Nevada is the leading gold producing state in the United States and it is also among the top producing areas globally. The state’s gold production comes from both large-scale open-pit mining and smaller underground operations. The Carlin Trend, located in northeastern Nevada, is one of the world’s richest gold mining districts. However, another geologically significant area in Nevada, the Walker Lane Trend is experiencing a gold exploration renaissance.

Multi-billion dollar market cap global mining firm, AngloGold Ashanti (NYSE:AU), has spent the last decade acquiring a large set of assets within the Beatty Mining District of Nevada. At the end of 2023, AngloGold published a resource for its “Merlin Deposit” totaling more than 9 million ounces of gold. In total, AngloGold’s Beatty Gold District assets boast ~16 million ounces of total gold resources:

The Walker Lane is a geological trough that extends from Oregon down through eastern California and into western Nevada. It is characterized by a series of faults and shear zones that have been the site of significant geological activity over millions of years. This geological setting is conducive to the formation of mineral deposits, including gold, silver, and copper. The Walker Lane trend diverges from the more extensively developed and researched Carlin and Battle Mountain-Eureka trends in Nevada, offering a relatively underexplored area with a lot of potential.

Mining in the Walker Lane trend includes both historical operations and modern exploration projects. The area has seen a resurgence in interest from mining companies looking to explore and develop new resources in a region with a proven geological endowment. The Walker Lane’s gold mining potential is bolstered by Nevada’s established mining infrastructure, favorable mining laws, and a historical precedent of significant mineral discoveries.

Key projects and mines in the Walker Lane trend highlight its diversity and potential for contributing to Nevada’s gold output. These include both large and small operations, with exploration companies actively seeking new deposits and expanding known ones. The trend’s geological complexity, with its mix of volcanic rocks, fault zones, and varied mineralization, presents both challenges and opportunities for geologists and miners.

The Walker Lane trend represents an exciting frontier in Nevada gold mining and exploration, with high quality gold assets becoming much more valuable in recent years. One company has managed to assemble two unique assets that were previously held by gold mining major Kinross Gold (NYSE:KGC).

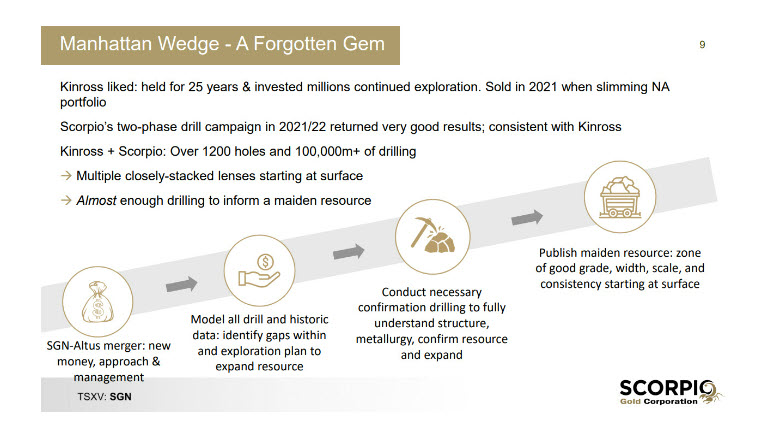

In 2021, Kinross divested some of its non-core North American assets as it prepared to acquire the Great Bear Project for C$1.8 billion. Scorpio Gold (TSX-V:SGN, OTC:SRCRF) acquired the Manhattan Goldwedge Project from Kinross Gold in 2021.

