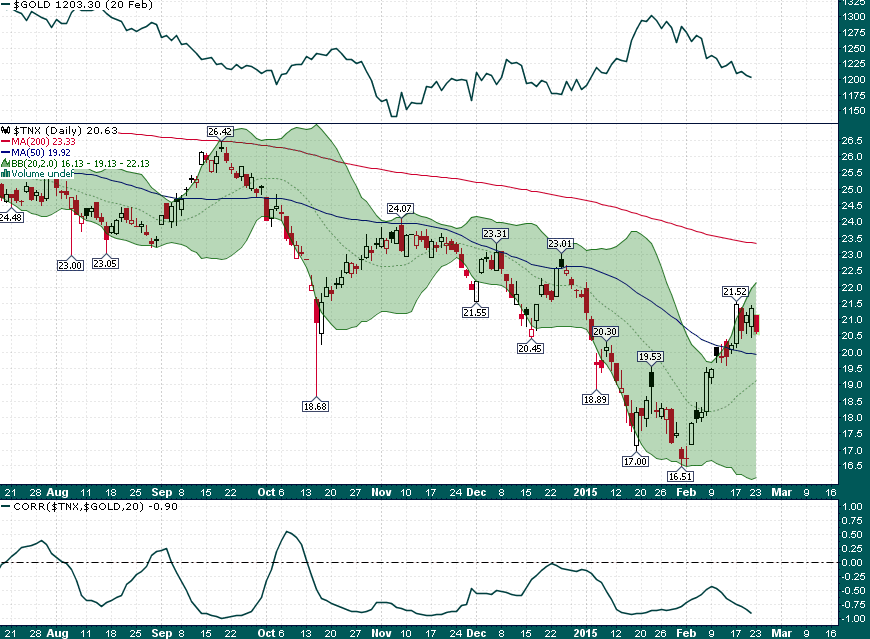

The yield on the 10-year US Treasury note has surged 50 basis points in the past few weeks and in turn gold has fallen nearly $100/oz. The negative correlation between yields and gold has been strong for the last 6 years and this correlation has become even stronger in recent weeks:

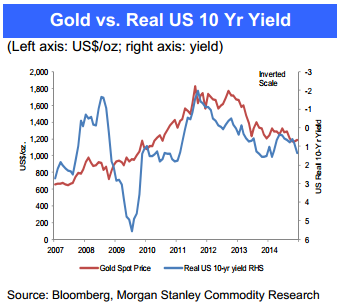

Since the 2008-2009 Global Financial Crisis gold has held a strong inverse correlation to real 10-year yields

Recently the negative correlation between gold and 10-year yields has reached 90%! (bottom of chart below)

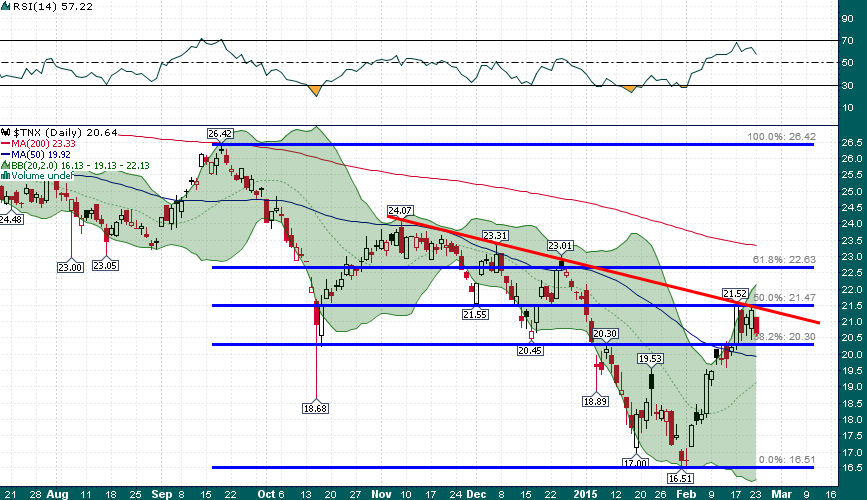

Given the strong correlation between 10-year yields and gold there are a couple of key yield levels to watch in the 10-year note over the coming weeks:

The recent rally in yields stopped at a logical area of resistance (~2.15%). A breakout above 2.15% would have negative implications for gold, whereas, a decline back below the 2.00% yield area should set in motion the next leg higher in gold.