When I spoke with 321gold founder Bob Moriarty a couple months ago he was vocal that a market crash was going to occur by the end of October. October came and went and stocks continued moving higher. Trends tend to trend after all. However, as we turned our clocks back an hour Sunday morning the market picture has quickly changed, as evidenced by TSLA’s sharp ~20% drop since its founder and CEO Elon Musk announced that he would sell 10% of his shares.

In this month’s conversation Bob and I discuss extreme sentiment, why a market crash is coming, tax loss opportunities in junior mining shares, and more importantly why natural resources are the ‘cheapest motel in town’. Without further ado, Energy & Gold’s November 2021 conversation with Bob Moriarty….

Goldfinger: There is a lot to talk about today Bob. Let’s start with the stock market, the broader stock market and what you’re seeing there in terms of sentiment, price action and what the Fed announced on Wednesday.

Bob Moriarty: Okay, did you go to 321gold today? Have you read my latest piece?

Goldfinger: I am just reading it now Bob, and I see the DSI for the Nasdaq and S&P 500 are both at 93 as of yesterday’s close.

Bob Moriarty: Okay, it’s a short piece, and strange enough, it’s going to answer many of your questions.

Goldfinger: So what does that mean? So you were just early? The crash is going to happen now?

Bob Moriarty: Interestingly if you read the piece entirely, that’s exactly what you can conclude. Now, bear in mind that when I started talking six to nine months ago about there being highs in August or early September and then a crash in late October, I was throwing darts at a dartboard that was 50 meters away. Now, I have access to a lot of the information and I’ll just flat tell you, the Dow is up 300 points today, the Nasdaq is up 90 points today, the S&P’s up 33 points.

The Nasdaq and the S&P, had a reading of 93 yesterday. If this holds, obviously it’s going to go up. If we had a reading of 95 or 96, I would say you could set your watch, because in 15 minutes it’s going to crash. So what I’m going to say is, I think that I was wrong. I just wasn’t wrong by very much. I think it will happen fairly soon, I believe we’re going to have a crash. The VIX is very low and the S&P and Nasdaq are at extremes that indicate a crash is coming.

Goldfinger: The Fed announced the start of the tapering process. Everybody expected that, but the main takeaway from it is that he’s not worried about inflation, it seems, and says that we have more work to do on the jobs front.

Bob Moriarty: You and I approach predicting from different directions. I totally ignore the Fed. I mean, face it, the Fed has been wrong about everything they’ve ever done. They are the cause of the economic chaos in the United States. I mean, they’re so stupid, why would you listen to stupid people? So I ignore what they do, but I’m just going to flat out tell you, sentiment is the single most important element in predicting the near-term future. And the sentiment in the Fear & Greed Index is 85, on the upside it’s 93, VIX is very low. We’re going to have a crash very soon.

Goldfinger: So it’s always interesting to say, “We’re going to have a crash very soon.” And it’s another thing to make money from it, and that’s the reality of the situation. It’s very easy to sit up and make calls, but it’s another thing to trade them. Do you have any insights on how you would trade this?

Bob Moriarty: Yeah, I mean, well here’s what I would say, in the general market I would go to 100% cash. Do remember, cash is an investment.

Goldfinger: So zero exposure to large cap US stocks, hold a lot of cash, and then where would you still have investments?

Bob Moriarty: That’s a really good question, I believe if the resource stocks are the antithesis of Tesla, the antithesis of Bitcoin, the antithesis of the S&P and the Nasdaq, and when the market crash comes, I believe there’s to be a lot of money poured into resources because quite bluntly, they’re the only cheap motel in town.

Goldfinger: Okay, so would you be more weighted towards precious metals, base metals, towards energy?

Bob Moriarty: Okay, and again, that’s a really good question. Now, can we agree that commodities in general, with the exception of gold and silver, have an absolute run? The ratio of gold and silver to commodities in general is the worst that it’s ever been, but commodities have gone up. Are we in agreement there?

