Two of the biggest checkmarks a junior mining company can have are

- Strategic investment by one of the largest mining companies in the world.

- A track record of legitimate discoveries with multiple world class drill intercepts

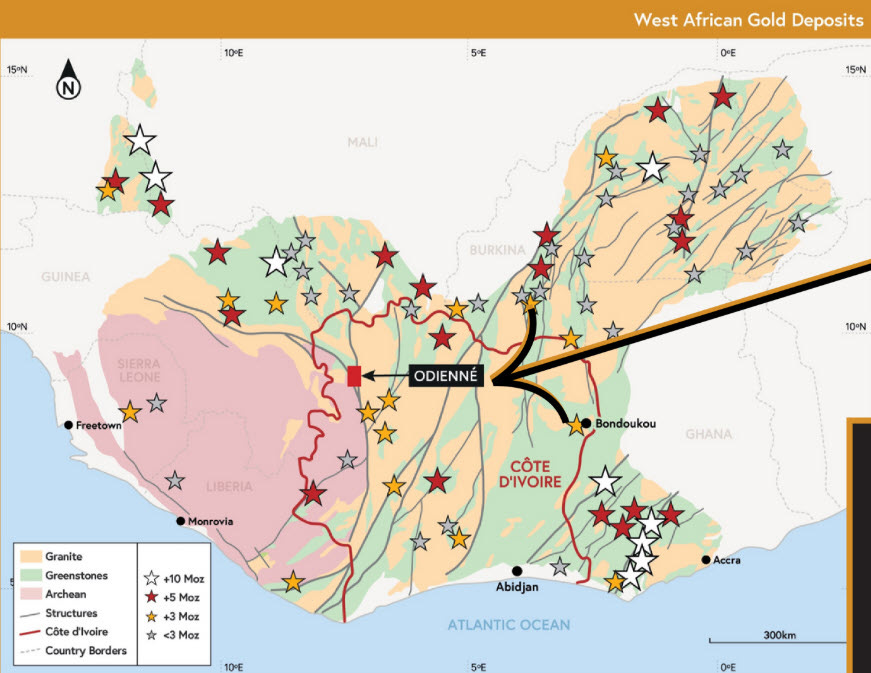

It’s not often that we find a junior company with a sub-$50 million market cap that checks both of these boxes. However, in Awale Resources (TSX-V:ARIC, AWLRF) we have found one. Awale controls nearly 2,500 square kilometers of mineral tenure in western Africa (Ivory Coast). Awale has four discoveries to its credit at the flagship Odienné Project, in the northwest Denguèlé Region of Côte d’Ivoire, close to the borders of Mali and Guinea.