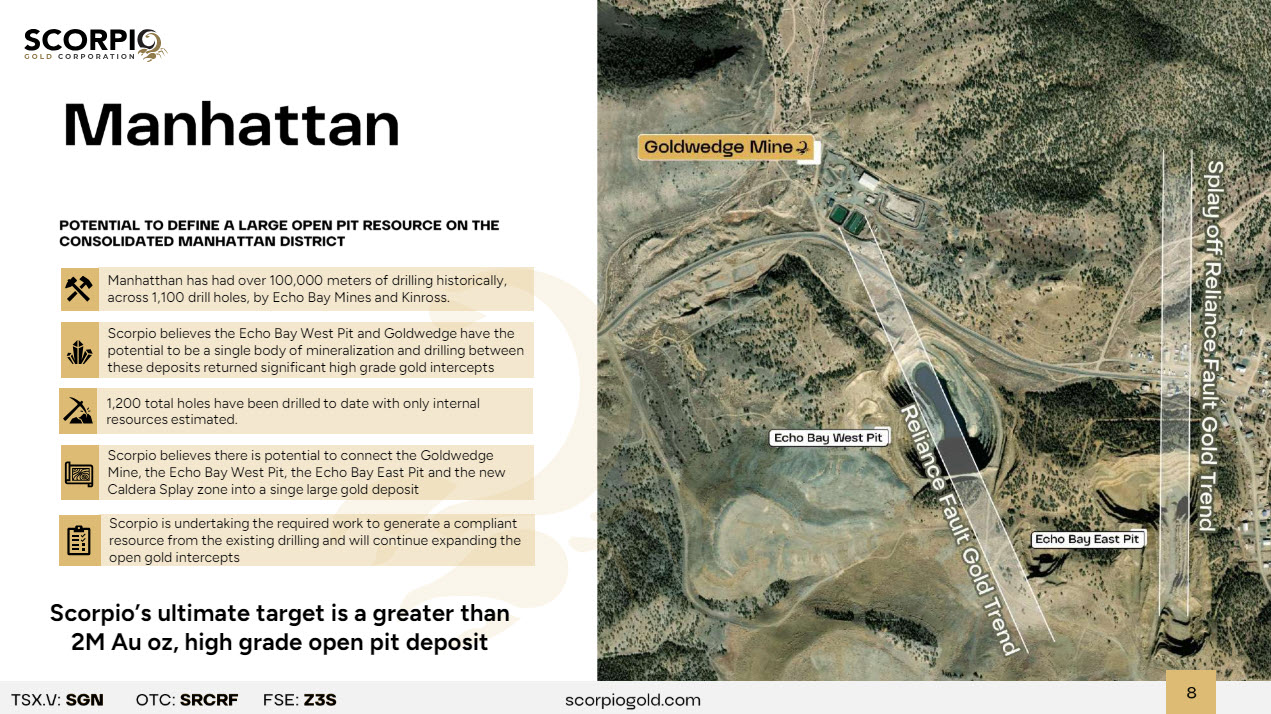

The acquisition gave Scorpio a 100% interest in the Manhattan Goldwedge project located in the Walker Lane Trend of Nevada – Manhattan Goldwedge encompasses the advanced exploration-stage Goldwedge property with a fully permitted underground mine and a 400 ton per day mill facility. The project area includes notable deposits like the Goldwedge, Keystone, and Jumbo gold deposits within the Manhattan Mining District of south-central Nevada. The area has seen extensive exploration and drilling efforts by Scorpio Gold to understand and expand the knowledge of the geology and controls to mineralization.

The exploration and drilling activities at the Goldwedge deposit have revealed several styles of gold mineralization, including fault breccia and vein hosted to stratabound replacement style in limestone and pervasive quartz-sericite-pyrite alteration hosted. Drilling results from different years have identified significant mineralization, indicating the presence of gold within and subparallel to the fault zones and as dilational lenses and veins extending outward from the fault zone along fractures oriented sub-parallel to bedding.

Moreover, Scorpio Gold’s acquisition of the Manhattan project property claims from Round Mountain Gold and KG Mining Inc. expanded its control over the land around the Goldwedge project, incorporating two past-producing mines. This acquisition enhances the potential for both expanding surface operations and underground mining and exploration, consolidating a large land position along the Reliance Fault Zone, which has significant exploration potential for high-grade gold targets.