Goldfinger: Yes.

Bob Moriarty: Okay, what has happened to the resource stocks in copper and lead and zinc and moly is in the energy stocks. What has happened to them?

Goldfinger: Well, energy stocks have done pretty well. Some of the base metal stocks have not done as well.

Bob Moriarty: Absolutely, and when you consider the increase in energy across the board, the stocks have not done well at all. So the commodities are doing great but the shares behind them are not. One of the points that I make in “Nobody Knows Anything” is that if you have a list of 15 different investments, if you sold what has gone up the most lately and you bought what had gone down the most lately, you would make money every time.

I say something that’s so contrary to every other advisor that investors ignore me, but they ignore me at their peril. You have to buy what’s cheap and you have to sell what’s expensive. And because that’s so simple, people don’t get it.

Goldfinger: So what’s cheap today? Can you give me any names more specifically?

Bob Moriarty: Good question. Okay, again, do we agree that if we’re going to go to green energy, that electric vehicles and what goes into electric vehicles has to go a lot higher in price? Are we in agreement there?

Goldfinger: Yes.

Bob Moriarty: Okay, batteries are the key to green energy, period. If you have solar farms and if you’ve got wind farms, they are worthless without batteries as storage, and everybody’s been looking at electric vehicles instead. There’s been $300 billion that these major automobile companies have said they’re going to have to invest in electric vehicles, but strangely enough, copper hasn’t gone up, nickel hasn’t gone up.

I ran into a stock that was so cheap I simply couldn’t believe it. When you’re making a battery for electric vehicles, what commodity do you need the most of?

Goldfinger: I know we need a lot of different metals including copper, nickel, graphite, and lithium. Even iron ore.

Bob Moriarty: Graphite.

Goldfinger: That’s interesting.

Bob Moriarty: Yeah, I didn’t know that. That was a total shock to me. Graphite is 53% of the cost of the battery for electric vehicles. I had no idea that was true. And when you look at the projections for 2020 to 2030 or from 2020 to 2050, I think the demand for graphite is going to go up 400% between 2020 and 2030. Somebody contacted me and they have a graphite project in Brazil, and in comparison to the other companies, the industry at the same stage, they are 15 to 25 times cheaper.

The company symbol is simple, it’s Sierra-Tango-Sierra (TSX-V:STS), and I’ll give you the name here in just a minute. But it’s so cheap I couldn’t believe it. When I started investing in it, they had a $15 million market cap. They have about a $20 million market cap now, the company is South Star Battery Metals. It’s very cheap and I wrote a piece a week ago and I said that it has 20-fold potential. I actually lied because I think the potential is a lot higher than 20-fold.

It’s the single best stock that I’ve seen in 20 years. It is so cheap and it’s so much demand for the basic commodity. It’s going to go a lot higher.

Goldfinger: Interesting. And they have a project in Alabama, too.

Bob Moriarty: Yeah, they just picked up the project in Alabama. Now I’ve actually been to that project. I don’t know what the average investor thinks about Alabama, but I went to Alabama and boy, where the project was, was absolutely in the boondocks. I mean, there’s been no issue whatsoever with Not In My Backyard there. The local area is depressed and they’re going to be very eager to have money come in.

And strange enough in comparison to what they have in Brazil, the grade in Alabama is higher. So they’ve got a good resource in Brazil. They’re building a pilot plant. They’re starting shortly, they’re going to do 5,000 tons in a year, and they’re going to build a phase two plant that I think has 25,000 tons a year capacity. But it’s just a great stock and I welcome the move into a project in Alabama because it’s going to add a lot more depth to the company.

STS.V (Daily)

Goldfinger: Let’s talk about gold, so gold has been pinned to this $1,800 level it seems for so long, but as of this moment on a Friday morning, we’re $1,804.80 and it seems like it wants to go higher. What are your thoughts on gold here, in the final two months of 2021?

