The 1984 movie Revenge of the Nerds was one of the first films I saw in theaters (I was 5, so no, I’m not a millennial) and quickly became a classic. The plot involves a battle between a nerd fraternity and a jock fraternity. The jocks were better looking and athletic, the nerds were smarter and well, nerdy. After suffering through some bullying and humiliations, the nerds emerged victorious in the end; the nerds got to live in the Alpha Beta (jock frat house) until the Alpha Betas repaired the damage they had caused to the Tri-Lams house (nerd frat), and many of the nerds gained the admiration of ladies who had previously chosen to be in the company of the jocks.

Fast forward to November 2017 and the nerds are emerging victorious again. Cryptocurrencies, which began the year at a less than US$20 billion total market cap, now have a total market capitalization of nearly US$300 billion (a more than 1500% rise in less than 1 year!).

Bitcoin, the leading and most well known cryptocurrency has risen from around $1,000 per Bitcoin to begin the year to more than $9,000 today (and a market cap of more than US$150 billion).

While many people have begun to participate in the cryptocurrency craze (more on that later), it’s the early adopters that are now sitting on veritable fortunes. The nerds who were mining Bitcoins and trying to proselytize everyone they knew back in the early days (literally just a few years ago as Bitcoin was introduced in January 2009) are now multi-millionaires, and in some cases, billionaires.

Satoshi Nakamoto (most people believe this is a pseudonym for another person), the creator of Bitcoin, is now worth more than US$7 billion by most estimates. Vitalik Buterin, the creator of Ethereum, is 23 years old and worth ~US$200 million by most estimations.

It can be said that one of the greatest wealth transfers in history is taking place as cryptocurrencies seemingly add US$10 billion or more of market capitalization each day. Even among people who I am friends with there are two guys who were buying Bitcoin during the 2013-2015 time frame. They each invested around $10,000 at prices ranging from $100 to the mid-$200s, they are now both on the verge of being millionaires simply through their Bitcoin holdings. At this stage these types of stories are far from being uncommon.

Bitcoin (and cryptocurrencies as a whole) is unique in many ways but perhaps the most striking aspect to me (coming from a stock market background) is that the hardcore crypto devotees haven’t sold any of their coins. In the stock market it would be almost unthinkable to be staring at 2000%+ gains and not take some profits off the table. However, for the true crypto converts their cryptocurrency wallets are a way of life. They are holding the future of currency, the new medium to transfer value, why would they sell any of it? In fact, not only do they not sell any, they buy and/or mine more even as the prices continue to move higher.

When I have asked crypto maniacs about portfolio diversification and the dangers of being too heavily concentrated in one sector answers have ranged from: “I am diversified, I have Bitcoin, Litecoin, Ethereum, Dash…..” OR “Bitcoin is the new world currency, why would I diversify?”

I bought my first cryptocurrency, Ethereum, in April at $47. Looking back it feels like I was an early adopter, especially compared to the mass public participation I have witnessed in the last couple of months. I recall asking a couple of dozen people back in April if they owned any cryptocurrencies, nobody did.

In the last week I have overheard people talking about Bitcoin, Litecoin, Ethereum etc. at almost every location I have visited. In South Beach I overheard three guys in their late-20s talking about how much Litecoin they owned and how they needed to buy more before it exploded to the upside. The confidence they had that the only possibility was that the price had to go higher was remarkable, and frankly scared me.

Another phenomenon which has begun popping up are MLM (multi-level marketing) type companies using Bitcoin as a hook to enroll people under the auspices of “participating in the new economy.” One such company is called USI Tech, USI Tech claims to have an automated trading platform for trading forex and Bitcoin which they claim delivers “outstanding results” without offering any transparency or even the slightest clue as to how this happens. So outstanding are their results that they say “even the most experienced traders” are “jealous” of their results:

Without going into great detail (instead you can read this well written piece exposing many of the red flags of USI Tech) USI Tech has many of the red flags of a Ponzi scheme and as best I can tell it is nothing more than a glorified multi-level marketing operation using the word Bitcoin to attract an entirely new audience of gullible investors which they could not attract with only a ‘forex platform.’

Taking a poll of 30 random people/acquaintances a couple of days ago a full 50% of them now own some cryptocurrencies! Remember in April it was 0! I have also noticed that people who have never invested in anything (not even 1 share of stock or a silver coin) are suddenly willing to invest in cryptocurrencies. Rising prices do wonderful things for confidence!

Coinbase added 100,000 new users on Thanksgiving Day alone! The public is getting involved in crypto in a big way and there are no signs the bandwagons of new adopters are stopping anytime soon.

“The move appears to be retail driven,” said Brian Kelly, a CNBC contributor and CEO of BKCM, which runs a digital assets strategy.

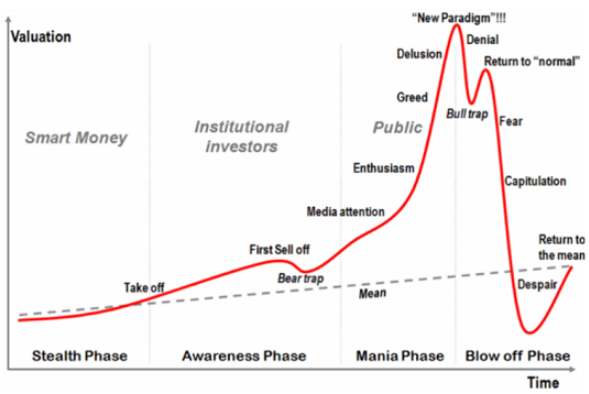

If we take a look at the market cycle chart where do you think cryptocurrencies currently are?

It’s safe to say we are at least in the greed phase, and there is a strong argument we could be in the early stages of the ‘delusion’ or ‘new paradigm’ stages. After all, crypto is the key to the new digital economy (new paradigm) right? And prices can only move higher (delusion) right?

Am I calling a top? No, not really.

Even though I have witnessed things in the last few weeks which would get me aggressively short if Bitcoin were a stock, I wouldn’t short Bitcoin or any other cryptos for that matter, yet. Bitcoin et al. are in a massive bull market, but even in the strongest bull markets prices can get overextended and sentiment can become terribly overheated.

Blow-off moves tend to be longer in duration and more violent in price action than anyone could possibly envision. Maybe we need to see $1 trillion in crypto market capitalization before things get truly insane.

I have a feeling that things will get very interesting over the next several weeks as the CME gets ready to launch Bitcoin futures contracts. An event like this could help stimulate a parabolic blow-off rally (as institutional investors pile into Bitcoin), and it could also help to reduce volatility in Bitcoin prices (more liquidity and making it easier to sell short). 100% gains are probably about to become much harder to come by in the $1 billion+ cryptos, sorry to break the bad news to all of those who opened a Coinbase account on Thanksgiving Day; the nerds were in way before you and now you’re helping them get richer.

Disclosure: Author is long Bitcoin, Ethereum, and Litecoin at the time of writing and may buy or sell at any time without notice.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.