For most hard rock mining investors, the thought of generating cash flow is an alien concept. The focus is usually on exploring for, and then making a new discovery. Then once the discovery is made, advancing the project to the point where a much larger company is willing to acquire it for a big premium.

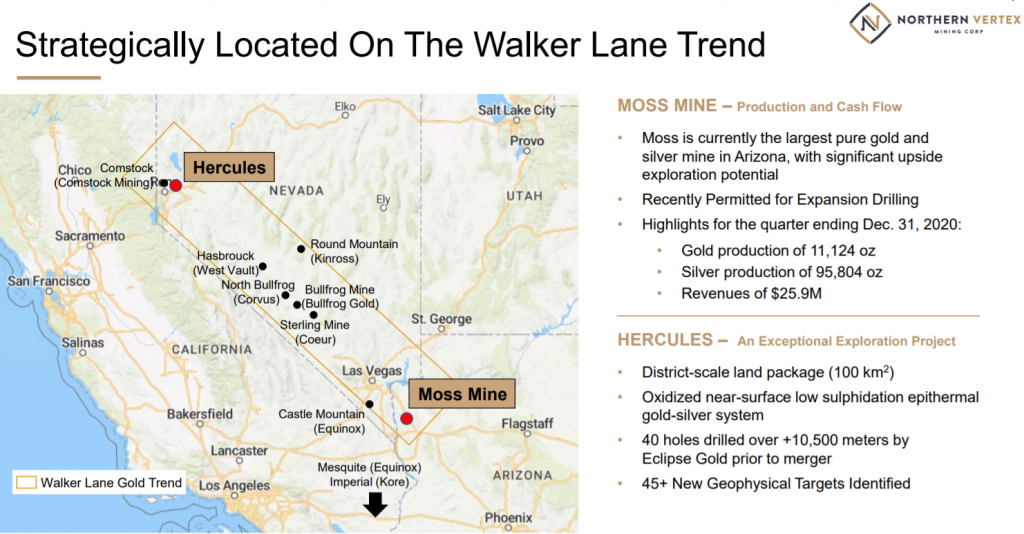

It’s a rare situation where a junior mining company has both the ability to generate significant cash flow from mining operations, while building out a long term resource growth story across a large, highly prospective property package. This is exactly the situation unfolding with Northern Vertex Mining (TSX-V:NEE, OTC: NHVCF) at its Moss Mine and Hercules Property in the Walker Lane Trend of Arizona/Nevada.

