We all know that the market is a fickle friend and Westhaven Ventures’ shareholders are being reminded of this lesson today. This morning, Westhaven reported the remaining assays from its spring 2018 drilling campaign at Shovelnose, which consisted of 7 diamond drill holes totaling 2,639 meters. This program resulted in the best drill intercept to date at the Shovelnose gold property and Westhaven President & CEO Gareth Thomas made it clear that they are excited to follow up on hole SN18-03 (2.62 g/t Au over 28.7 meters including 9.7 g/t Au over 2.9m’s), which is open along strike to the north, south and up-dip to the east.

In fact, Westhaven is so excited about Shovelnose that they have called an audible and decided to go right into a follow-up drill program at Shovelnose which will begin in two weeks (moving the Skoonka drill program out to August/September). The next Shovelnose drill program will consist of 7-8 holes (roughly 300 meters in depth) totaling roughly 2,500 meters. Mr. Thomas added “We are confident we are zeroing in on a key, economic-grade gold horizon. With a fully financed drill campaign slated to begin in the coming weeks, we are looking to follow-up on the success of hole SN18-03, which is open along strike to the north, south and up-dip to the east. This program intersected by far the most significant gold mineralization to date and we are very keen to get back there.”

It’s not often that I see a junior mining CEO confident enough to stick his neck out in an NR and write “We are confident we are zeroing in on a key, economic-grade gold horizon.” – in my opinion these words represent an impressive degree of confidence.

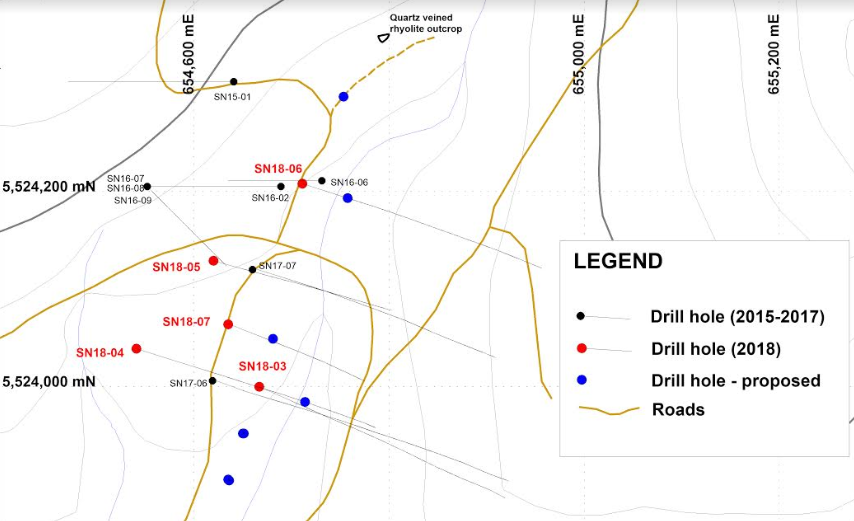

This is a map illustrating some of the proposed holes for the next program at Shovelnose:

Notice that Westhaven is planning to drill at least four holes in the immediate vicinity of SN18-03 (to the north, east, and south) and the speed with which they want to get back out there tells me that they are confident that they really are zeroing in on an economic-grade gold horizon.

One of the things that stands out to me about the Westhaven management team is that these guys care a lot about shareholder value and avoiding dilution – they have a lot of skin in the game through ownership interests in the company and the only way they are going to profit is through making an economic gold discovery that sends the share price higher (total management annual salaries total only C$150,000). Insiders have consistently purchased stock on the open market and exercised warrants, to the point that directors & officers of WHN own roughly 40% of the total shares outstanding. Westhaven runs a tight ship and it is one of the best examples of management’s interests being aligned with shareholder interests that I know of in the junior mining sector.

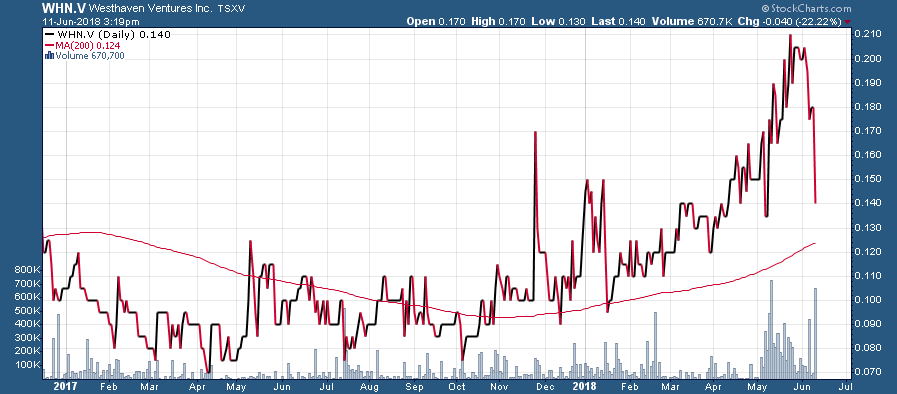

The February-May rally which saw WHN shares more than double set expectations higher and this latest batch of assays clearly didn’t meet those expectations. However, the recent decline has presented investors with a golden opportunity to get in at a sub-C$10 million market valuation just before the company embarks on its most important drill program to date.

WHN.V (2017-2018)

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Westhaven Ventures Inc. is a high-risk venture stock and not suitable for most investors. Consult Westhaven Ventures Inc.’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by Westhaven Ventures Inc. so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.