Shares of Aben Resources (TSX-V:ABN) have slid lower along with other Golden Triangle explorers in recent weeks. The delays in receiving assays back from the labs hasn’t helped the situation either; investors tend to sell first and ask questions later when they perceive that a company’s drilling results are being released later than expected.

Just a few weeks ago expectations for many of the Golden Triangles names such as Aben, Golden Ridge, and GT Gold were through the roof. Now it seems as if the market pendulum has swung the other way and the lab delays are being interpreted as being a sign that these companies don’t have anything noteworthy to announce to the market. However, from a trading standpoint it’s usually a much better idea to buy shares of stocks with lower market expectations as opposed to situations in which expectations might be overly-inflated.

The chart setups in both Aben and Golden Ridge (TSX-V:GLDN) appear to be attractive from a risk/reward standpoint.

ABN.V (Daily)

Important support/resistance zone between C$.24 and C$.28. However, ABN still remains in a year-to-date uptrend with rising 50-day and 200-day moving averages (the slope of moving averages are more important than specific price levels).

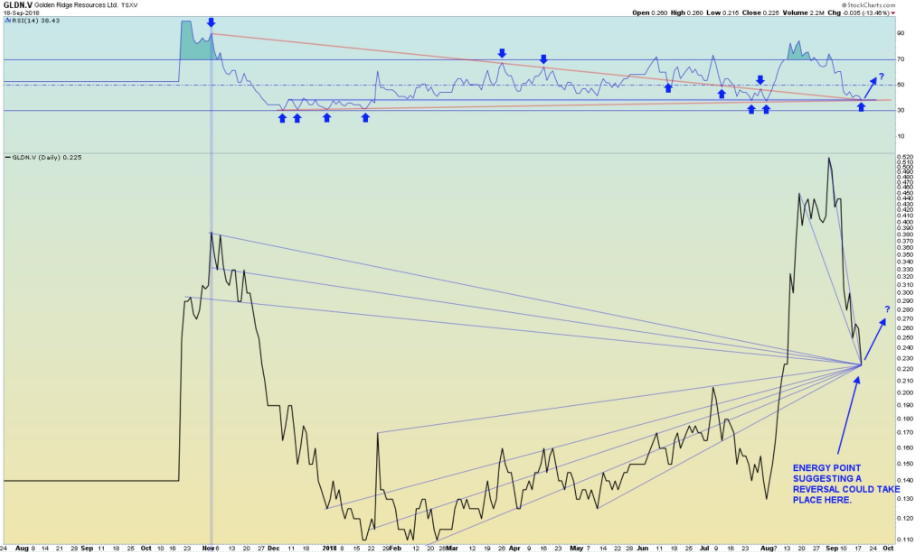

One of my favorite fellow technicians Ty Martin posted a couple of excellent charts highlighting ‘energy points’ (confluence of trend lines that typically coincide with price reversals) in ABN and GLDN:

ABN.V Energy Point Chart

GLDN.V Energy Point Chart

Two of Ty’s recent energy point charts have worked extremely well (NVO.V and GDX) and I have a feeling that at least one of these will prove to be prescient.

Disclosure: Author owns shares of ABN.V and GLDN.V at the time of publishing this post and may buy or sell at any time without notice.

Disclaimer

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Aben Resources Ltd. is a high-risk venture stock and not suitable for most investors. Consult Aben Resources Ltd’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated to cover Aben Resources Ltd. and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.