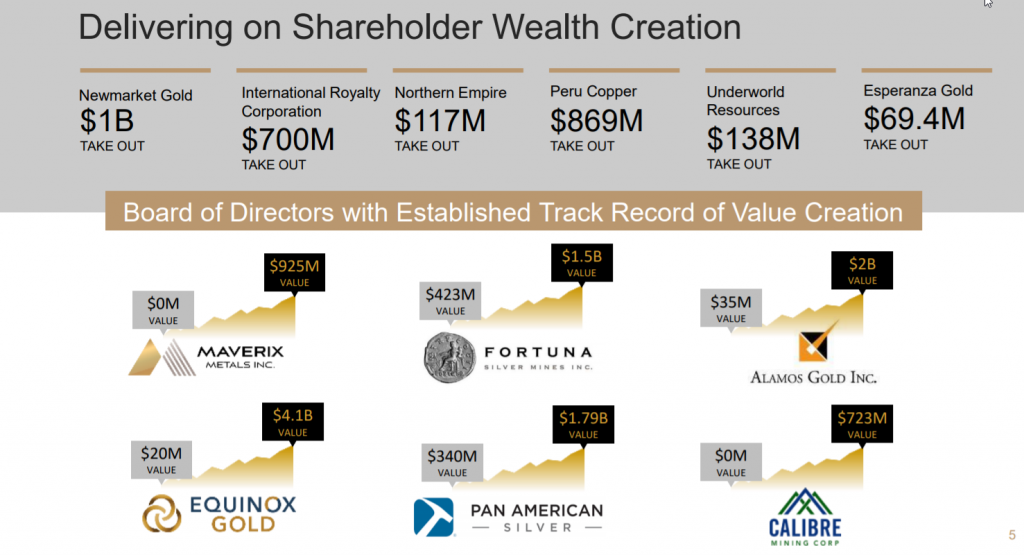

The Northern Vertex management team boasts a strong track record of creating shareholder value and decades of experience across numerous companies. With the Moss Mine, President Mike Allen, Chairman Doug Hurst, and the rest of the Northern Vertex team have the opportunity to utilize cash flow from a producing mine to fund exploration that can help grow Moss to becoming a much larger, more profitable, longer-lived mining operation.

The location of Moss is unique. Nestled in the northwestern corner of Arizona, near the Nevada/California borders, Moss is the largest producing pure gold & silver mine in the state. Arizona is a state largely known in the mining world for its copper, however, Arizona’s southern portion of the Walker Lane Trend has a rich history of precious metals production.

Moss is also unique in that it is located in an area with excellent road access and updated infrastructure. I drove from Phoenix to visit the Moss Mine (3 ½ hours), but Las Vegas is actually an even shorter drive (about 90 minutes). Moss is responsible for creating 150 jobs in an area of the Arizona/Nevada border that has higher levels of unemployment than the more densely populated areas of both states.

Moss is also unique in that it is located in an area with excellent road access and updated infrastructure. I drove from Phoenix to visit the Moss Mine (3 ½ hours), but Las Vegas is actually an even shorter drive (about 90 minutes). Moss is responsible for creating 150 jobs in an area of the Arizona/Nevada border that has higher levels of unemployment than the more densely populated areas of both states.

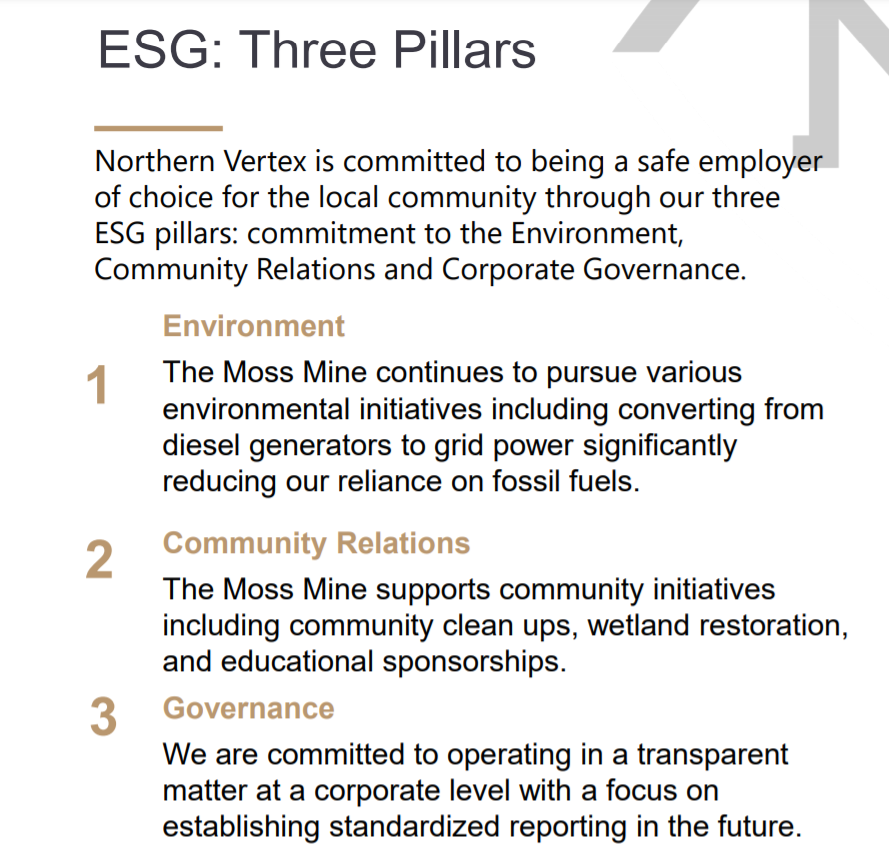

Northern Vertex takes ESG (environmental social governance) seriously and I was impressed by the minimal environmental impact that I saw when I visited Moss.

