We are living in an unprecedented market environment in which market participants are embracing high levels of risk, and seemingly believing there is relatively little downside risk. Tesla is on its way to a US$1 trillion market cap, Bitcoin recently traded as high as $42,000, and every day there are $2-$3 billion worth of new SPACs (Special Purpose Acquisition Companies) created. The natural resources sector has received some benefit from this new wave of risk taking and market speculation, however, the precious metals sector is suddenly the most boring and least loved sector of the stock market. In Energy & Gold’s January 2021 conversation with 321gold founder Bob Moriarty we delved into the market where “risk no longer exists” as well as a couple of Bob’s favorite junior miners including Novo Resources and Nevada Copper.

Goldfinger: A lot has happened since we last spoke about a month ago. I want to start with the market. We’ve been seeing some really extraordinary things in the market, whether it be Bitcoin, or Tesla making a 700-plus billion dollar market cap, or all of these SPACs, these special purpose acquisition companies that people just give money to, go public with no particular business. But then they acquire things, they acquire assets or they acquire a business into the public shell.

It’s a very interesting market environment, and also in the junior mining sector we’re seeing all these bought deals. I don’t know if you saw last night, but Orezone is raising almost US$200 million in a bought deal. We have Great Bear with a C$70 million dollar bought deal that was up-sized from C$39 million. What do you make of the market environment that exists today?

Bob Moriarty: I think it’s the first stage of hyperinflation. People are literally throwing money at anything to see if it sticks. Now, as far as Bitcon is concerned and Tesla and the general stock market, it’s an accident just waiting to happen. I am astonished that people are still suggesting investments in Bitcon, and I’ll tell you why. Were you aware that one half of one percent of Bitcoin investors control 83% of the Bitcoin?

Goldfinger: I wasn’t aware of that exact number, no.

Bob Moriarty: Well, I didn’t come up with it. The article is still on Kitco, and I believe that’s true. Guys have tried to beat me to death for years because I don’t find the price of gold and silver being manipulated as being significant for two reasons. First of all, if you look at a chart of gold and silver and compared it to anything else, it would be virtually identical. Why people get themselves in such a tissy over manipulation is beyond me.

But, second of all, and it’s more important, if you do believe gold and silver are manipulated, why the hell would you invest in it in the first place? Is manipulation a signal to buy, or is it a signal to sell? And I don’t think you can make money on it based on a belief in manipulation, and if you can’t make money on it, it’s just noise. And I know that you support Bitcon and all the 4,407 variations, but that money is all going to disappear. It’s going to go to zero. Bitcon is going to fly off to crypto heaven. Governments are making it crystal clear they’re not going to allow digital currencies, private digital currencies to compete with their digital shit coin.

Goldfinger: Well, let’s be clear. I wouldn’t say I support the crypto currencies, but I trade them just like I would trade anything else, just like I would trade Great Bear or Novo Resources. To me it’s just a trade, it’s not a religion. I don’t support them. I have way more money invested in gold and silver than I do in any of those cryptos.

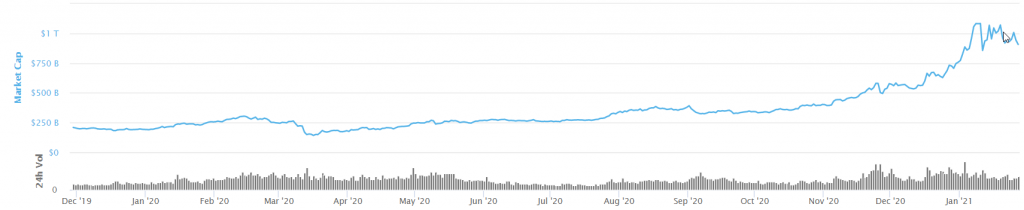

It’s interesting because it seems to me, and you could tell me if I’m wrong, that Bitcoin is, perhaps, one of the first times, or the first time in history that retail investors, small speculators bought at very low prices very early on, and bigger institutional investors and hedge funds are buying much later and at much, much higher prices. Is this the first time in history that we’ve seen a market of this size (total crypto market cap recently reached the US$1 trillion mark) where the small retail investors got in low and early and the institutions buy high and late?

