The uranium sector continues to be one of the leading sectors in the entire stock market in 2023. The nuclear energy revolution is here, and it is likely to continue to accelerate for the rest of the decade. We have seen the uranium spot price soar past $60 a pound in recent weeks, and reach $70/lb at the time of this article.

So far most of the institutional money moving into the uranium space has been buying Cameco (NYSE:CCJ) and other billion dollar market cap companies like NexGen (NYSE:NXE) and Energy Fuels (NYSE:UUUU). However, as the bull market evolves, we can expect money to flow down the food chain and across the uranium mining sector.

URA (Daily)

To put this into perspective, Cameco’s current US$18 billion market cap is larger than the next 10 largest North American listed uranium stocks combined. This sector is so small that any institutional inflows are likely to have an outsized impact on share prices.

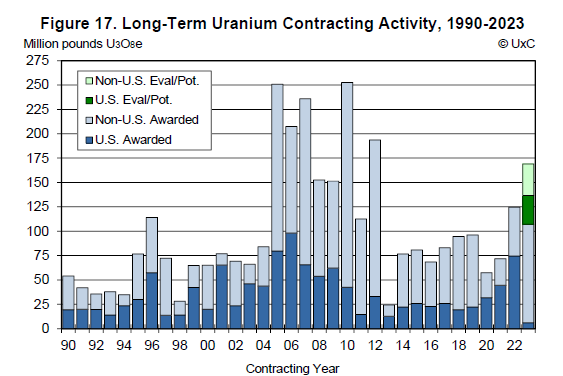

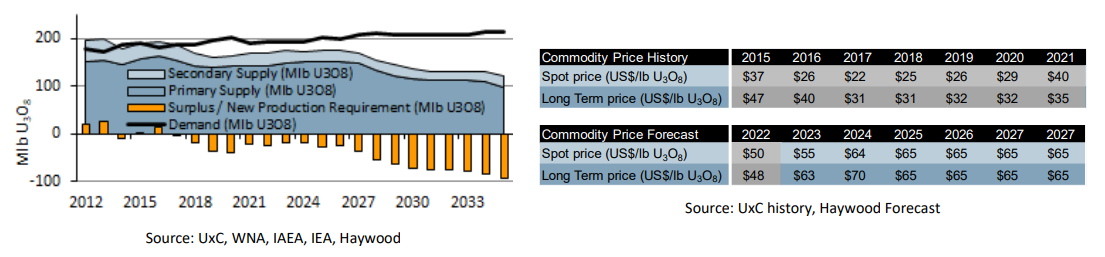

As one might expect, we are seeing contracting activity pick up substantially so far in 2023, and along with it the U3O8 spot price has increased nearly 40% year-to-date:

Yet, even with this recent acceleration in long-term uranium contracting activity, according to the latest analyst research the uranium market remains woefully undersupplied over the coming years:

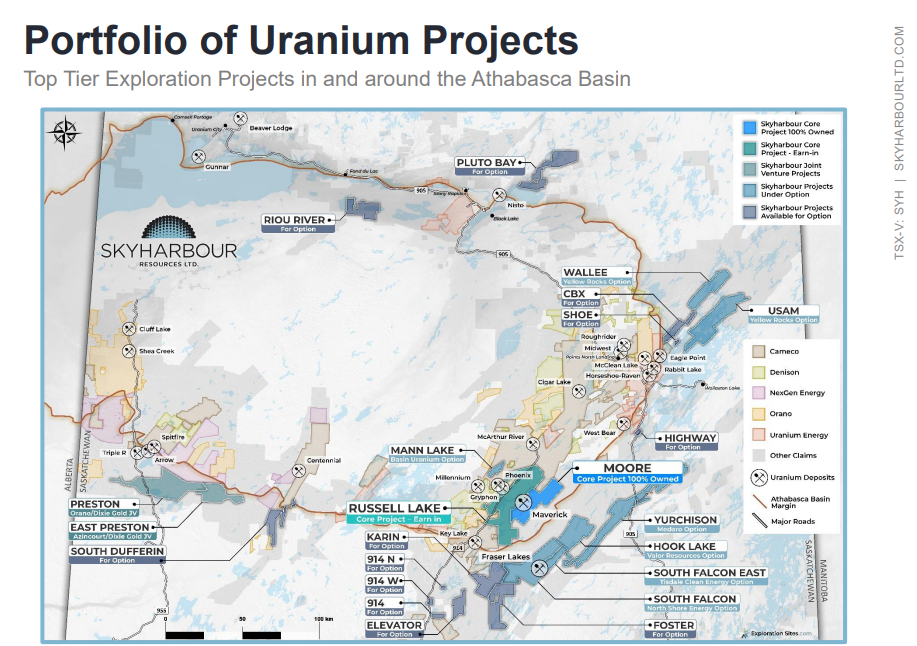

One company which we have highlighted on numerous occasions is Athabasca Basin focused Skyharbour Resources (TSX-V:SYH, OTC:SYBHF). The Athabasca Basin in Saskatchewan, Canada is an ancient sedimentary basin hosting the world’s richest uranium deposits and mines. Moreover, Saskatchewan is rated the #2 mining jurisdiction in the world, per the Fraser Institute.

The Athabasca Basin is widely regarded as one of the best locations for uranium exploration and mining for several reasons:

- High-Grade Deposits: The Athabasca Basin is home to some of the highest-grade uranium deposits in the world. The high ore grade makes mining operations more economically viable, as extracting uranium from higher-grade ore is less costly compared to lower-grade ore.

- Established Infrastructure: The region has well-established infrastructure, including roads, power, and water, which facilitates mining operations. This reduces the initial capital investment required to develop new mines or expand existing ones.

- Political Stability: Canada, and Saskatchewan in particular, offers a politically stable environment with a well-established regulatory framework. This is an important factor for mining companies, as political instability can pose significant risks to mining operations.

- Strong Support Industry: The area has a robust mining support industry, including experienced contractors, suppliers, and skilled labor. This availability of resources and expertise facilitates the development and operation of mining projects.

- Environmental Regulations: While strict, Canadian environmental regulations are clear and predictable, which provides a level of certainty to mining companies. Companies that adhere to these regulations can mine in an environmentally responsible manner.

- Research and Development: The presence of research institutions and ongoing exploration activities contributes to the advancement of mining technology and practices in the region, which can enhance the efficiency and environmental sustainability of mining operations.

- Abundance of Resources: The Athabasca Basin still has large areas that are underexplored, offering potential for new discoveries. This abundance of untapped resources is attractive for exploration companies looking to secure future mining prospects.

These factors collectively contribute to making the Athabasca Basin a prime location for uranium exploration and mining, attracting companies from around the world to invest and operate in the region.

