The uranium sector continues its long “nuclear winter” which is now approaching a decade since Fukushima (March 2011). Share prices are dribbling along the bottom or even making new lows, however, there are some green shoots emerging to which investors might want to pay attention.

First of all, US President Trump has announced a plan to create a strategic uranium reserve with a US$1.5 billion provision in the federal budget over a ten year period (US$150 million is being allocated for uranium purchases in 2021). This amount of money could develop a strategic reserve consisting of 30-40 million pounds of uranium while still leaving uranium producers to fulfill the needs of US nuclear utilities which amounts to another 50 million pounds of uranium per year. Considering how tight the global uranium supply/demand balance is currently this US strategic uranium reserve stockpile will help a market already teetering on deficit tip further and faster into deficit. Furthermore, it helps clear the air for US nuclear utilities, which account for over 25% of annual demand, to come back to the contract market after almost two years of uncertainty around the Section 232 Petition and subsequent Nuclear Fuel Working Group.

The second big news event of the last couple of weeks for the uranium sector was an admission by North America’s largest uranium producer, Cameco (NYSE:CCJ, TSX:CCO), that it will purchase more than 20 million pounds of U3O8 on the market in 2020 – this is more than double what Cameco will produce from its own uranium mines. A couple of soundbites from the Cameco earnings call caught my attention:

“…demand is on an upswing & utilities have a growing wedge of uncovered requirements, precisely at the same time that supply is on a downswing, and today’s prices are insufficient to reverse this trend. Our optimism & confidence in the uranium market transition is growing.” ~ Tim Gitzel, Cameco CEO

“We have not seen the current level of prospective business in our pipeline since before 2011.” ~ Tim Gitzel, Cameco CEO

Don’t just take Cameco’s word for it, there are growing signs that a turn could be at hand in the uranium sector. After a very challenging year in 2019, Cameco’s chart shows a clean double-bottom amid bullish money flow CMF) and relative strength (RSI) divergences:

CCJ (Daily)

After a decade long bear market many uranium explorers/developers have charts that look like coiled springs – the double-bottom in Cameco is a strong first indication that a turn is at hand. However, much of the uranium sector is still bouncing along the bottom despite the fact that Cameco shares have rallied ~20% in the last two weeks.

While the potential upside among many uranium producers/developers/explorers could be substantial (anywhere from 200% to 1000%+ depending upon the company and market cap), I believe the most important point from an investing/trading vantage point is that the risk is small relative to the potential upside. I love the prospect of risking 20% of my investment with the potential to profit anywhere from 10x to 50x the amount I’m risking – this is the exact setup I see right now across the uranium sector.

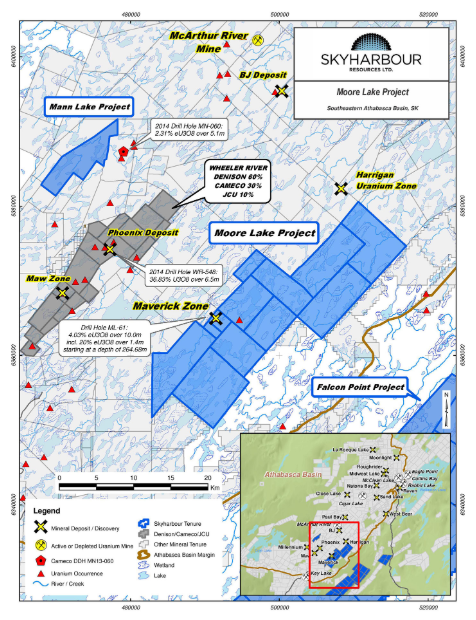

We also know that the biggest torque is likely to be offered by explorers with tiny market caps (below $20 million). While there are many potential ways to play a turn in uranium there is one uranium stock in particular that I find extremely attractive right now. This uranium exploration company and project generator checks all the boxes in terms of share structure, insider buying, quality management, and an impressive project portfolio that is on the verge of generating a ton of news flow over the next few months. Not to mention two larger strategic partners in Denison Mines and France’s Orano.