Bob Moriarty: Okay, think of gold as a teeter totter. You’ve got Tesla on one end of the board, you’ve got gold on the other. And you and I have spent a lot of time talking about Tesla. The market cap of Tesla is higher than the next 10 automobile companies combined. That is simply patently absurd. I’m not going to say people haven’t made money. They’ve made a lot of money on it, but that’s an absolute disaster waiting to happen.

Bitcon, same story. I mean, I think there’s 7,000 variations of Bitcon now. We’re in financial Never Never Land, and we’re about to go back to reality very soon.

Goldfinger: So reality is bullish for gold?

Bob Moriarty: True, absolutely. Well, here’s why and the comment that I just made, if you made a list of 15 different investments and you sold what had gone up the most, and you bought what had gone down the most, gold and silver would be right there at the bottom, and Tesla, the S&P and the Nasdaq would be up there at the top. The market cap of Tesla is simply insane.

Now I’m not saying it won’t go higher, but it has gone curvilinear and market crashes start when any investment goes curvilinear. And gold’s going to do it someday, but today the greatest short in the world is going to be Tesla.

Goldfinger: All right, so let’s talk about some companies we’ve discussed before. Let’s start with Novo Resources. Obviously this has not gone well in 2021. They put out a couple of news releases recently. The first one was they were doing maintenance on the crusher and now this morning they put out, “Processing has resumed after a one-week shutdown for maintenance.” I mean, it seems like startup problems are sort of par for the course in the mining industry, but the market isn’t even going higher today on this news with gold actually above 1,800, so what’s going on here?

Bob Moriarty: Well, the teeter totter is still in the favor of Tesla and the S&P and Bitcon and the Nasdaq. And when the teeter totter moves, which I’m absolutely convinced is very soon, gold is going to go up a lot and Novo is going to go up a lot more. For some reason, there’s a very small group of people on the chat boards that absolutely hate Novo. And somebody on the inside has been passing information on to one of the guys who was the vendor of Comet Wells in Western Australia. He’s just got this giant attitude towards Novo now,and he’s posted a lot of inside stuff that’s totally illegal to do.

In a startup operation, that’s where you’re supposed to have problems, okay? I’m never concerned. Somebody starts up a gold mine and a mill and a crusher breaks, it’s down for a week. Come on, give me a break! I mean, are you kidding? It’s machinery. It’s supposed to break, but let me give you an analogy. I’m going to tell you something that’s going to scare the pants off you.

I’ve got a bakery that I go to four or five times a week, and I went in the other day about 5:30 and they were mopping the floor, and there wasn’t a piece of pastry in the shop. Now these guys close at 7:30 and they said, “Okay, we’re closing early today.” I said, “Oh, okay.” I came back the next day and as it turns out it was about five o’clock and they were preparing to close.

And I said, “What’s up?” And they said, “Well, we have 14 people who work here and nine of them are out sick.” I have never heard, in my life, of any industry, any company anywhere, where two thirds of the people are out sick. That scares me.

Goldfinger: Why were they out sick? I mean, that seems not a coincidence. Is this a vaccine thing?

Bob Moriarty: Yeah. There are emergency rooms and hospitals all over the world that are filled with patients with all kinds of complaints, but it’s not COVID, okay? I have been absolutely straight up for 18 months. The whole COVID thing is bullshit. It is bullshit. It’s a bad flu and they’ve been playing it like a harp, pretending it’s the Black Death. Well, it’s not the Black Death.

If you’re not over 70, in fact, you’re okay. Some of the things that they’re doing today are so criminal, I hope they end up in war crimes trials. They’re giving the jab to 5- to 11-year-old kids. Now 5- to 11-year-old kids are at zero risk from COVID. Yes, they can catch COVID, but it’s a flu. They get over it, and it’s absolutely unequivocal. There’s no question the jab is killing people and it’s killing a hell of a lot more people than anybody realizes.

