I have explained on numerous occasions that the CFTC Commitments of Traders (CoT) data should not be used as an exact market timing tool. In fact, most of the time the CoT data is noise with virtually zero signal. However, there are rare occasions in which I believe astute market participants can actually derive a signal from the data, but only when it reaches unusual extremes. Now is one of those occasions…

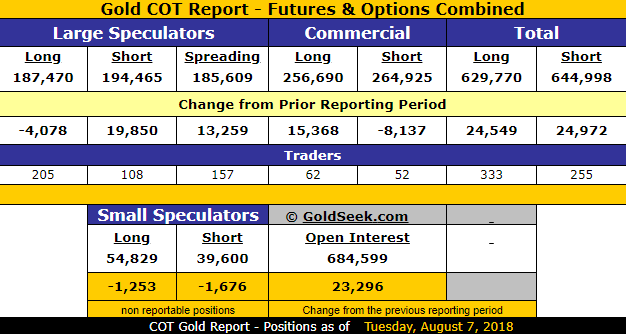

Large speculators have actually moved to a net short position in gold (using the futures & options combined report) for the first time EVER! Yes, that’s right large futures speculators (CTAs, hedge funds, etc.) have never been as pessimistic on gold as they are now.

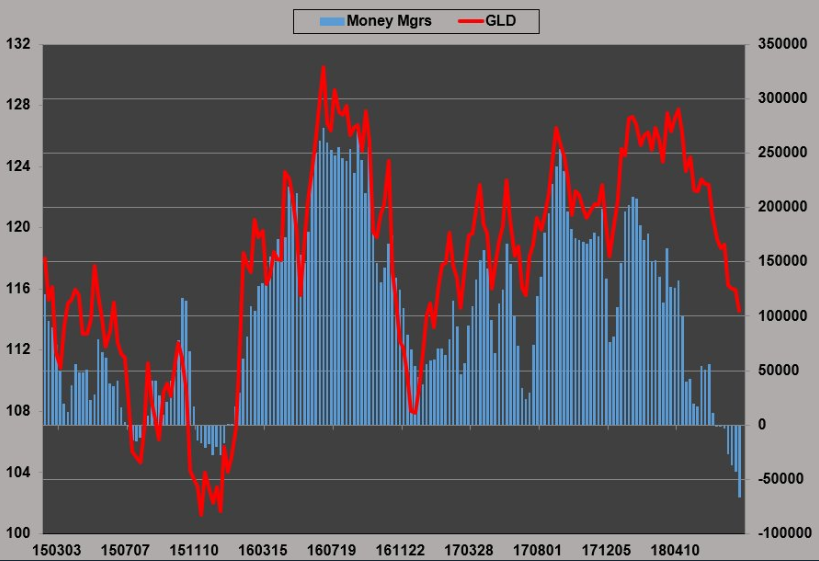

Looking at only “managed money” futures market participants we see another all-time record short position which now totals roughly US$8 billion net notional:

Chart via David Brady

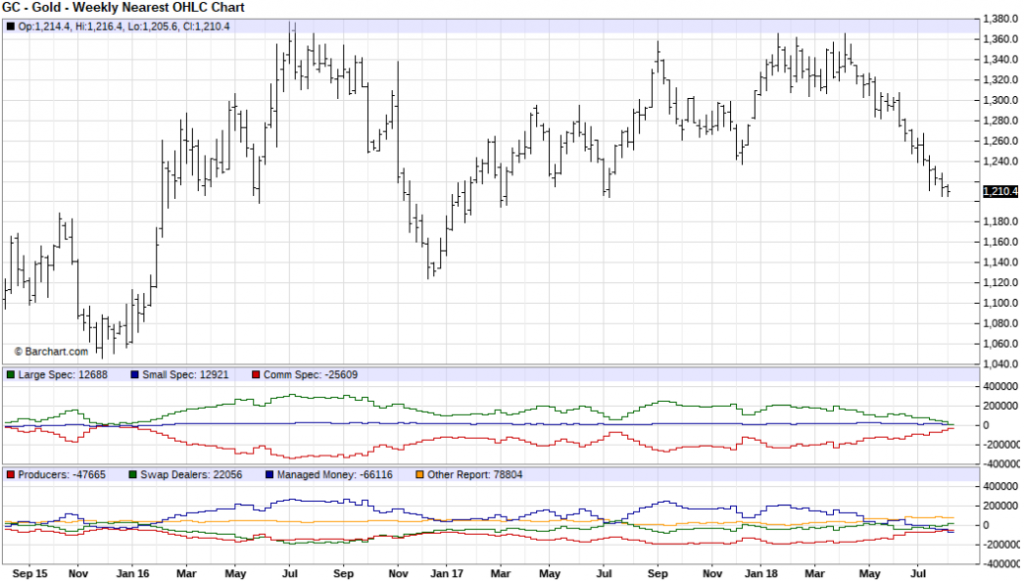

Technically speaking gold doesn’t look great as it continues to oscillate within a relatively narrow range while forming what could be interpreted as a bearish flag pattern. The weekly chart shows a clean and orderly downtrend since the April peak, however, it is worth noting that gold has strong support in the $1200-$1210 area and we have seen the yellow metal hold strong in recent days in the face of extreme in the US dollar.

All of the key ingredients are in place for a strong buy setup in gold:

- CoT ‘Buy Signal’ as commercials move to what for all intents & purposes is flat positioning (commercials always have a heavy short position in gold futures), while momentum traders (hedge funds & CTAs) hold their largest ever short position which will take more than a few days to cover.

- Gold is very close to major support ($1200-$1210).

- Bullish divergence as gold has not made a lower low while the US Dollar Index continues to climb to 52-week highs.

- Sentiment as measured by the DSI has been in depressed territory (below 20%) for more than a month.

- Seasonality.

The way I see it is that there two possibilities here: Either gold is a strong buy here and we will see a decent sized rally (5%+) begin within the next couple of weeks OR gold is in the grips of a vicious bear market which will consistently experience extreme CoT positioning and bearish sentiment extremes. I will leave it to my readers to figure out which possibility is the correct one.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.