Some of the best investment opportunities occur at key turning points, when the vast majority of market participants do not appreciate an opportunity. This often occurs when investors are operating from a classic cognitive bias called recency bias; when market participants evaluate their portfolio performance based on recent results, or on their perspective of recent results, and make incorrect conclusions that ultimately lead to incorrect decisions about how a market or individual security will behave in the future.

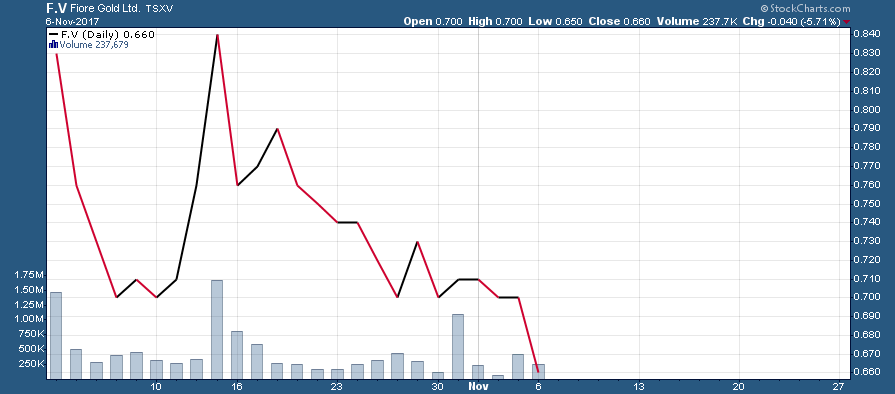

After a recent slide in its share price (post combination with GRP Minerals), such an opportunity could exist in the shares of Fiore Gold (TSX-V:F, OTC:FFRRF). The decline, since shares resumed trading on October 2nd, has shaved more than C$40 million off its market capitalization. At a recent price of C$.70 per share, Fiore has a C$68 million market cap (based on 97.5 million shares outstanding) and a modest enterprise value of C$47 million (based on C$21 million cash in the treasury).

Fiore’s flagship Pan Mine is producing gold (1,602 ounces of gold in September), and Fiore is ramping up ore production with the goal of achieving a steady-state mining rate of 14,000 tons of ore per day by January 2018 (with projected gold production of 35-40,000 ounces in fiscal 2018; October 2017 through September 2018). Fiore is also committed to exploration at Pan through infill and extension drilling near the existing North, Central and South pits.

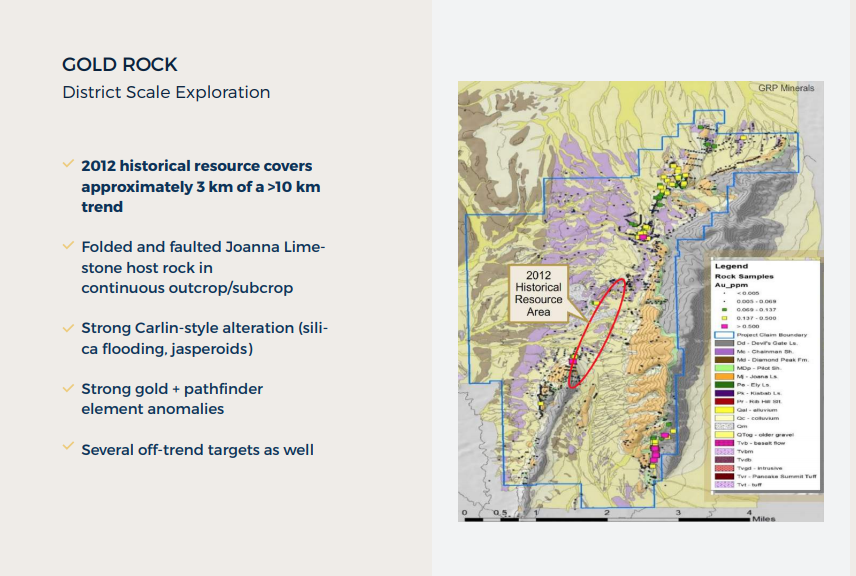

While Pan offers Fiore a producing asset and cash flow, the real juice for Fiore sits 13km to the southeast of Pan at its 100% owned Gold Rock deposit. Gold Rock has a historical resource of 343,000 ounces Au consisting of 18.1 million measured and indicated tonnes of 0.58 gram gold per tonne, and another 409,000 ounces Au inferred consisting of 30.5 million tonnes grading 0.41 gram gold.