Upon arriving at Moss I was impressed by the attention to detail that mine manager Joel Murphy demonstrated when showing me around the project and introducing his team. Northern Vertex employees and management are extremely focused on safety and creating a positive atmosphere and team camaraderie and chemistry.

Murphy has been instrumental in correcting some of the early challenges that Moss encountered early in its startup in 2019, challenges that have since been overcome. Murphy was very clear to use the word “opportunity” repeatedly, each challenge, or what some would call “problems”, Murphy sees as opportunities. Opportunities to rise to the challenge and hone operations.

Among the Northern Vertex Team’s many achievements at Moss in the last couple of years has been increased mill throughput from the nameplate 5,000 tonnes per day to a mill that is currently running at 12,000+ tonnes per day.

Your author standing near the crusher at Northern Vertex’s Moss Mine in Arizona

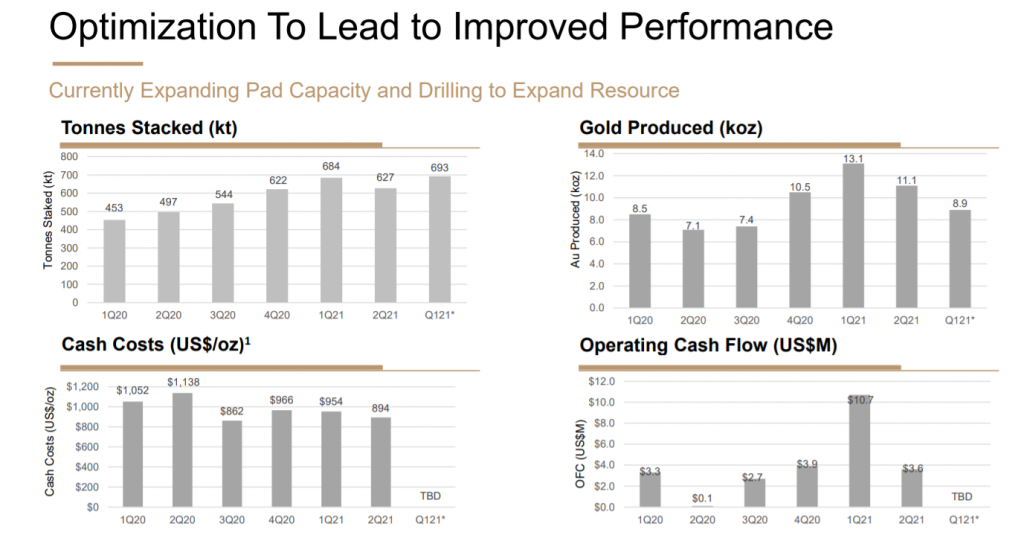

The Northern Vertex team’s results speak for themselves with gold production nearly doubling from Q2 2020 to Q1 2021, and operating cash flow jumping 3x from Q1 2020 to Q1 2021:

The Moss Mine is continuing to produce at an annual rate of roughly 40,000 gold equivalent ounces. However, the real upside for NEE shareholders from today’s current C$150 million market valuation is in expanding the resources at Moss, and then expanding the production profile to 100,000+ gold equivalent ounces per annum.

S Some of the ‘fruits’ of the Northern Vertex Team’s labor.

Some of the ‘fruits’ of the Northern Vertex Team’s labor.

