investor’s worst enemy.

I believe we can simplify things a great deal with one clear chart:

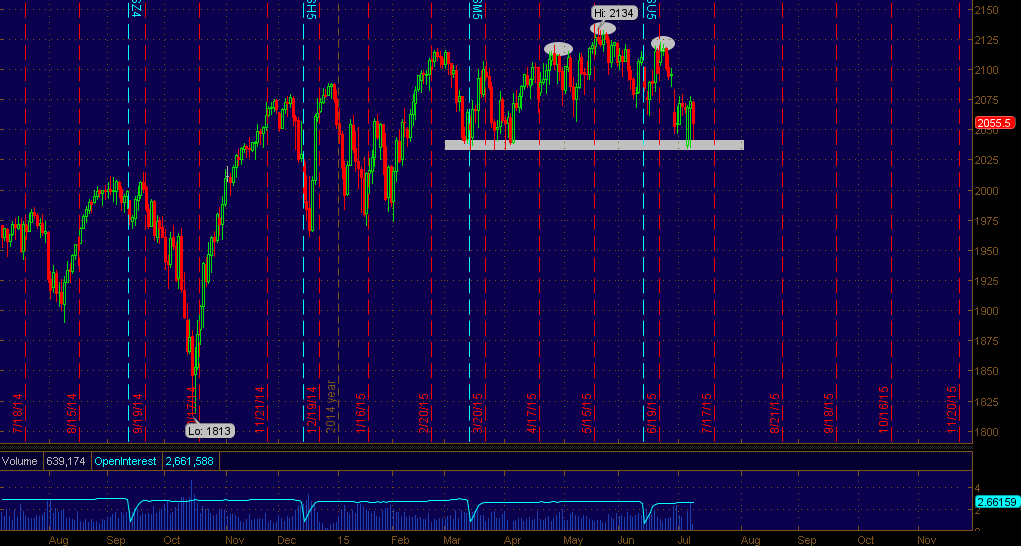

E-mini S&P futures (Daily)

There is a clear head & shoulders pattern which has formed during the last few months. The significance of this potential topping pattern increases when laid against the backdrop of a 6+ year bull market which has seen the S&P 500 more than triple.

The 2035-2040 support zone in the E-minis now takes on huge importance with a decisive break below 2035 targeting a move down to at least the 1970s and potentially much lower. Meanwhile, if support holds and price begins to move higher we can interpret this pattern as a consolidation within the context of an extended uptrend.