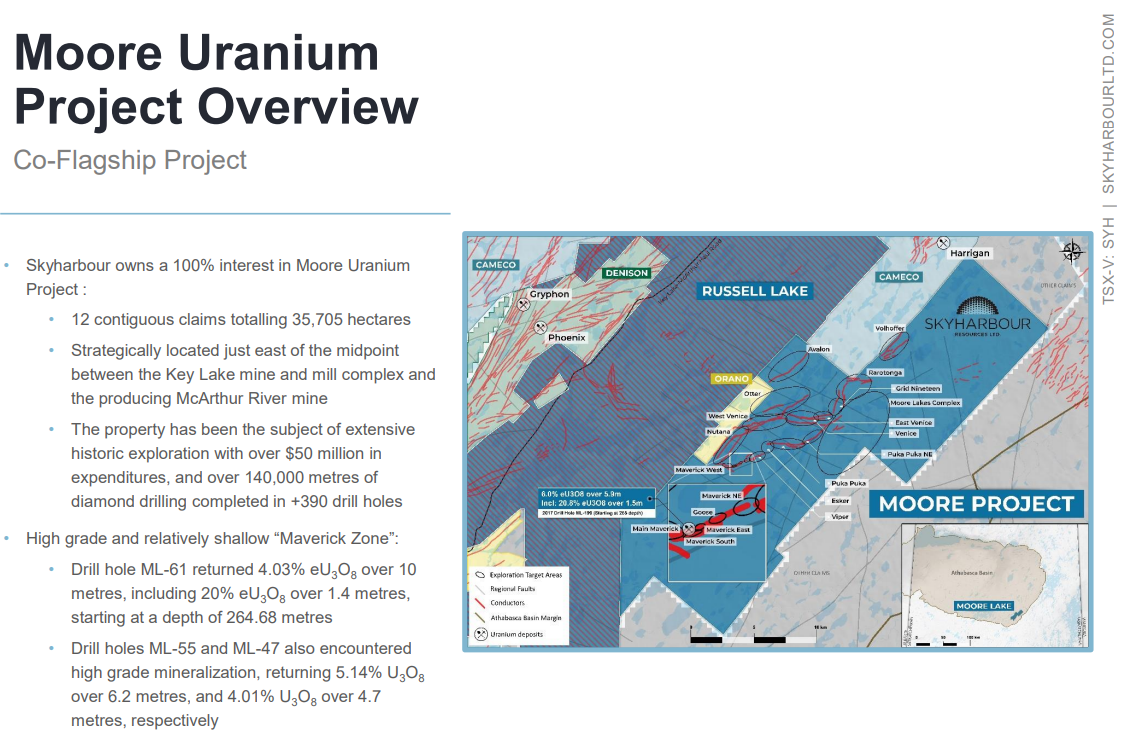

Skyharbour Resources holds a substantial portfolio of uranium exploration projects in Canada’s Athabasca Basin, including twenty-four projects, with ten being drill-ready, spanning over 518,000 hectares. It acquired a 100% interest in the advanced-stage Moore Uranium Project from Denison Mines and has the option to acquire up to 100% of the Russell Lake Uranium Project from Rio Tinto.

In addition to being an exploration company focused on their core projects, Skyharbour also applies a prospect generator strategy, partnering with companies like Orano Canada Inc. and Azincourt Energy to advance secondary projects. The company now has two joint ventures and six active earn-in option partners, with signed option agreements totaling over $37 million in partner-funded exploration, with potential for over $28 million in shares and over $19 million in cash payments coming into the Company assuming the partners fully complete their earn-ins. Skyharbour has thirteen other 100% owned projects scattered throughout the Athabasca Basin, which will add to their growing prospect generator business as they seek partners to advance those assets.

The Company aims to maximize shareholder value through new discoveries, partnerships, and advancing projects in favorable jurisdictions.

Skyharbour’s initial exploration/drilling at Russell Lake is wrapping up (10,000 meters of drilling) with assays pending and a follow up drill program being planned. In addition, Skyharbour is currently working on an NI 43-101 Mineral Resource Estimate at its 100% owned Moore Lake Project, and intends to continue drilling with a focus on new/refined basement hosted targets in the new year. Russell and Moore are strategically located between the Key Lake mine and mill complex and the producing McArthur River mine:

With the uranium market recovery in full swing, the companies with the choice assets in the best jurisdictions stand to benefit the most. Skyharbour Resources is uniquely positioned with one the largest set of assets in the Athabasca Basin, and the market has recently begun to take notice:

SYH.V (Daily)

______________________________________________________________________

Disclaimer:

The contents of this article have been reviewed and approved by Skyharbour Resources Ltd. The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Skyharbour Resources Ltd. is a high-risk venture stock and not suitable for most investors. Consult Skyharbour Resources Ltd.’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by Skyharbour Resources Ltd. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.