The U.S. Geological Survey has confirmed that the Wolfcamp Shale in Texas is the largest continuous oil and gas deposit ever discovered in the United States. Despite being a hub of U.S. oil production for the last 100 years, Texas is nowhere near running dry. The USGS estimates that the Wolfcamp contains 20 billion barrels of oil and 16 trillion cubic feet of natural gas. All of this oil is recoverable, however, much of it will have to be extracted from the earth utilizing hydraulic fracturing (fracking) of horizontal wells.

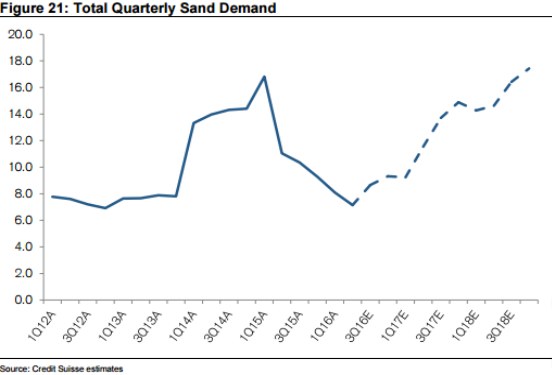

These horizontal wells now require up to 2,500 pounds of frac sand per lateral foot per well, with some wells requiring 25,000 tons of sand for one well completion. This is a massive increase in frac sand usage that looks set to only increase further:

Frac sand demand appears to be entering into overdrive and there is a small cap silica sand producer uniquely positioned to feed this surging appetite. Select Sands (TSX-V:SNS) is a silica sands producer which operates the Sandtown silica sand project near Cave City, Arkansas. The Sandtown Project is located 650 rail-miles closer to the major Texas, Oklahoma, and Louisiana energy markets than the Wisconsin silica mines. This geographic advantage gives Select Sands a competitive advantage by offering up to a $15/ton transportation cost savings to customers.

Select Sands also has two other substantial advantages compared to peers: The Sandtown Project is operational year round with no sub-zero ground temperatures and Sandtown contains premium high-purity silica with high roundness and sphericity. While delving into silica sand grade can get a bit technical, it is simplest to understand that roundness and purity are important and that the kind of silica sand that Sandtown produces is in high demand.

Investors caught on to the Select Sands story in August and began driving SNS shares higher, then in October SNS made a transformative acquisition by acquiring assets from Ozark Premium Sand (assets valued at US$42mm were acquired for US$5mm):

SNS.V (Daily)

Following the acquisition SNS shares pulled back on light volume, more than likely just some natural profit taking and a result of overall weakness in the oil space. However, yesterday’s 20% surge on solid volume indicates that the pullback may be over and fresh highs are on the way.

SNS shares trade at a significant valuation gap relative to its larger silica sand peers. As SNS moves Sandtown into the energy markets, this gap should narrow and there is even the potential for SNS to trade at a premium to its peers due to its cost efficiencies and location advantage.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Select Sands Corp. is a high-risk venture stock and not suitable for most investors.. Consult Select Sands Corp.’s SEDAR profile for important risk disclosures.

EnergyandGold has been compensated for this post so some of EnergyandGold.com’s coverage could be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.