Bob Moriarty: Well, I’m not sure that’s significant. That’s absolutely true in the junior gold market, and it always has been true. Individual investors have an absolute advantage over big corporations. But I just read, I think, today that Blackrock had set up three funds to invest in Bitcon variations. And if that isn’t the mark of a top, I don’t know what is. Now, I’ll be absolutely candid, I don’t think it’s something you can predict to the day, but guys investing in Bitcon and Tesla right now are just waiting to get creamed. The same thing is true of the general stock market. The stock market is an accident waiting to happen.

Total Cryptocurrency Market Capitalization

Goldfinger: I don’t know if you read the article I wrote yesterday, “When Risk No Longer Exists”

Bob Moriarty: I did. It was a brilliant article, and it was absolutely timed perfectly. Now, here’s the issue that every investor needs to think about. Does risk ever disappear?

Goldfinger: No. Never.

Bob Moriarty: It actually expands. So when it appears to be decreasing, it’s actually increasing. The idea of a market without risk is absurd, it absolutely can’t happen.

Goldfinger: If there’s no risk, then you’re basically saying that prices can never go down. And that, basically, means that nobody will want to sell. And the supply of money will always be going up. So, in some sense, that’s sort of what the Fed has done in the last year. They’ve increased the supply of money, which has caused asset prices to go up. But is this going to go on forever? And the answer is no, because at some point if the Fed continues to do this, it will have all sorts of unintended consequences.

You say hyperinflation, well, certainly we’re going to get very high inflation. I don’t know if it will be hyperinflation. The Fed can always raise interest rates to pull back monetary policy. It’s very interesting because the market participants have the tendency to extrapolate the recent past well into the future and to make of thinking it’s going to go on forever, and that’s never correct. The market has a tendency to change character when the herd least expects it to. The recent history in the market may continue for a week. It may continue for a month. It may even go on for a year, but the market always changes. There are always market cycles. There are always economic cycles. And the best investors are cognizant of the cycles and where we are in them.

Bob Moriarty: Well, I’m not necessarily in agreement with that. I think the very best investors are all aware of contrarian investing. I’d argue that you don’t actually have to know anything about Bitcon or Tesla or Black Rock or gold or silver or anything else. All you have to do is understand human psychology. And when the mob falls all over itself, which is, essentially, what you’ve said, is the mob is convinced there’s no risk, that is when things are the most dangerous. And if you understand contrarian investing, and I think everybody that I know who is a successful investor is a contrarian.

Goldfinger: A contrarian to a point, but don’t you agree that the bull market, for example, the bull market that we saw in gold last year when we went from $1450 to $2050, that sometimes you’ve got to run with the herd?

Bob Moriarty: Well, yeah. I was, absolutely. I was saying it’s a good deal. I was buying the crap out of silver at $12. And if you’ll remember, we did an interview, and I think it was in August. And I said we were going to have a correction because that’s a perfectly normal thing to do. And I took umbrage at you telling me I was too early. I don’t give a shit about being too early. I want to be too early. Better too early than a day too late.

But, clearly, we were set up for something that was going to be a correction. And, actually, a correction seems to have gone on longer than I believed. We’re in the most irrational market in the stock market and Bitcon and Tesla and in gold and silver. I think gold and silver have more correcting to do. And do I understand the cycle? No, I don’t, and I don’t pretend to. I just know that people are way too optimistic, and I would fault the Fed.

Somebody wrote a piece today that said, “If you think that the deficit in 2020 was bad, wait until you see the deficit for 2021.” I think Biden and his cronies are totally insane, and I think they’re going to blow everything up. And here’s what’s funny, and I know you think it was an honest election, and I absolutely don’t agree with that. But I’ll tell what really happened, Biden and Harris hijacked the Titanic.

Goldfinger: Well, that’s another topic. But I believe that the economy has a lot of challenges. And the deficit is going to be very, very big. But you know what? Trump was the biggest deficit president in history.

Bob Moriarty: Give Biden six months.

Goldfinger: Politicians, it doesn’t matter who they are, love deficit spending.

Bob Moriarty: Well, here’s what’s interesting, and I think we can agree on one thing, it doesn’t make a rat’s ass who was inaugurated on the 20th, spending is out of control. And it’s going to get far worse regardless of whoever the president is in this cycle, it’s really screwed. I remember in the ’60s there was some kind of academic competition in the Soviet Union. The first prize was one week in Moscow, and the second prize was two weeks in Moscow.

Goldfinger: So, that’s not much of a prize.