A good friend of mine and her husband just drove back from the UK and their daughter’s 32 and she has a room-mate. It’s not in any kind of sexual way, but she has a male room-mate who’s 38. He went out for a job, came back, couldn’t breathe, laid down, didn’t wake up. There are people keeling over in every country with very high vaccination rates, and dying. And the death rate is probably five to 10 times higher than the CDC is admitting.

If you’re going to go into the VERIS system at say statistic, there’s a 6- to 12-page report that has to be filled out. I don’t give a damn what the CDC says about the number. We know the number is actually far higher. The CDC says that they believe that 1% of actual cases get reported to the VERIS. Now, I don’t think it’s 1% in terms of vaccine deaths, but I think that it could be 5% to 10% very easily, which could mean hundreds of thousands of people have already died in the United States from the vaccine.

Goldfinger: Yeah, so we kind of went off on a tangent there from the question about Novo Resources (TSX:NVO). And I do want to talk about the vaccine and the virus, but let’s talk about Novo a little bit more because you were very bullish on it early in the year, and obviously it had a tremendous run from 60 cents to over $8. The Pilbara projects were such a focus of the company for a couple of years and now those seem to have really been put on a back burner.

And they’re trying to basically mine this so-so project at Beatons Creek which is having startup issues. What happened to the Pilbara nuggety gold story?

Bob Moriarty: It’s very interesting that you ask that because I was going to get into it. My point about two thirds of the people who are sick in this bakery, the single biggest problem with Novo right now, and every small resource company in Western Australia, is COVID. Now, it’s not the flu that’s the problem. It’s the government reaction. Australia has literally been closed for the last 18 months. Quinton hasn’t been over there for 21 months.

One of the things that Quinton wanted to do a lot of years ago, and Novo should have been in production five or six years ago when I wrote about it. It’s in the book. They had an opportunity to pick up the Jundee Mine and they would be a near $2 billion company right now if that deal had actually gone through, but it didn’t.

The iron ore companies are throwing money at people and because Australia’s been totally locked down, nobody can go into the country, including Australians. The labor problem is absolutely enormous. It’s gotten so bad that even the people working for the government departments are quitting and they’re going to work for the iron ore companies.

Well the iron ore price, I think, shot up to $188 or something like that and it’s below $100 now. The reaction to COVID has caused total chaos in the world. Three weeks ago, the price of natural gas in Italy went up 30% in one day. It’s up threefold in Europe in the last year. There are shortages of food, there are shortages of truck drivers, there are shortages of energy, and Novo has gotten absolutely whacked by this.

They lost their grade control guy, who was a good guy and doing a professional job. And they were right on track up until July. He quits, goes and gets a job at 50% higher pay with the iron ore companies. They had to bring in a couple of brand new, young geologists, who unfortunately didn’t have the background or the skill or the training to be able to do grade control, so they lost control of what they were feeding to the mill and they went from producing eight or 9,000 ounces a month to 4,000 ounces a month.

Now, again, it’s a startup. This is when you’re supposed to screw up. And if you’re a young geologist and they throw you in the shit, you have to get your act together PDQ, and they will. I’m absolutely confident of it, but one of the things that everybody needs to remember is that there’s a relationship between banded iron formations and gold.

And if you have the largest banded iron formation in the world, which the Pilbara does, you’re also going to have the largest gold operation in the world, which the Pilbara does. So yes, they haven’t moved nearly as fast as I would love to see them, but it’s not a function of bad management. It’s a function of bad government.

NVO.TO (Daily)

Goldfinger: So Novo is definitely a tax loss opportunity candidate here in the next few weeks. I’m going to ask you a tough question. If you had to just choose three tax loss, silly season stocks to buy in the next month, what would they be?

