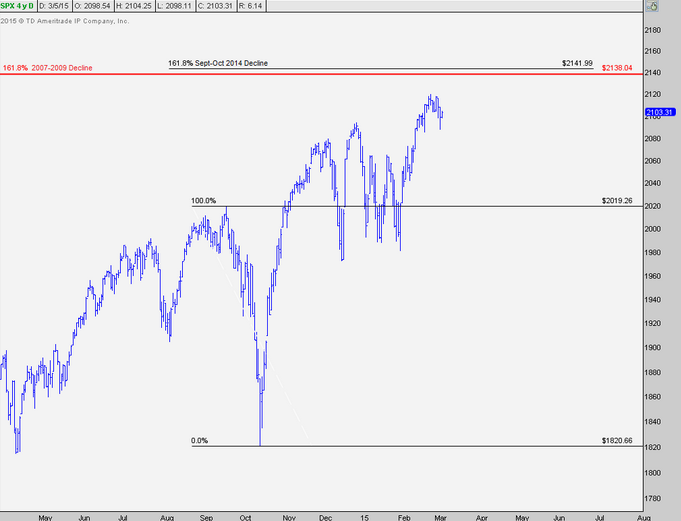

I was chatting with renowned technician J.C. Parets a couple of days ago for an interview that will be publish next week and he mentioned the Fibonacci cluster around 2140 on the S&P 500 as an upside target for the current rally:

Considering today’s bloodshed the fact that the SPX came within 1% of the 2140 level makes this level all the more significant. Downside levels of interest now become ~2065 (50-day SMA and previous resistance from January) and 2020 (September high and 100% Fib level).

While one day does not make a trend, there are at least a few reasons for equity bulls to be concerned after today’s action:

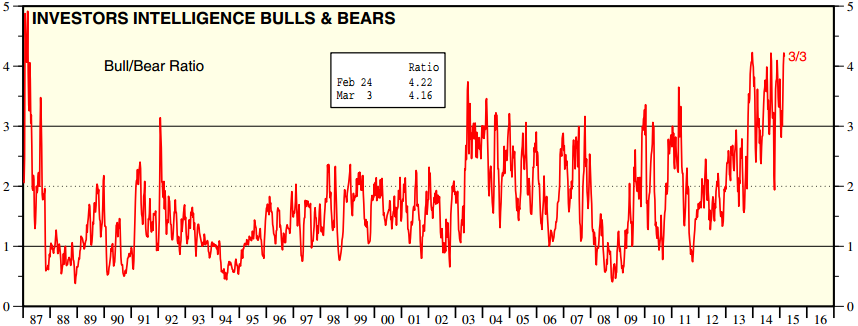

- The series of marginal new highs followed by a sharp downward move has more bearish significance due to the fact that the time spent consolidating at new highs allows for more fresh bulls to get sucked in

- Sentiment was extremely elevated during the past couple of weeks which only adds to the magnitude of the potential unwind

- Today’s breakout in yields was quite significant, a move above the ~2.3% level in the 10-year would be a strong indication that we are finally entering a long awaited ‘rising rate environment’ that would not be friendly to equity valuations

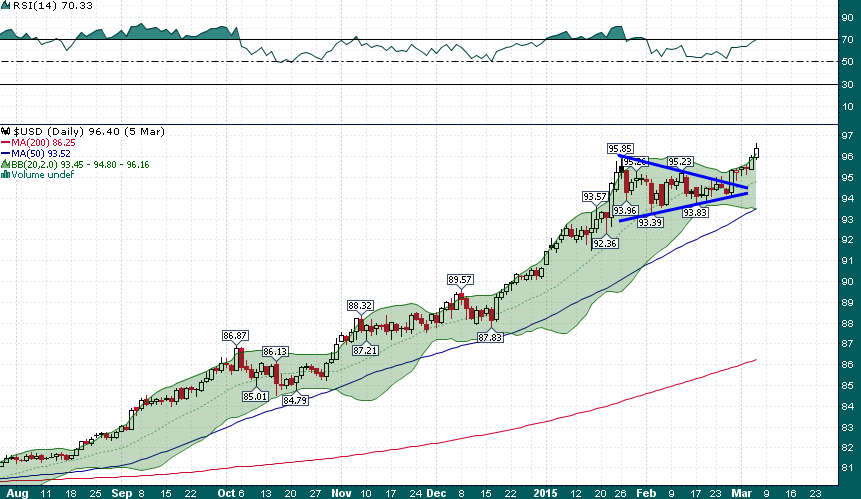

- Extreme strength in the US dollar which shows no signs of stopping (expect this to lead to earnings warnings over the coming weeks and earnings misses when Q1 earnings are reported beginning in April)

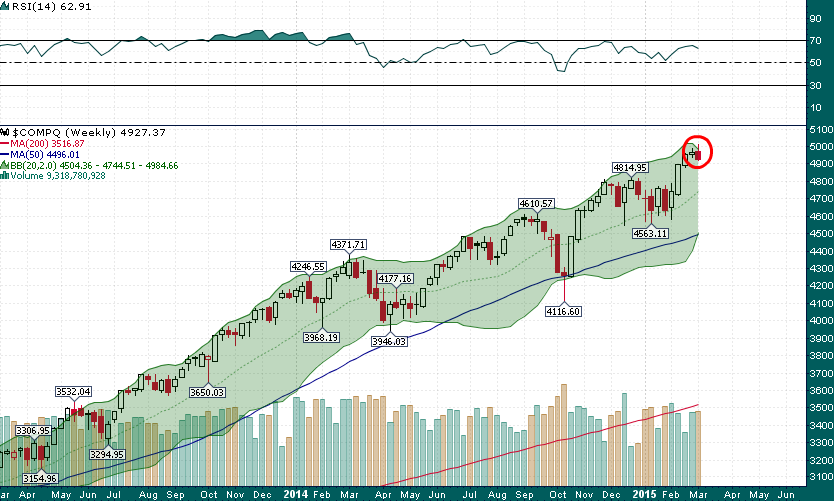

- Despite all the hooplah about “Nasdaq 5000” earlier in the week the Nasdaq Composite printed a bearish engulfing candlestick on the weekly and even AAPL’s inclusion into the Dow was not enough to keep it afloat as the week drew to a close

‘Tweezers top’ with a bearing engulfing candlestick on the weekly

If I could only look at one market or indicator for the next year it would definitely have to be the yield on the 10-year note. If long rates really do begin to pick up it could add to a potentially toxic combo for equities along with extreme US dollar strength (headwind for corporate earnings given that roughly 1/2 of S&P revenues come from outside the US) and historically high equity valuation multiples.