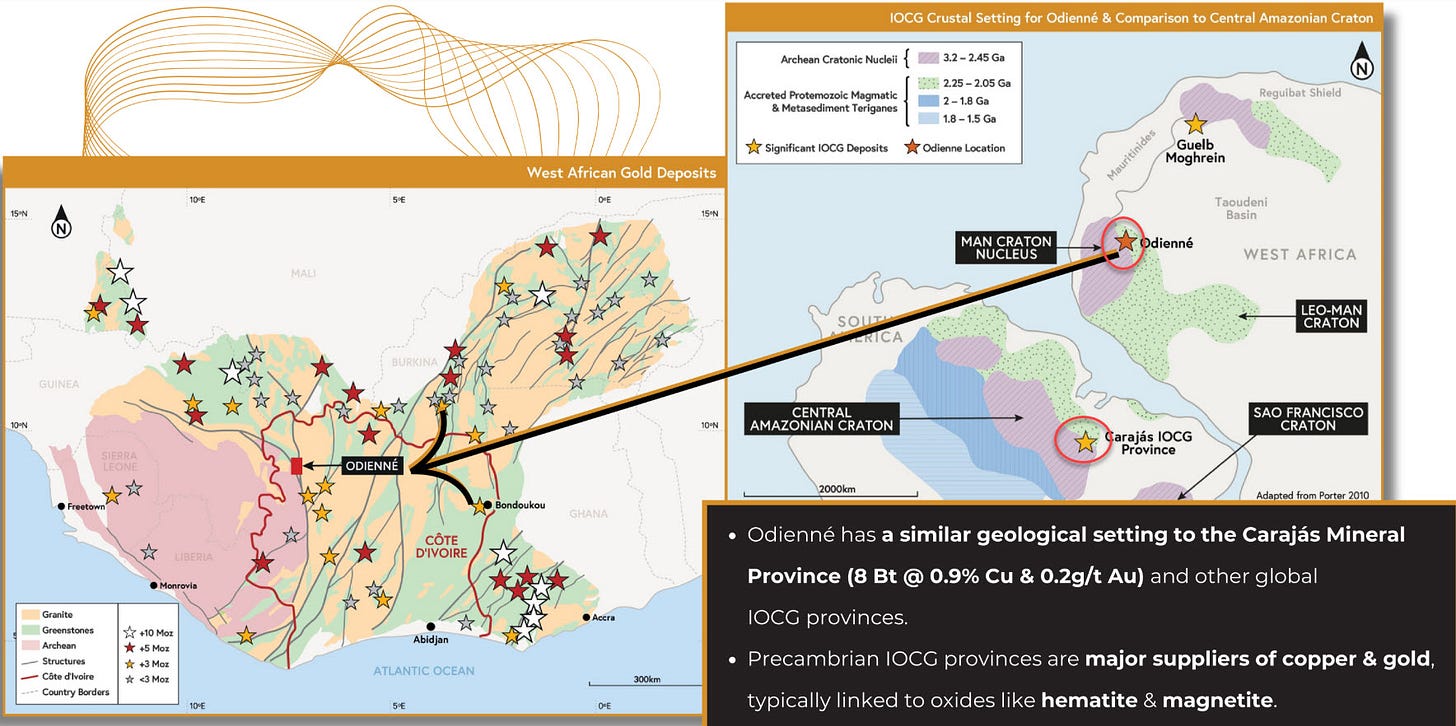

Odienné sits in a comparable geological setting to other significant Iron Oxide Copper Gold (IOCG) provinces globally. For example, the Brazilian IOCG districts sits at a similar contact between cratons:

At Odienne, Awale has made discoveries at four different targets areas including:

- BBM – New copper/gold discovery within an 8 kilometer corridor with anomalous copper/gold soil geochemistry.

- Empire – High grade gold discovery on the 20-kilometer east-west Empire Gold Corridor

- Sceptre East & Sceptre Main – large multi-kilometer high tenor copper-gold targets