Bob Moriarty: Irving (CSE:IRV) , same situation with them. 100% of the problem is the government’s reaction to COVID. Novo Resources, which is the cheapest they have ever been in real terms, and Labrador Gold (TSX-V:LAB), which is another New Found Gold, but it’s six months behind New Found Gold.

Goldfinger: Okay, and speaking of New Found Gold (TSX-V:NFG), they announced some potentially troubling news this morning. Seems there’s some bias in how they’re sampling the core and sending it to the lab. The stock is down 20% as I speak. Do you have any comments on that?

Bob Moriarty: That’s a really interesting situation and it goes back to my comments about Tesla, Bitcoin, the S&P. The market is so irrational on both ends of the teeter totter. Here’s what happens. You understand the problem of nuggety gold, okay? You’ve got a diamond core drill and you drill 50 meters and you got a lot of VG, and you can see the VG. You got to split the core and how do you do it so that you get an actual, accurate, representative sample from both sides of the core?

And the answer is, you can’t. Measuring nuggety gold is always, always, always, always a problem, and literally their QP looked at it and said, “Hey, look, I mean, we’ve got all these extraordinary results. However, are we getting accurate measurements?” So what they’ve come up with is this process of the Chrysos PhotonAssay where they do a 100% assay, literally assay the whole thing. This is a tempest in a teaspoon. When you have thousands of samples, any error tends to be rounded out. New Found has the gold.

And it’s a good solution, so if you ask for four tax loss, silly season stocks, I would have to talk about New Found. New Found down to two bucks is patently absurd. New Found’s going to be a $10 Billion company.

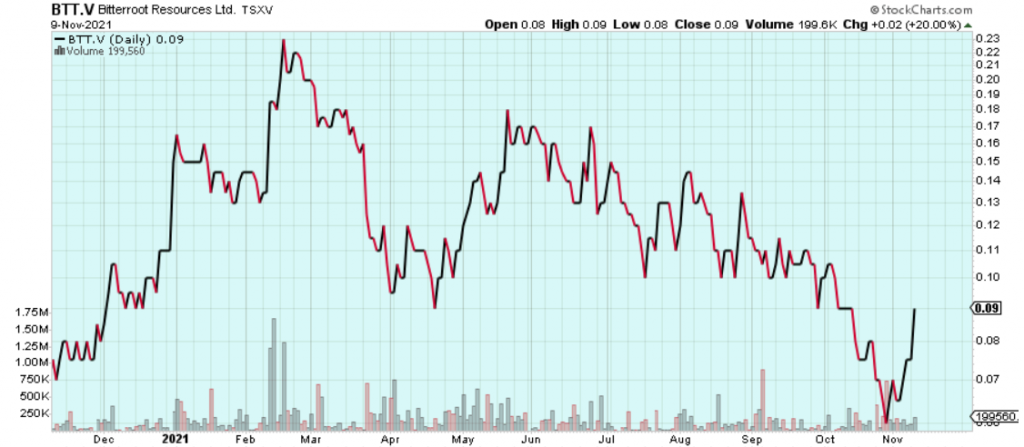

Goldfinger: Speaking of electric vehicles, battery metals, and tax loss silly season opportunities. We have spoken about Bitterroot Resources (TSX-V:BTT, OTC: BITTF) before and the share price recently dipped to a new 52-week low. Bitterroot is exploring for copper/nickel conduit-hosted massive sulfides in Michigan’s Upper Peninsula and they have had some nice sniffs of high-grade copper/nickel sulfides. They are on a break from drilling until after the Holidays but I think this could be a good one to pick up on any tax loss related weakness. (Update: Interview With Bitterroot Resources CEO Michael Carr).

Bob Moriarty: Bitterroot is a great story and you got in at the bottom, good move. I own a bunch.