In a recent interview, Fiore Gold CEO Tim Warman offered the following comments about Gold Rock:

“The mineralization we see at Gold Rock in the open pit runs for ten kilometres from one end of the property to the other. And that same geology and structure continues north to Kinross Gold’s Bald Mountain mine which has 2.2 million oz. gold in reserves. So we believe Gold Rock is very prospective,”

All drilling permits are in place for Gold Rock, and Fiore is planning a drilling program beginning in Q1 2018 (March) to expand the existing resource – an updated resource estimate for Gold Rock is planned for late 2018. The federal mine permitting process is also nearing completion with the EIS Record of Decision, expected in Q1 2018.

The Fiore/Kinross connection hasn’t been talked about much. However, Kinross took a 9.9% stake in Fiore as part of the GRP/Fiore combination financing. Moreover, Kinross’s Bald Mountain mine to the north has the same geology and structure as Gold Rock. Kinross is clearly interested in the exploration upside at Gold Rock. In the next couple of weeks, a joint exploration meeting between the Kinross Nevada team and Fiore is planned to occur on site at Gold Rock.

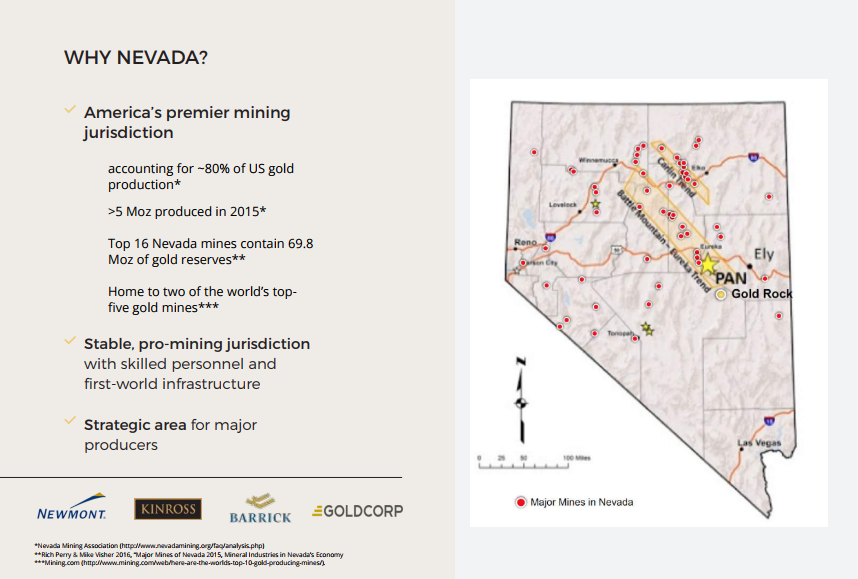

While Pan and Gold Rock are the primary focuses for Fiore right now, the third prong of the strategy to becoming a 150,000+ ounce gold producer is acquisitions. Warman has his eyes on a couple of potential acquisitions in the range of 40,000-60,000 ounces per year, in Nevada. The idea of forming a larger company by combining several smaller assets within the same geographic region (Nevada) is an attractive one because scale can help to unlock value that may not be otherwise available.

I’ll make no bones about it, Fiore shares are cheap at C$.70/share and a sub-C$50 million enterprise value. Fiore is barely trading at more than 1x projected 2018 sales (based on 35,000-40,000 ounces of gold production at Pan and a US$1275 gold price), and the exploration upside at both Pan and Gold Rock are being underestimated, in my opinion. Kinross took a 9.9% stake in Fiore for a reason, they clearly see substantial potential upside at Gold Rock.

F.V (Daily)

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Fiore Gold is a high-risk venture stock and not suitable for most investors.. Consult Fiore Gold’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for marketing & promotional services by Fiore Gold so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.