Bob Moriarty: Well, Biden and Harris have bit off something sour. I feel sorry for whoever is the captain of this ship because the ship is sinking, and it’s sinking fast. And with some of the numbers that they’re hurling around, we’re going to see unintended consequences like we never even dreamed of before.

Goldfinger: So, I just want to go back to something that you said because you sounded a little cautious or bearish, actually, about gold and silver there. But the last time we spoke, I’m just pulling up the article, which was almost a month ago. And you said, “We’ve seen the bottom for gold and silver. And junior miners will be up substantially a month or two from now.” So are you changing your mind on that?

Bob Moriarty: I changed my mind three weeks ago. I looked at the DSI and I looked at the action of gold and silver and I said, “Wait a minute, people are getting way too bullish too soon.” Gold didn’t get particularly high. It got to 69, but silver got to 90, and that’s absolutely a mark. That’s not going to be a bottom. That’s not going to be, “Hey, things are going to get interesting.” That’s a danger signal. And strange enough, the general stock market indexes are approaching nosebleed levels now. So, yeah, I absolutely changed my mind, and that was probably three weeks ago. And I’ve written about it several times and made it clear that I thought gold and silver were going to continue correcting.

Goldfinger: So, if we’re not at a bottom, and the juniors are not going to be up… I think it can be confusing for a lot of people because we, as market participants, sometimes have to change our mind because there’s new information coming in constantly. But if you’re an investor in natural resource stocks, long-term investor, and you say, “Well, now we’re not at a bottom in gold and silver. We might go lower,” so what does that mean for an investor in junior mining companies like Lion One or Novo Resources or Great Bear etc.? Does that mean you should sell your stocks now?

Bob Moriarty: No. What it means is it’s an opportunity to clean out the trash and throw it away. What I do, I’ll be candid, I’ve got some pretty good-sized positions. And I can’t go sell everything I’ve got in Lion One or Novo or Irving without moving the market.

So, rather than putting an order in to sell at the market, I will clean out some of the clutter and put it into the stocks that I like better. Now, I think there’s a lot of great stocks out there, and I think there’s a lot of opportunities. But if you own something that hasn’t moved in the last year or two, it’s a great opportunity to get rid of it and put it in something that’s better.

Now, long-term, actually, even medium-term to long-term, what the Fed is doing to the dollar is extremely positive for gold. But when everybody is writing about how high gold is going to go and how high silver is going to go and how it’s guaranteed to go higher, you’re going to have a correction. I saw that. I changed my mind. I said that I changed my mind. And I think we’re going to continue down. But that does not mean sell everything. It means it’s a good opportunity to clean up what you’ve got. There are always opportunities.

Goldfinger: There are always opportunities. And even in a market that’s going sideways, or maybe even lower overall, there’s still bull market stocks. There’s still stocks that have good exploration stories and they are making good progress on their projects. And one of the things that we’ve seen, actually, in 2021 in just the three weeks or so we’ve had so far this year is battery metals. We’ve seen graphite stocks and lithium stocks and all these battery metal companies actually doing very, very well. And it seems that the future is actually very bright for base metals.

When you think about the fact that there’s been a significant lack of investment in copper and nickel projects over the last decade, kind of since 2012 everything kind of went dormant. The world is under supplied for what’s coming with all these electric vehicles and the electrification of the power grid. Are there any base metal companies that you like out there right now? What are your thoughts overall on this battery metals bull market that we’re seeing take shape?

Bob Moriarty: I’m not sure I would call it a battery metals market. That implies that that is the prime mover. But you actually already nailed the prime mover. The base metals have been ignored for years. They’ve gotten creamed. Copper was down big-time, lead, zinc, everything was down, which is perfectly normal.

And it got so bad that anybody that’s been invested in the base metals for the last six months has done really well. And I would be a little hesitant right now to say they’re a good place to go into, quite bluntly, because I don’t have anything that I’m a real fan of. I’m pretty much 80% a gold and silver guy, but, my god, copper has gone up a lot more than gold has.

Goldfinger: And, actually, there’s very few really high-quality copper projects out there around the world, especially ones that are ready to come online in the near future. The copper price might end up going even higher.