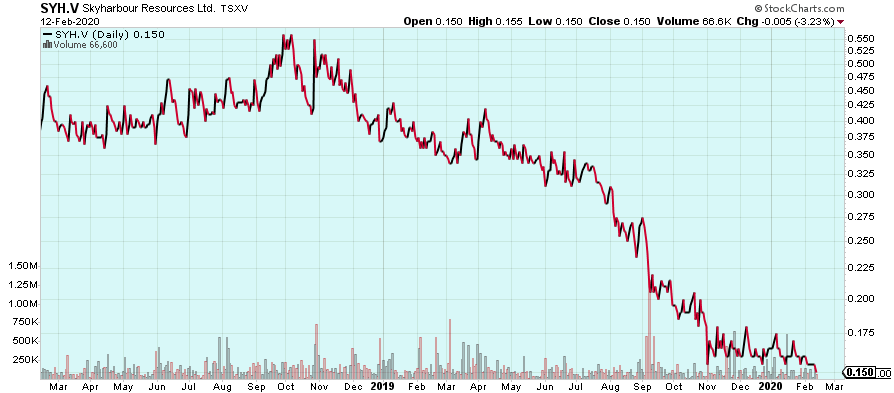

Skyharbour Resources (TSX-V:SYH) has a C$11 million market cap and SYH shares are trading near 52-week lows:

SYH.V (Daily)

2019 was a tough year for most uranium companies as the commodity price stagnated and the Section 232 decision forced a lot of event-driven funds out of the sector that had bid prices up in 2018. However, from ugly charts and big price declines come excessively bearish investor sentiment which in turn creates opportunity. Skyharbour CEO Jordan Trimble has certainly taken notice of the recent price declines in SYH shares and the opportunity presented by current share price levels:

Trimble has purchased more than 1,000,000 SYH shares since the beginning of September 2019 and he is an active buyer of shares on the open market virtually every week.

The insider buying in SYH and the extremely depressed sentiment in the sector would be enough to pique my interest on their own. However, it gets even better. Skyharbour has begun drilling its flagship Moore Uranium Project in the Athabasca Basin, and two of its option partners (Orano and Azincourt) already have field and drill programs underway at two of Skyharbour’s other projects as a part of a combined $11.5 million spend in exploration and cash payments to earn-in up to 70% on the Preston and East Preston projects. This means that there are three different ways that Skyharbour can generate transformative news flow over the next several months. Meanwhile, SYH shares are behaving like the company is standing still. This is a large disconnect and in my opinion the risk of further downside vs. the potential for significant upside in Skyharbour shares is about as attractive as i’ve ever seen.

Recently, we saw news from ISO Energy (TSX-V:ISO) that spiked ISO shares more than 30%. This spike wasn’t even based upon assay results, it was based on hand-held spectrometer readings on two drill intersections that indicated strong radioactivity. In the uranium heyday of 2007 such news might have caused a stock like ISO to double overnight, a ~30% spike is a good start – this is a good sign that the uranium sector is beginning to awaken from its doldrums.