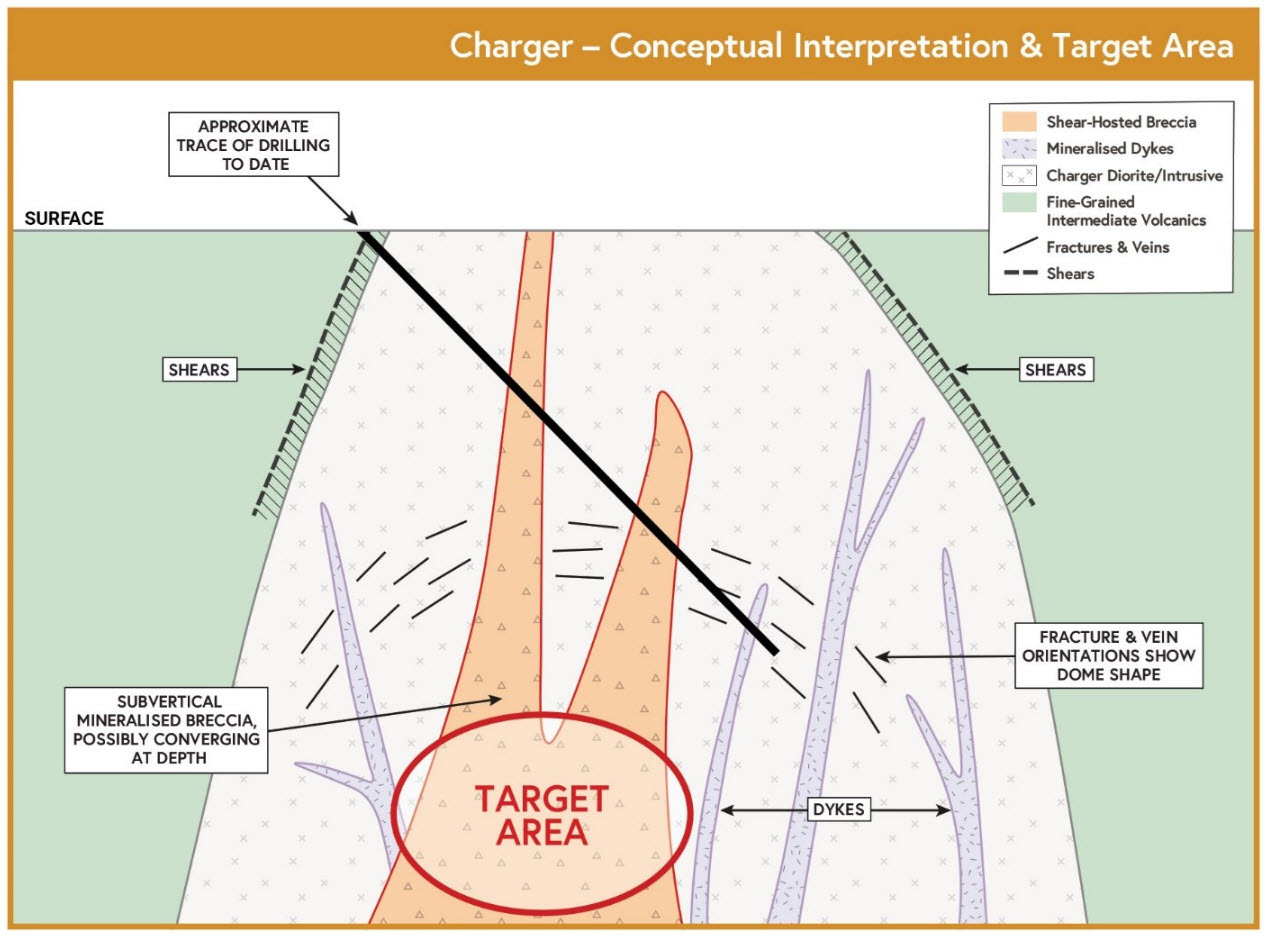

- Charger – High-grade copper-gold discovery with near surface hematite breccias (Charger just delivered one of the best gold drill intercepts of the last decade)

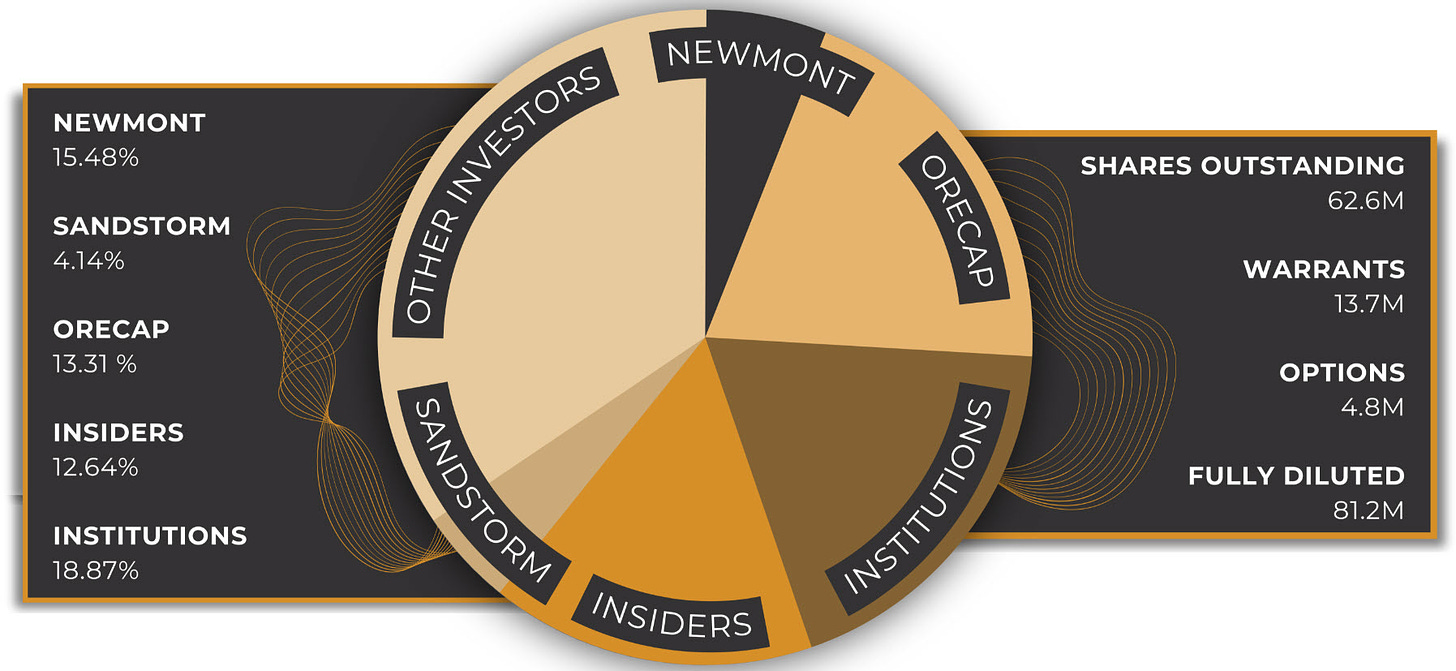

Awale’s discovery success at Odienne has been substantial enough that it attracted the interest of the world’s largest gold producer, Newmont (NYSE:NEM). Newmont has taken a 15% stake in Awale, and also entered into a JV agreement that allows NEM to earn up to 65% of the Odienne Project. By funding US$15 million in exploration expenditures at Odienne, Newmont will earn a 65% interest in the project.

