Non-GAAP earnings per share or “adjusted” EPS is the number that companies would like investors to focus on because it excludes so called “non-recurring” items such as restructuring charges, stock based compensation, and goodwill impairments etc. As a rule non-GAAP earnings are always higher than GAAP earnings. Moreover, the gap between the two generally becomes very wide during recessions as can be seen in the chart below:

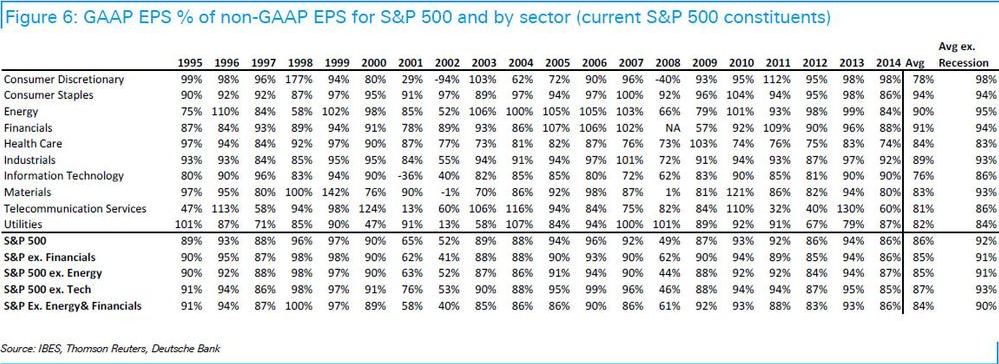

In 2008 GAAP earnings were less than 50% of the so called non-GAAP “adjusted” earnings numbers for the S&P 500. The interesting aspect of the above chart is that the year before the last two market peaks (1999 and 2006) also coincided with the largest GAAP EPS percentage of non-GAAP EPS. After all this makes sense, when times are good companies don’t have any need to take goodwill impairments or restructuring charges etc.

This begs the question, what’s happening now? In 2014 S&P 500 GAAP EPS was $102/share while non-GAAP EPS was $118/share. We are 5 years removed from a recession and the stock market is roaring so why the large disparity between GAAP earnings and non-GAAP earnings?

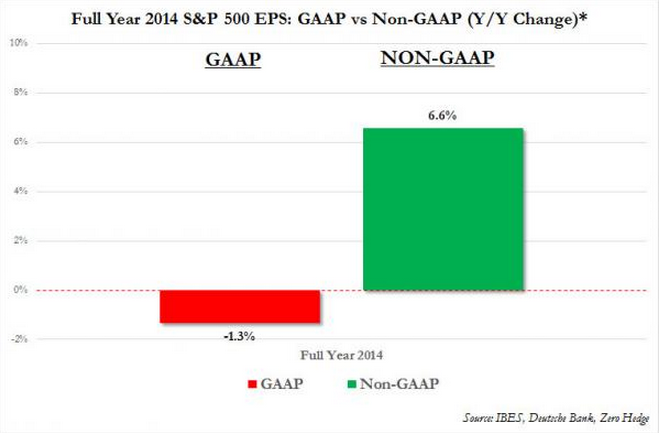

Without getting too wonkish the answer is that companies are excluding just about anything they can get away with in order to come up with their “adjusted” non-GAAP numbers and the results are quite startling. GAAP earnings for the S&P 500 actually fell year-over-year during 2014:

While valuation multiples have been expanding and future earnings estimates continue to factor in nearly double-digit growth the reality is that real earnings are not only not expanding, they are actually falling! One has to to wonder how long investors will continue to pay up for faux earnings growth and promises that as a rule are not kept by corporate management…