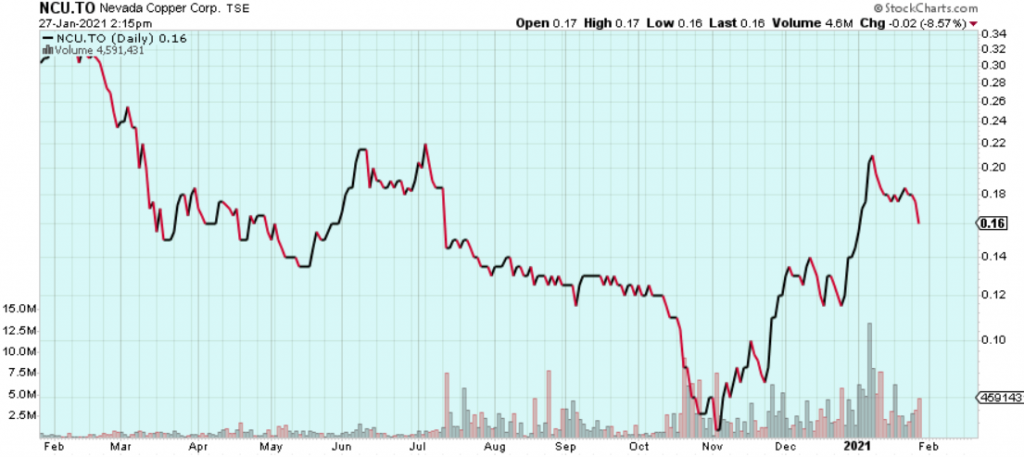

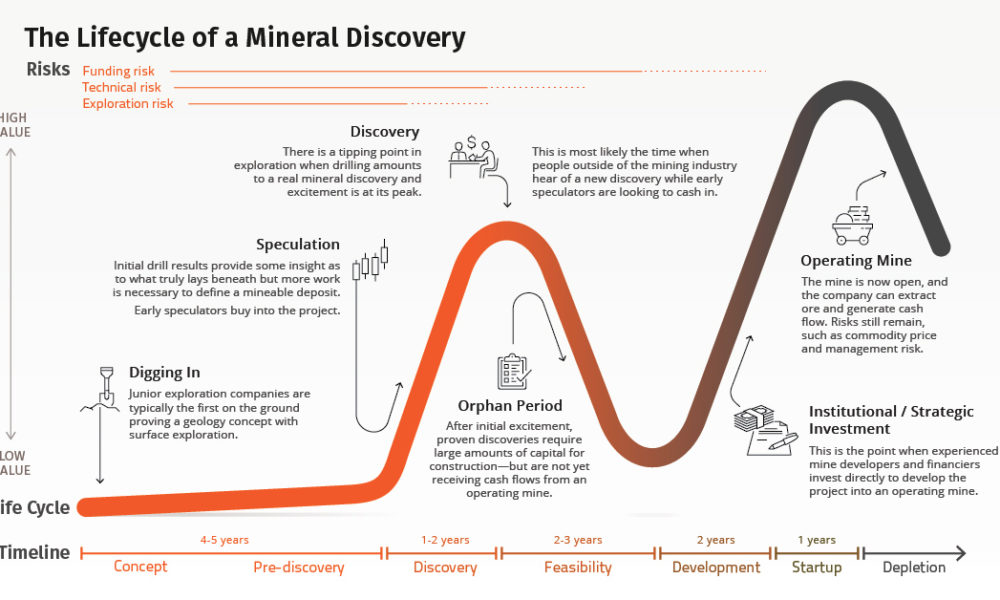

Bob Moriarty: You just raised a good point. Nevada Copper (TSX:NCU) has had an interesting situation, and they’ve been whipsawed three or four times by the price of copper, but they are in production now. They’ve got the issues sorted out, and the stock is cheap. I like that a lot. It’s not a exploration play. It’s a production play, and they just went into production. On the Lassonde curve, that’s where you make all your money.

NCU.TO (Daily)

Goldfinger: One of the brokerage firms I follow put Nevada Copper as one of their top picks for 2021. It’s naturally kind of speculative because it’s early. It’s not like they’ve been operating that mine for many years. So there’s usually some operational challenges at the start. But if they have ironed it out, you’re in a great jurisdiction with a metal that is very much needed. So, the chart also looks like it bottomed. It definitely bottomed a couple of months ago, so that’s definitely one to keep your eye on in 2021, and it’s in Nevada, so that’s a definitely favorable jurisdiction.

So, turning to the junior mining sector and some specific companies, I know that Novo Resources (TSX:NVO, OTC: NSRPF) is ramping things up. And this is going to be a big year for Novo Resources as they move into production at Beaton’s Creek. Can you update us on Novo?