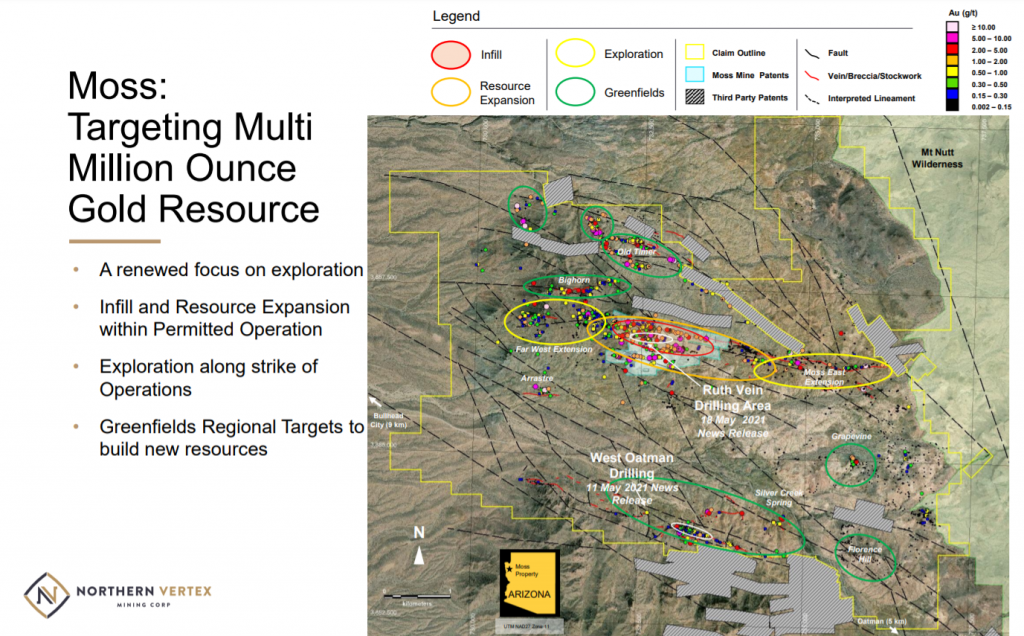

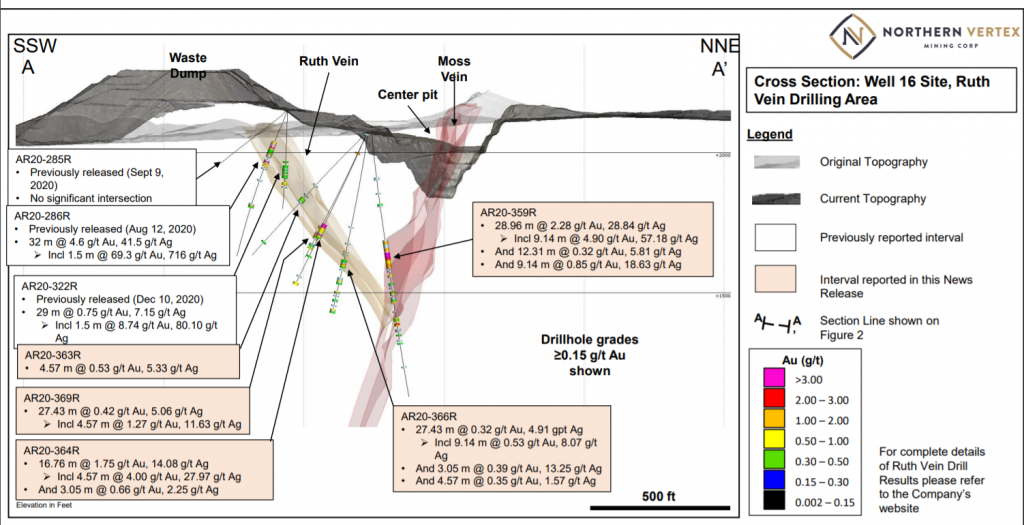

Moss has uncomplicated geology, outcropped veins at surface for over 5 kilometers. The Moss project has gold-silver stock-work, brecciated, low sulphidation, epithermal vein system with relatively consistent grade and a low strip ratio. Overall, this project has strong resource growth potential and numerous exploration targets permitted for drilling.

