Would you like to see a tight share structure?

Check out GSP Resource Corp (TSX-V:GSPR):

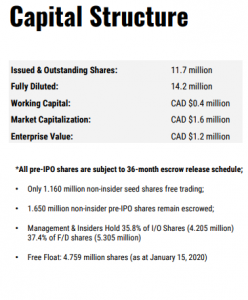

14.2 million shares fully diluted with management and insiders holding more than 35% of the fully diluted share count.

14.2 million shares fully diluted with management and insiders holding more than 35% of the fully diluted share count.

You’ve got a free trading float of less than 5 million shares in GSPR, and a fully-diluted share count of less than 15 million shares. This is the tightest share structure I think I have ever seen. There are 1.4 million warrants outstanding at a $.20 exercise price that might get driven in as the company ramps up its Alwin Project near Teck’s Highland Valley copper mine in southern BC. In the event this happens GSPR would receive nearly C$300,000 in cash which would help fund summer drilling at Alwin.

Before I get too far ahead of myself let me just say that GSPR caught my attention because of its CEO Simon Dyatowski. Simon is one of the young, up and coming CEOs in the junior mining sector. He has an extensive background in the industry, including through his father and other family connections. He is wicked smart (CFA Charterholder) with both a finance and geology background. He also gets it, in terms of how to do things and create shareholder value by being careful with the treasury and avoiding excessive dilution. GSPR’s share structure is his creation, simply because he has learned from seeing other companies make mistakes and ultimately fail.

Right now GSPR has C$300,000 in the treasury and a C$2.2 million market cap. It simply doesn’t get much cheaper than this. I can think of dozens of companies who have 10x the valuation with much worse management than GSPR. The difference is that these larger market cap stories have done more promotion and been around longer. GSPR is just getting started and the company has carried out virtually zero marketing.

Today’s announcement that GSP has commenced drill permitting at its flagship Alwin Copper-Gold-Silver Project means that GSP is moving things along at a steady pace. GSP intends to begin a drill program at Alwin in May/June after spending the next few months digitizing all data regarding the Alwin Mine property and to produce a 3-dimensional model of mineralization in order to determine the best way to proceed with the property’s development (see news release dated January 30, 2020).

Alwin is an intriguing project (with historic copper grades up to 10% Cu) whose proximate location to the Highland Valley Mine (2 kilometers) makes it especially appealing. In addition, the Highland Valley open pit is expanding towards the Alwin property boundary.

I have purchased 100,000 GSPR shares on the open market in the last month, simply because I see the stock as too cheap and I like the jockey (CEO Simon Dyakowski). I am a buyer at C$.20 or below in GSPR and I see strong potential for a 2x or 3x return over the next six months as GSPR advances Alwin and updates the historic resource to 43-101 standards.

The bigger potential is for GSPR to become a 10-bagger much like we saw in Blackrock Gold (led by another young and energetic CEO, Andrew Pollard) earlier this year as BRC advanced from a $2.5 million market cap to a nearly $30 million market cap over the span of four months. The share structure is certainly there for GSPR to 10-bag, the rest is up to market conditions and management execution. This is where I like my bet on GSPR CEO Simon Dyakowski.

BRC.V (March – September 2019)

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. GSP Resource Corp Inc. is a high-risk venture stock and not suitable for most investors. Consult GSP Resource Corp Inc.’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by GSP Resource Corp Inc. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.