Newmont’s investment and JV interest in Awale demonstrates the potential that these truly ‘newmont sized’ targets hold. Last week, Awale announced results from drilling at the BBM Target. Drill results reported include:

- 75 meters @ 2.4 g/t gold equivalent (Au Eq) from 242m downhole in hole OEDD-74

- 44 meters @ 2.5 g/t Au Eq from 131m downhole in hole OEDD-65

- 40 meters @ 1.9 g/t Au Eq from 194m downhole in hole OEDD-76

- 39 meters @ 1.6 g/t Au Eq from 60m downhole in hole OEDD-64

All holes at BBM came back highly mineralized & intercepted target geology. Awale has now confirmed plunging high grade mineralization over 500 meters of strike at the BBM Zone. Drilling now covers a 2 kilometer strike along a shear zone, which sits within a high tenor, 8 km-long geochemical gold in termitaria trend.

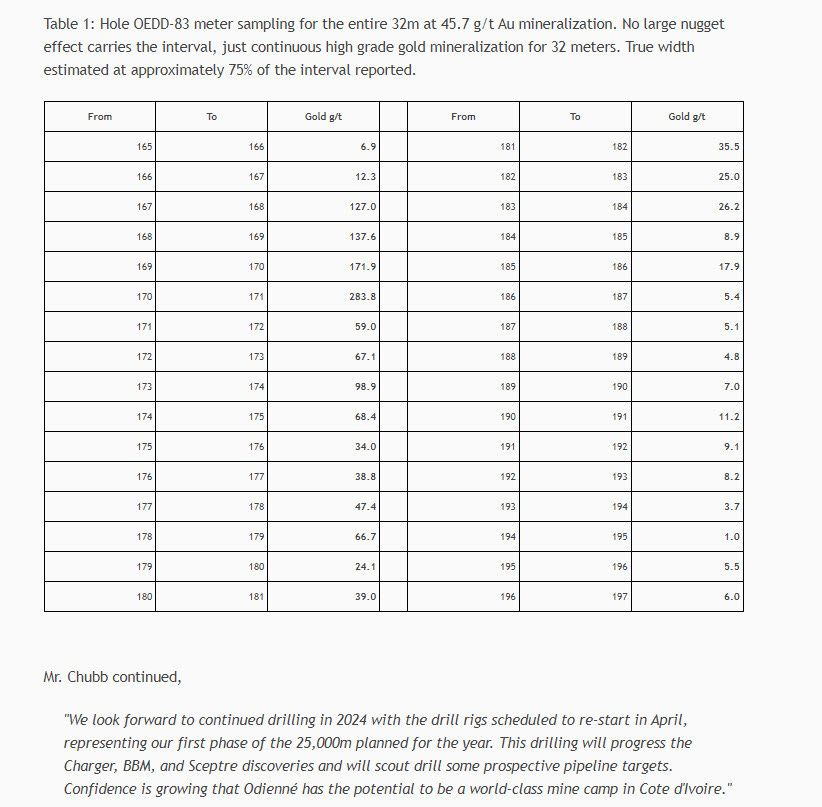

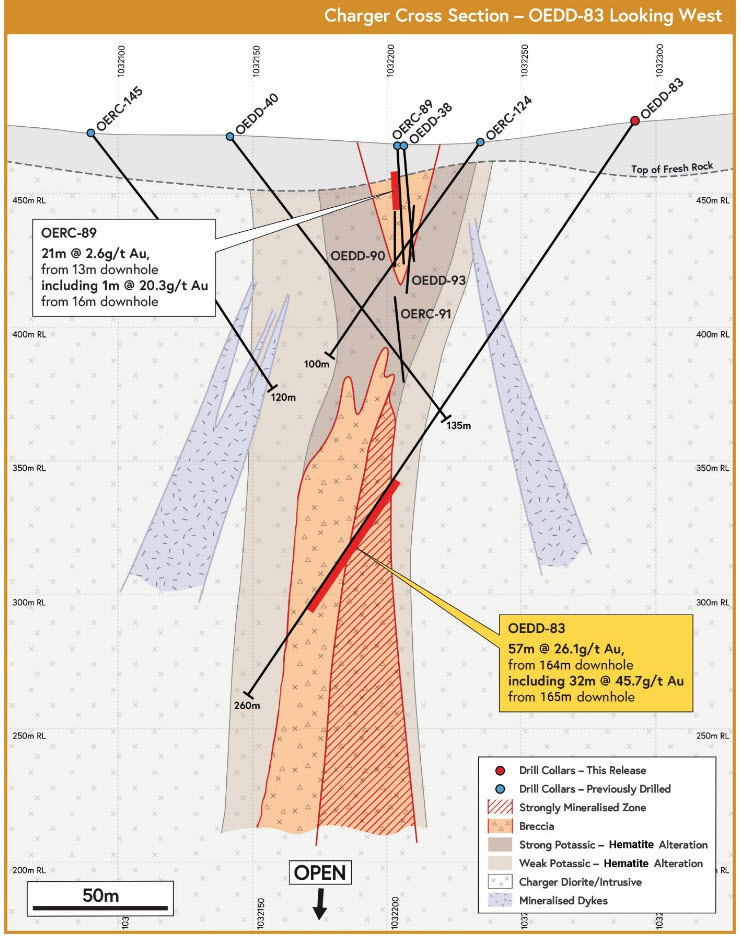

Monday morning, I awoke to quite a surprise in the form of Awale’s latest drill results update. Hole 83 at the Charger Target on the company’s Odienné Project in Ivory Coast delivered a truly world class gold intercept of 45.7 g/t gold over 32 meters.

The assay breakdown shows consistent high-grade gold mineralization throughout the 32 meter interval:

Awale’s geological interpretation of Charger shows multiple gold mineralized breccia pipes extending up from a deeper source, like fingers on a hand. The evidence shows the mineralized pipes widening at depth, with potential for the pipes to coalesce at depth:

Awale CEO Andrew Chubb stated:

“This drill hole is absolutely spectacular. I have been looking at gold projects for the last 20 years and have never seen anything like this. Odienné has produced very high-grade mineralization since we started drilling, though we always felt that some special things would come as we continued our work. The harder we press at Odienné, the more it gives back, and we’ve only just scratched the surface.

We look forward to continued drilling in 2024 with the drill rigs scheduled to re-start in April, representing our first phase of the 25,000m planned for the year. This drilling will progress the Charger, BBM, and Sceptre discoveries and will scout drill some prospective pipeline targets. Confidence is growing that Odienné has the potential to be a world-class mine camp in Cote d’Ivoire.”

