After last week’s bond rout/rate rally many sell-side analysts came out over the weekend calling for investors to get into bonds to take advantage of the sell-off. This morning prices are even better as the 30-year yield rises above 3.20% and the 10-year quickly closes in on the big round number 2.50% yield level.

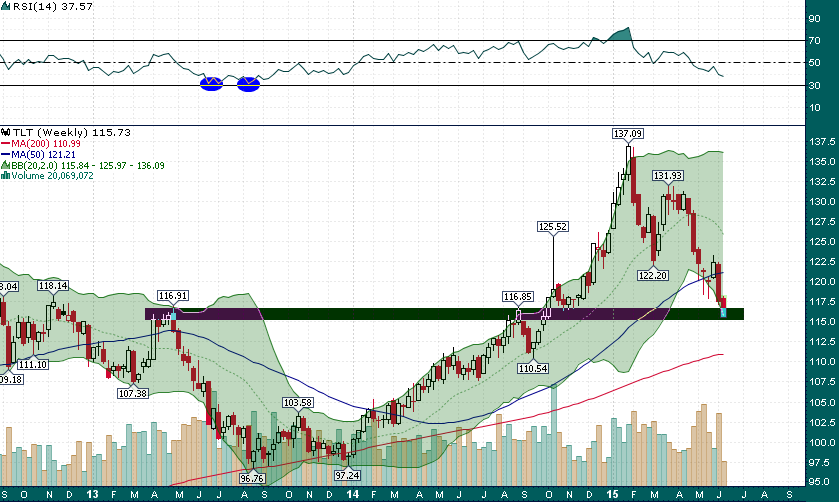

To get a better idea of how important the current test is for bonds have a look at the dividend adjusted weekly chart of the 30-year Treasury bond proxy TLT:

While it is only Wednesday TLT is threatening its 2nd consecutive weekly close below the lower Bollinger Band, something that didn’t even occur during the 2013 ‘Taper Tantrum’. There are ample reasons to believe that this may indeed be a buying opportunity in Treasuries and we are certainly at an important long-term level for Treasuries technically speaking. The concern is that investor sentiment isn’t nearly bearish enough to believe that a sustainable bottom is about to be put in place:

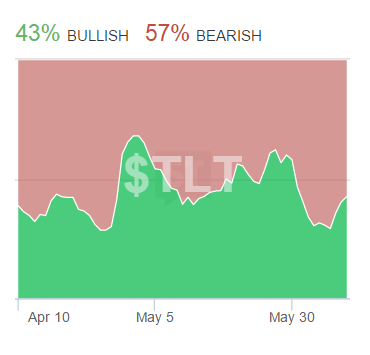

StockTwits offers a real-time investor sentiment gauge which offers an interesting insight into investor sentiment currently:

Surprisingly, StockTwits sentiment on TLT has actually RISEN as TLT as continued to sell-off during the past several days. The last time we saw this sort of divergence with StockTwits sentiment rising as TLT was selling off (late-April) turned out to be a bearish omen with TLT falling nearly 7% over the next couple of weeks.

Surprisingly, StockTwits sentiment on TLT has actually RISEN as TLT as continued to sell-off during the past several days. The last time we saw this sort of divergence with StockTwits sentiment rising as TLT was selling off (late-April) turned out to be a bearish omen with TLT falling nearly 7% over the next couple of weeks.

With sell-side analysts falling all over themselves to tell investors to ‘buy the dip’ in Treasuries and retail investors growing more bullish as technicals deteriorate one must begin to wonder if there is just too much complacency in bonds…