Bob Moriarty: They will be in production pouring gold probably in three to four weeks. I have written a book. It’s finished. I’m going to release it when they do their first pour, and I have made it crystal to Rob Humphryson and to Quinton, if there is any change in time, I want to know. I want to be the second guy to know. But I believe February 15th they’re going to be pouring gold. Now, we should talk about the Lassonde curve for a minute. Do you know what I’m talking about?

Goldfinger: Absolutely. Very important.

Source: Visual Capitalist

Bob Moriarty: As a company goes into production, that’s the sweet spot for investing. Nevada Copper would be a perfect story. They got as low as $.06 in September/October last year. They’re $.18 now. But they’re down 80% from where they were in 2016. And at $3.60 a pound copper they will make a lot of money.

But same thing with Novo, all the naysayers have been pissing on Novo’s parade for years, but they’re going into production. I believe there will be somewhere between 125,000 and 150,000 ounces of gold production per year. I think the cost is going to be around $800 to $900 an ounce, all in sustaining capital. And that’s going to fund everything else they do. They should never have to do another financing. So I think Novo is going to be a hit. There are a lot of juniors that have corrected severely in the last month that I think will offer 200%-500% return potential. So, it’s a time to invest to move into the good quality juniors.

Goldfinger: So that’s big news for Novo, and I agree. So, when you publish that book and they do the first gold pour, that’s going to be a big catalyst. They are in the sweet spot in the mining cycle, at least with Beaton’s Creek. One of the things we haven’t heard much about is the nuggety gold projects near Karratha, the Purdy’s Reward and Comet Well Projects. Those projects really captured the market’s attention in 2017 and 2018, but we haven’t really heard much about those lately. What’s the status of those projects? Are they just sort of on hold because they’re focusing on these other projects, or what’s going on there?

Bob Moriarty: Well, the most important project, by far, is Beaton’s Creek and the mill at Nullagine. In the book I write about stuff that most investors aren’t aware of. Quinton Hennigh has been waiting for Millennium to go bankrupt for, literally, five or six years. And there was no question in his mind that it was going to happen. And if you looked at the numbers, there was no question whatsoever it was going to happen. The plan has always been to get a product asset and to fund everything else with the cashflow from production.

Now, Quinton, I believe, has the nuggety gold issue sorted, and that is literally through the use of mechanical sorting machines. I think that’s going to make a big change to the industry. There’s some other technical issues, and I still don’t know what the solution is going to be.

I don’t know how you’re going to be able to get a resource on the conglomerate when it’s under a basalt cover because you can’t drill it. You could find out the conglomerates there, and you can know gold is there, and that’s going to be an important issue. But there are hundreds of linear kilometers of conglomerate at surface. And the sorting machines are going to really lower the cost of production. You will crush the material. You’ll blast it and crush it and run it through a sorting machine. And then take the gold, literally, to Nullagine and run it through the mill there.

Goldfinger: So this brings me to another topic. A lot of people who don’t really have experience in the nuts and bolts of mining exploration and making a new discovery, don’t understand how hard this business actually is. Sometimes you’re drilling, you lose the drill in unstable or fractured rocks, or it’s harder to drill because you don’t have water or you don’t have enough water. You’ve still got to pay your crew, even if you drill a shitty hole or you lose the hole, or what have you. Can you just give us some of your experience in exploration and the challenges involved? When things go according to plan and smoothly it’s actually the exception?

Bob Moriarty: Actually, not. When things go smoothly and everything is working, it means you’re doing a great job of lying. The interesting thing about the book is that I got to participate, literally, from the theory stage all the way to production. I was an intimate partner in the process, and, obviously, I know a lot more about what really went on than most outsiders. I know more about Novo than anybody outside the company, period. And I have never read a book that talked about the entire sequence. And I’m just going to tell you, if you think there’s problems in exploration and getting into production, it’s 10 times worse than you think it is.

You get your employees trying to screw you. You get other companies trying to screw you. You get the financial people trying to screw you. You get the regulators trying to screw you. You get the guy that’s running the country trying to screw you. And then the commodity price goes down, and you’re screwed again. It is so difficult. It’s one of the most difficult areas of endeavor I’ve ever seen. You literally can’t plan six months in advance.