BTT.V (Daily)

Goldfinger: Thank you, I think you also bought Bitterroot at a pretty good price. So going back to the vaccines and COVID, there’s a large segment of the population, I mean, really it’s one out of three people in the US at least, that don’t want to be vaccinated, that aren’t vaccinated. And their lives are made much more difficult in many ways by these vaccine mandates, either by governments or corporations that they work for, and that’s creating … I mean, we’ve seen it in the airline industry.

It’s creating major labor shortages, causing flights to be canceled. It seems to me and we discussed it before, making people inject something into their body is not constitutional. It shouldn’t be mandated. It should be a personal choice. I think that we can both agree on that. I don’t agree with you as much about the deadliness of the vaccines.

I think the vaccines do have some side effects for certain people for sure, the same way that COVID itself can wreak havoc on a certain people subset of the population. Like you said, if you’re over 65, if you’re morbidly obese, if you have diabetes or what have you, COVID’s going to be a problem, the same way that the vaccine might be a problem for certain people. So it needs to be weighed carefully, the risks and the potential benefits, right? It shouldn’t be forced upon anyone.

Bob Moriarty: Well, what’s the potential benefit for 5- to 11-year-olds, and I’m going to tell you. Zero!

Goldfinger: No, I think that’s wrong. I think that they should not vaccinate children under 16. I think that the data is very clear. The risk of vaccination is actually greater than the risk of COVID for young people.

Bob Moriarty: Okay, let me give you another perfect analogy. There was a doctor, I think her last name is Lee and she’s done some great reports. She was a Navy surgeon. She has access to all the Navy medical information. She did a study on it. And at the time she did the study in the entire US military, 2.2 million people, there were only 20 people who had died of COVID in eighteen months. They are a very low risk category.

They did studies comparing the adverse effects from the vaccine on people the same age, and her conclusion was the vaccine would kill 50 to 60 times as many people as it would save. I have seen a lot of reports that have indicated that it kills either one or two per person, say there are five or six or seven in this case. In the military you’ve got the youngest and the healthiest group in the United States, who are at very low risk.

They’re not obese, they’re not over 70 and there’s no risk from the COVID. And her conclusion as a Navy doctor, was 50 to 60 times so many people were killed. I’m going to tell you, and I’m absolute on this and I’m absolutely correct on this. Everything you’re being told is a lie. There was a flight surgeon from Alabama who had a bunch of helicopter pilots, and she saw her pilots that she was giving physicals to, having terrible physical effects, and she was having to ground two or three people a day.

And she reported it and they said, “You got to shut up, okay? We can’t allow you to say that.” They’re lying about the numbers. They’ve been lying about this bullshit from the very beginning. This thing was supposed to kill 66 million people. Even with them faking the numbers, it’s one tenth of that, okay? The CDC came out and admitted that 94% of the people that they had written up as COVID deaths actually died from co-morbidities, and there was only six% of the people who died from COVID.

People died from the flu every fucking year. Get over it, it’s no big deal, okay? We know how to prevent it. You prevent it with Vitamin D and Vitamin C and zinc. And we know how to cure it, and you cure it with ivermectin or HCQ, and you’re not allowed to say that. If you say that if we were doing a video right now, it would be yanked from YouTube. You’re not allowed to say HCQ and ivermectin will cure it. Well, they will fucking cure it.

The British government just released death results for 24 million people in the group studied. Having the “vaccine” resulted in 1.8 times as many deaths from anything as the unvaccinated group. The CDC actually had to change the definition of “vaccine” in early September because the jab clearly does not prevent the disease or produce immunity. The new definition says the jab produced protection from a specific disease. You could probably get away with saying washing your hands, brushing your teeth and wearing clean underwear also provides “protection.” What the hell does that even mean?

Goldfinger: So final point, unless you have something you’d like to add. We had this climate change conference among these global leads where they flew in 400 private jets to this meeting so they could virtue signal about getting off of fossil fuels. And basically the main takeaway from this is that the global economy is going to be steered aggressively away from fossil fuels over the next decade.