The Manhattan property’s acquisition underscores Scorpio Gold’s commitment to exploring and developing gold resources in Nevada, particularly within the Walker Lane gold belt, renowned for its gold production capabilities. With continued exploration and drilling, Scorpio Gold aims to further define and expand the known mineralization within the Manhattan Goldwedge project area, leveraging historical and newly acquired data to maximize the project’s potential.

Scorpio is planning to commence its 2024 drill program at Manhattan in early May 2024.Scorpio intends to conduct a targeted diamond-drill campaign, alongside detailed mapping, sampling, and a target generation field program. Over the past months, Scorpio has worked to build an updated internal resource estimate based upon this historic data and intends to work towards putting out a 43-101-compliant resource on Manhattan by the end of 2024. The 2024 drill program will be designed to optimize the year end 2024 Manhattan Resource Estimate. Details of the drill program are expected to be disclosed by Scorpio shortly.

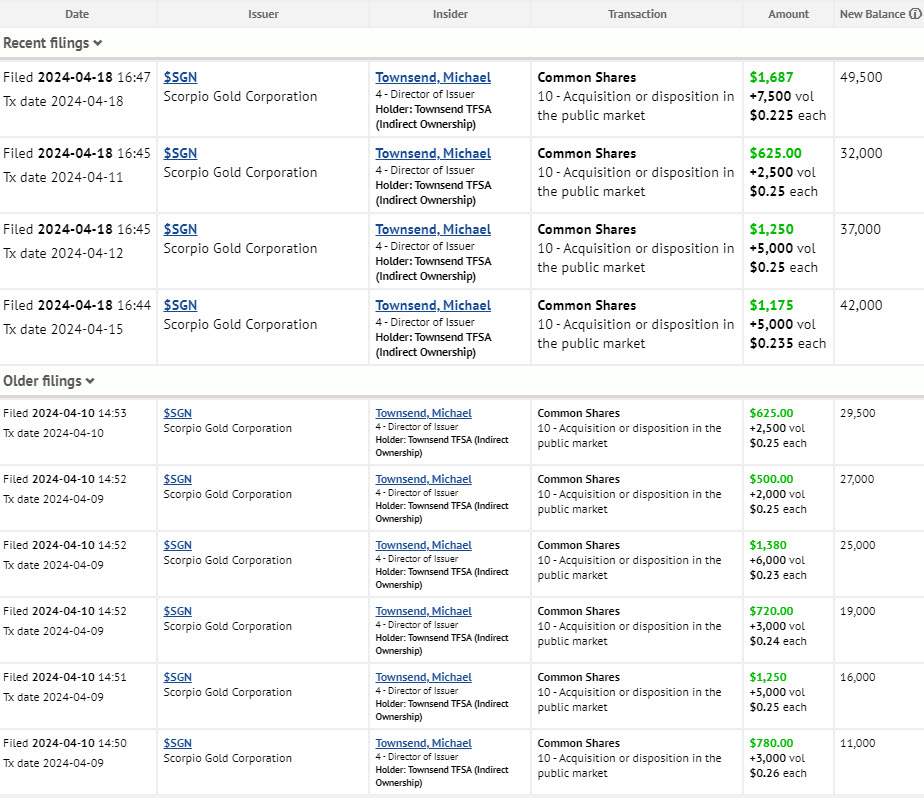

Scorpio Gold Director Michael Townsend has been steadily buying Scorpio shares on the open market throughout the month of April, with 50,000 SGN shares purchased to date:

Scorpio Gold CEO Zayn Kalyn sat down with Gwen Preston at the Metals Investor Forum in early March:

Energy & Gold looks forward to visiting Scorpio’s Walker Lane Trend projects as drilling gets underway next month. We will update readers with our observations from site. In the meantime, you can follow Scorpio Gold on social for the latest updates and their website at scorpiogold.com.

__________________________________________________________________

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Scorpio Gold Corporation is a high-risk venture stock and not suitable for most investors. Consult Scorpio Gold Corporation’s SEDAR profiles for important risk disclosures.

EnergyandGold has been compensated to cover Scorpio Gold Corporation and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.