Hole OEDD-83 was specifically targeted to drill through potential mineralization associated with the newly recognized NE structural control. This intercept is 60 m north of the 2 previously intercepted breccia pipes, and is under the discovery hole at Charger, OERC-89.

Assays are still pending from a few holes at the Lando Target. Drilling is set to resume at Odienné in April with a 25,000 meter drill program using multiple rigs. Newmont is funding 100% of the drilling in 2024 as it seeks to earn a 51% interest in the project. Newmont can earn up to 65% of Odienné with a total of US$15 million in exploration spending.

In total, Awale has a nearly 2,500 square kilometer land position in Ivory Coast. More than 2/3 of the project area is on 100% owned claims with no option agreements. As Chubb says in his CEO quote, Awale has just scratched the surface in exploring these Newmont sized targets.

I bought a position in Awale after last Monday’s results from BBM. It was hard to buy last week as the ARIC chart already looked like a rocket leaving Earth. However, the drill results from BBM and the multi-target discovery potential help to explain the stock’s performance.

ARIC.V (Daily)

What are the results from BBM and Charger worth? We’re about to find out.

Some may point to the JV deal with Newmont as being a negative for Awale due to the fact that Newmont will soon be the majority owner and operator of this project. While others will see the clear benefits of having Newmont invest US$15 million in exploration expenditures without Awale spending a dime. In addition, the value of the validation and technical collaboration that Awale enjoys through the Newmont partnership cannot be overstated.

Awale has a fully diluted share count of 81.2 million shares. However, nearly 50% of the free trading float is held by a combination of Newmont, Sandstorm, OreCap and company insiders:

Awale’s results from Charger and BBM have captured the attention of many junior mining investors. The fact that the company will be back drilling again at Odienné within the next 2-3 weeks will help to maintain this newfound investor interest in the company.

Disclosure: Author owns shares of Awale Resources at the time of publishing and may choose to buy or sell at any time without notice.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

Goldfinger Capital, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.