Resource expansion drilling has been successful in identifying higher grade mineralized zones that are not within the current resource estimate at Moss. Some of these recent drill results include:

-

Drillhole AR20-359R which returned 28.96 meters grading 2.28 g/t gold, and 28.84 g/t silver (2.66 g/t gold equivalent), including 9.15 meters grading 4.90 g/t gold and 57.18 g/t silver (5.67 g/t gold equivalent) for the Moss Vein below the Center pit

-

Drillhole AR20-364R, which returned 16.76 meters grading 1.75 g/t gold, and 14.08 g/t silver, (1.94 g/t gold equivalent), including 4.6 meters grading 4.01 g/t gold and 27.97 g/t silver (4.37 g/t gold equivalent), in the Ruth Vein to the south of and below the Center pit

Northern Vertex is in the midst of an infill and resource expansion drill program at Moss which includes one diamond core drill rig and two RC drill rigs. The company has a C$6.5 million budget for drilling at Moss which equates to roughly 30,000+ meters of drilling.

Northern Vertex is in the midst of an infill and resource expansion drill program at Moss which includes one diamond core drill rig and two RC drill rigs. The company has a C$6.5 million budget for drilling at Moss which equates to roughly 30,000+ meters of drilling.

Areas of Moss targeted for resource expansion include:

-

Infilling between Moss East Pit, Main Pit, and West Pit – the idea is that these zones all connect at depth and this theory is beginning to be proven out by recent intersections of the Ruth Vein south of the main pit.

-

West Oatman Target – The West Oatman vein system runs parallel to the Moss vein and has similar characteristics. Previous drilling has defined mineralization along approximately one kilometer of strike. Mineralization remains open along strike and at depth. Initial follow up drilling will consist of 800 meters of diamond core drilling in seven holes to test the system along strike and at depth. Previous drilling indicates that the West Oatman vein system contains gold and silver mineralization along a strike length of at least 1,000 meters, and that mineralization appears to increase in both grade and thickness with depth.

-

Regional greenfield targets including Florence Hill, Bighorn and Old Timer – Driving around the property, one thing that immediately stands out is the amount of alteration and veining in the area. Northern Vertex is just starting to assess the full potential of the Moss Property. Numerous old workings dot the area, a testament to the mining history of the area. The nearby town of Oatman was home to some of the richest underground gold mines in Arizona. With it’s recently announced drilling on the West Oatman Target, Northern Vertex is beginning to systematically explore these greenfield targets.

The 2nd half of 2021 will be marked by a steady flow of infill/exploration drilling results, and the expansion of mining operations to a third leach pad – pad 3a is set to receive crushed ore beginning in June.

View of pad 3a at Moss from above

Investors can also expect a resource update from Northern Vertex in Q4 2021. The current resource totals slightly more than 600,000 gold-equivalent ounces in all categories (360,000 ounces of gold M&I, and 4,463,000 ounces silver M&I) and I expect the resource update to increase that total to at least 1,000,000 gold-equivalent ounces. It’s also important to note that as soon as Northern Vertex publishes an updated resource it will become stale due to the rapid pace of drilling and resource expansion at Moss.

Assuming that 1,000,000 ounces is the base case scenario at Moss, the market is currently valuing Northern Vertex shares at C$150 per ounce of gold-equivalent reserves at Moss. C$150 an ounce for a fully permitted producer in the best mining jurisdiction on the planet (Nevada ranked #1 by the Fraser Institute Survey with Arizona ranked #2) is not a tall price to pay. This leaves all the exploration upside at Moss and Hercules as pure blue-sky upside from the current C$.40 share price. Northern Vertex has US$13 million in cash and remains well funded for its exploration and expansion plans in 2021.

With 382.3 million shares outstanding Northern Vertex shares offer attractive value at C$.40 (roughly a C$150 million market cap) and I view NEE as an accumulate on weakness. While NEE may not be a 10x from its current valuation, I am willing to bet on this team creating enough value for the share price to be a 2x or 3x over the next few years.

Disclosure: Author owns NEE.V shares at the time of publishing and may choose to buy or sell at any time without notice.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Northern Vertex Mining Corp. is a high-risk venture stock and not suitable for most investors. Consult Northern Vertex Mining Corp’s SEDAR profiles for important risk disclosures. EnergyandGold has been compensated for marketing & promotional services by Northern Vertex Mining Corp so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.