What do you think the result of that is going to be? And it seems to me, if the supply of something like crude oil or natural gas that the world consumes in massive quantities every single day, if the supply of that is jeopardized, basic economics tells you the price of it is going to go way higher.

Bob Moriarty: I’m trying to find one of the comments from the COP26 and I can’t actually find it. Let me see which section it’s in. Oh, okay, beautiful. This was on mining.com so anybody can look it up, see if I’m a liar. Antonio Guterres came out and said, “We face a stark choice. We either stop it before it stops us. It’s time to say enough, enough of treating nature like a toilet, enough of burning and drilling and mining our way deeper. We are digging our own grave.”

Now here’s what’s totally crazy. If you believe in green energy, and hell, you’re free to believe in it if you want to, even though it’s total bullshit. If you believe in green energy, you need more graphite, you need more copper, you need more nickel, and this guy is saying “Enough of mining. We’re digging our own graves.” Those people are utterly, totally, absolutely clueless.

And they are part of the Davos crowd that Bill Gates and the Faucis and the Soros, who are quite comfortable with killing people off in order to save the trees. Well, great idea. We’ll kill a few billion people with the goddam vaccine that doesn’t work. We’re in for the damnedest change in the world economy. We’re about to go into the Dark Ages 2.0. The vaccine is far more deadly than anybody is letting on.It’s killing people left and right and it’s killed hundreds of thousands of people already.

There’s a video that I literally just played when you first called, of one of the premiers, I think for Victoria, and he was complaining that the emergency rooms and the emergency wards were totally filled up and they can’t figure out what’s causing it. People were coming in with all kinds of terrible problems. Well, what they’re coming in with is ADE, okay?

It’s a reaction to the vaccine. It is exceptionally dangerous. The guys who invented the goddamn thing had come out and begged the CDC and the NIH to stop shooting people up with the jab because it’s killing people. In Germany, 1,000 lawyers and 10,000 doctors are suing their health agency, saying “This is fucking dangerous. You have to stop.” And they’re correct.

You’re not hearing any of this in the news media. The news media lies about everything. So this brain-dead idiot at COP26 says “We got to stop mining.” Well, let me tell you, son, if you want to start heating your house with firewood, that’s what the choice is going to be. And you know of course, I can’t think of what the agency is in the United States that controls what you can’t and can sell, but you can no longer have a cast iron stove in the US. It’s illegal. You can’t walk into a department store and buy a stove.

Goldfinger: If funding is completely cut off or largely cut off to the oil and gas industry and the mining industry is attacked globally, then the price of all these raw materials, whether it’s copper, whether it’s oil, whether it’s tungsten, all these crazy, obscure metals, is going to go through the roof. Like you said, you mentioned graphite earlier in the conversation.

And graphite is not talked about much, and it’s in high demand. It’s in high demand, just like copper. The grades of copper deposits around the world continue to decline. The costs are going up.

Bob Moriarty: The price of every commodity is going to go up and we are seeing the effects of this so-called transition to green energy. We’re seeing the effects right now with the price of oil and gas and natural gas going through the roof. I mean, get used to a really bizarre economic future, because it’s going to be bad, and the idiots in charge are making it worse. I mean, regardless of how you feel politically about Trump or Biden or Kamala Harris, we’re governed by brain-dead idiots.

Goldfinger: We have seen a notable pick-up in M&A across the gold mining sector and most of the major stocks in the sector have begun to move higher in spite of the tax-loss season headwinds. One has to wonder if most of the tax loss selling has already been completed and the Thanksgiving/Christmas seasonal tailwinds will prevail over the next couple months.

Thank you for your time and insights as always Bob, it was a pleasure.

Disclosure: Author owns shares of Bitterroot Resources at the time of publishing and may choose to buy or sell at any time without notice. Author has been compensated for marketing services by Bitterroot Resources Ltd.

_______________________________________________________________________________________

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.