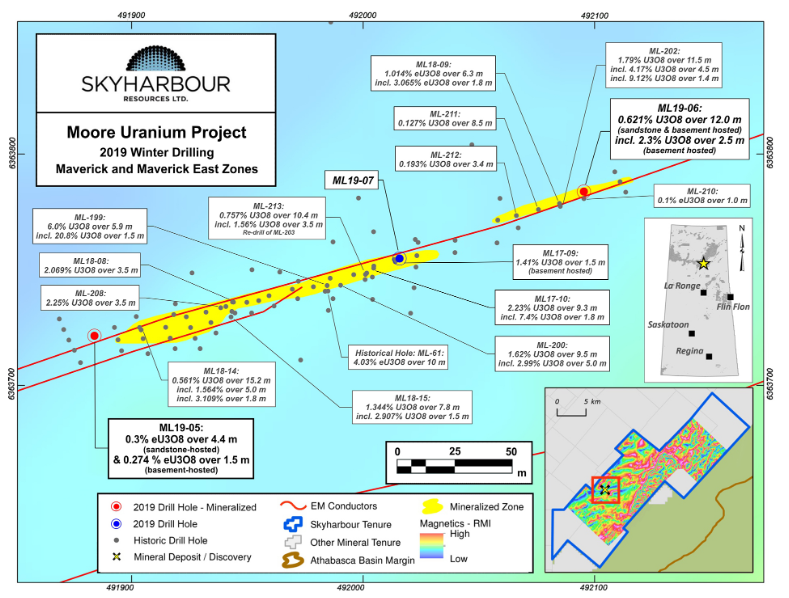

Skyharbour will be drilling ~2,500 meters in 7 to 9 diamond drill holes at Moore. The objective of the drill program is to test both unconformity and basement-hosted targets along the high grade Maverick structural corridor. Of particular interest are potential underlying basement feeder zones to the unconformity-hosted high grade uranium present along the Maverick corridor. These targets have seen limited historical drill testing.

Skyharbour plans to expand the high grade mineralization recently discovered at the Maverick East Zone and to test the Goose and Viper target areas along strike with a focus on basement-hosted mineralization. Only 2 kilometers of the total 4 kilometer long Maverick structural corridor has been systematically drill tested leaving substantial potential for new discoveries along strike, as well as at depth in the underlying basement rocks which have seen limited drill testing to date.

A recently completed UAV-MAG ( Unmanned Aerial Vehicle Magnetometer Survey) survey successfully identified high-priority cross-cutting features and structures along the Maverick corridor. This has helped to better identify drill targets for this upcoming drilling program at Moore. In addition, refinement of Skyharbour’s geological and structural model regarding the northward plunging mineralized zones at Maverick East is now complete and has greatly assisted in drill targeting the basement rocks of the Maverick East Zone, along strike and down dip from the current mineralization.

Here are some of the potential catalysts that will generate significant news flow in the first half of 2020 and which could also generate significant upside in the SYH share price in 2020:

-

A ~2,500 meter drill program at Skyharbour’s flagship Moore Project will begin next week. This drill program will target underlying basement feeder zones in the high-grade Maverick Corridor – these targets have seen limited historical drill testing.

-

Exploration and field work at Skyharbour’s Preston Project by partner Orano Canada is already underway – Orano has the option to earn up to 70% of Preston through C$8 million of cash and exploration spend over six years.

-

A C$1.2 million drill program (2,000-2,500 meters over 15 holes) by Skyharbour’s partner Azincourt at the East Preston Project as part of an option agreement is already underway as of last week – Azincourt is currently earning towards a 70% interest in the 25,000+ hectare East Preston project as part of a joint venture agreement.

-

A rebound in the uranium spot price as Cameco acquires more than 20 million pounds, a bulk of that on the spot market, and the Trump administration prepares to purchase US$150 million of uranium in 2021 (and US$1.5 billion over the next ten years), amid an increasingly undersupplied global uranium market.

-

A turnaround in the uranium sector amid improving fundamentals – the double-bottom in the Cameco chart and price action like we saw in ISO shares this week are early green shoots that investor sentiment is just beginning to shift more favorably after a decade long bear market.

At C$.16 per share SYH shares are dirt cheap and could easily double on good drill results or a sector rebound. Meanwhile, the downside risk is relatively minimal and that’s not something I often say about junior resource stocks. SYH CEO Jordan Trimble and other insiders have been buying up shares in recent months and I have also taken a cue from them by buying SYH shares on the open market recently.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Skyharbour Resources Ltd. is a high-risk venture stock and not suitable for most investors. Consult Skyharbour Resources Ltd.’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by Skyharbour Resources Ltd. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.