One of the things then you and I should talk about right now is what’s happening with assays. And the strange thing is somebody pointed out to me, it wasn’t really that the assay labs were backed up. What happened was the government was paying people more to not work than to work, and the low paid people at the assay labs just quit. And they’re back at home watching a ball game, drinking a beer or eating popcorn. The assay problem is going to continue as long as the government keeps throwing money at people to not work, and that’s a really serious issue. There are guys who have been waiting for assays for six or eight months. And how the hell do you move your project forward without any data?

Goldfinger: So the reason why I bring this up is because I notice on the chat forums, and I know you go on them sometimes, it’s very easy for people to throw stones when they actually don’t really have much knowledge or experience and say, “Well, why are these guys screwing this up? Why did they lose that hole, or why are we paying for holes that didn’t hit any gold.”

But the reality is, first of all, you’ve got to pay your crew because that’s their job. Their clocking into work, they’re paid by the hour or paid by the day. And if they work, they’ve got to get paid, so that’s first of all. No drill crew is going to say, “Well, only pay us if we hit gold with the drill.” Nobody is going to sign up for that job. That’s number one.

Number two, the reality of working in this business in the last year during COVID is that it’s hard to find labor. It’s hard to find good labor. It’s hard to keep the labor. A lot of companies that I talk to, a lot of their crew walk off the job or don’t show up for the next day, for whatever reason. A lot of it is, as you mentioned, because the incentive isn’t there. They’re given money just to stay home by the government, so it’s challenging. And also, with the quarantining and the COVID testing and all of the red tape that exist out there right now, it just makes things that much harder.

So, not to make excuses, but to talk about the reality of the situation right now. It’s not easy to get things done and delays have become the norm. It’s not an easy business. It’s not easy to make a new discovery, and it’s not easy to cut costs and find/keep good labor.

Bob Moriarty: That is absolutely correct, and that is absolutely the point of my book. And a lot of people will enjoy reading it, not just because it’s about Novo, but because it’s about the industry in general. There are so many shenanigans that go on behind the scenes that if investors knew about them, they would never touch the market with a 10 foot pole.

Goldfinger: And I think that there’s a couple of things that we can sort of take away from this conversation. The first one that comes to mind is margin of safety. So, you say it in a different way. You basically say, “Buy when nobody likes it, and it’s really beaten down, and the stock is down 90%.” But that could also be a margin of safety. When you’re buying something really cheap, when the expectations are really low, in a way, that builds in a margin of safety because the market is not expecting any good news. So if good news comes, it rips higher and that’s great. And if bad news comes, well, it’s already priced-in, to some extent. You get a margin of safety.

So I think it’s an important rule that when we are investing, especially in the junior mining sector, where things can often go not according to plan, you need a margin of safety. And you also need to realize that it’s like we expect timelines to be stretched out, whether it’s with assays or permits or building a mill or whatever. When they say a year, you can probably expect two years. And if it happens in two years, it’s actually pretty good.

Bob Moriarty: That’s an extremely valid point. Everything costs more and takes longer.

Goldfinger: And so, if we set ourselves up with realistic expectations, we’re probably going to be better investors. And we’re probably not going to be disappointed as much. And it’s just a matter of being realistic. And I said in my email this morning, every time as a trader or an investor where I think I couldn’t do anything wrong, that was actually the time where there’s the greatest risk of a big setback. And I think just the sort of thing holds true for junior mining companies and some of these projects. It’s just a probability game. Eventually, something is going to go wrong. It’s going to take longer than expected. It’s going to cost more than planned, et cetera, et cetera.

Bob Moriarty: That’s a very good point. There are 10 things that can happen with a junior mining company, and eight of them are negative.

Goldfinger: There you go. Absolutely. So, what would you say the big takeaway is right now? If you could end this conversation with some parting thoughts about the market landscape right now.

Bob Moriarty: The most dangerous market I have ever seen.

Goldfinger: And if it’s the most dangerous market you’ve ever seen, what should somebody do to avoid some of the dangers?

Bob Moriarty: They should buy the safest things that they can buy. The long-term fate of the dollar is absolutely fixed in concrete. It doesn’t make any difference what happens in the economy. We’re doing things that are catastrophic for the dollar. And, quite bluntly, we’re doing things that are catastrophic for society.

Let’s talk politics for just a minute (laughs). Biden and the Democrats have made it clear that they’re going to go into a feeding frenzy and attack anyone who supported Trump. When you have Twitter and Facebook and Google actually censoring the President of the United States because they disagree with him politically, you can never go back from there. You have just blown your society apart. Private companies cannot have that much power in a functional society.

And I’m just absolutely shocked by the hypocrisy of the Democrats and the mainstream media talking about the insurrection on January 6th when Pelosi advocated for violence last year from BLM and antifa, AOC advocated violence from antifa and BLM. Chris Cuomo said, “Who said that protests have to be peaceful?” Well, if you go back to 1870 and listen to Lord Acton, he said, “Power corrupts. And absolute power corrupts absolutely.”

Now, I believe along with 90 million Americans that the Democrats stole the election. And that would include all 75 million Americans who voted for Trump and 15 million Democrats who agree with the evidence that’s right in front of them. But when Twitter and Facebook and Google and YouTube censor every other point of view, they have just destroyed the country. They have to broken up into little tiny pieces if the country is to survive.

Goldfinger: So the freedom of speech is not free. And I think that we’ve learned that. Very interesting times, and I’ll say that I think without Trump being at center stage the world will be a lot less interesting. But, I think I am happy to not have a President of Twitter anymore. And I am cautiously optimistic for the future of this country.

I’m not as pessimistic and as dire as you, I think, are. But I do realize we have some serious problems and some challenges that we face, including freedom of speech. And what does that look like in the world that exists today, where we have all this social media and people are easily influenced by people that have a big bullhorn, a big following, and people are easily influenced.

Bob Moriarty: Let me give you an example of something that’s so dangerous I can’t believe most people have skipped it. Now will you agree that the Russian collusion in 2016 was between the DNC, Hillary Clinton and Steele?

Goldfinger: I don’t know.

Bob Moriarty: Well, the FBI knew because Steele went to the FBI and Steele told the FBI that the whole Russian collusion bullshit was to cover up for Hillary Clinton’s email scandal. Now, that’s not my opinion. That’s a fact. There is sworn testimony to it. But the point that I’m trying to make, whether you believe it or not, is Pelosi and Clinton literally two days ago said, “We need a 911 commission to look into Trump and Putin’s involvement in the insurrection on January 6th.”

And I just went, “You’ve got to be shitting me.” She got away with that bullshit for four and a half years, and Pelosi and Clinton are back playing that one-string banjo, “Putin did it.” I’m going, “My, god. How could anybody say that in the first place and expect Americans to be so stupid they would believe it?” And, unfortunately, I think they’re probably right, a lot of people will believe it, “Oh, yeah, Putin did it.” Now, I can prove categorically that the Russians had nothing to do with the so-called insurrection on January 6th. You know how?

Goldfinger: No.

Bob Moriarty: Popcorn sales in Russia are up 300%.

Goldfinger: Would you agree that Russia, led by Mr. Putin, who has had many people he didn’t like executed, has had people executed in various places around the world because he didn’t like them or what they were saying, would you say that he is an evil person? Bob?

Bob Moriarty: Would I say he is an evil person?

Goldfinger: Would you say that Putin is an evil person?

Bob Moriarty: No, not particularly. The U.S. has probably killed 10 or 20 times that many people.

Goldfinger: Now, you see? That’s a false argument. I’m asking about him. I’m not asking about anyone else. I’m asking if Vladimir Putin is an evil person?

Bob Moriarty: Trump ordered more drone strikes than Obama did. Trump, the guy who was going to end all these wars. Now, do I think that the leadership of the United States, literally for the last 20 years, is evil and murderous? And the answer would be yes. And you’re saying that Putin is going out and whacking his enemies. And I’m going to say, “Well, that doesn’t exactly surprise me.”

If you want to get into power today, and this is whether you’re Jack Dorsey or Steve Jobs or whether you’re any of the robber barons, you have to be a sociopath. Seth Rich was murdered, and he was murdered because he turned the emails of the DNC over to Wikipedia. And, in fact, Julian Assange, the United States is trying to murder him. Now, I was in a war. I’m against war. I’m against murder. So is Putin evil? Yeah, but so is Trump, so is Obama, and there’s a good chance that Biden and Harris will be too.

Goldfinger: All right. I think that’s a good place to end it. Thanks for your time and insights as always Bob. We live in interesting times and from a market standpoint 2021 is shaping up to be at least as entertaining and volatile as 2020 was.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. The companies mentioned in this article are high-risk venture stocks and not suitable for most investors. Consult company’s SEDAR profiles for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.