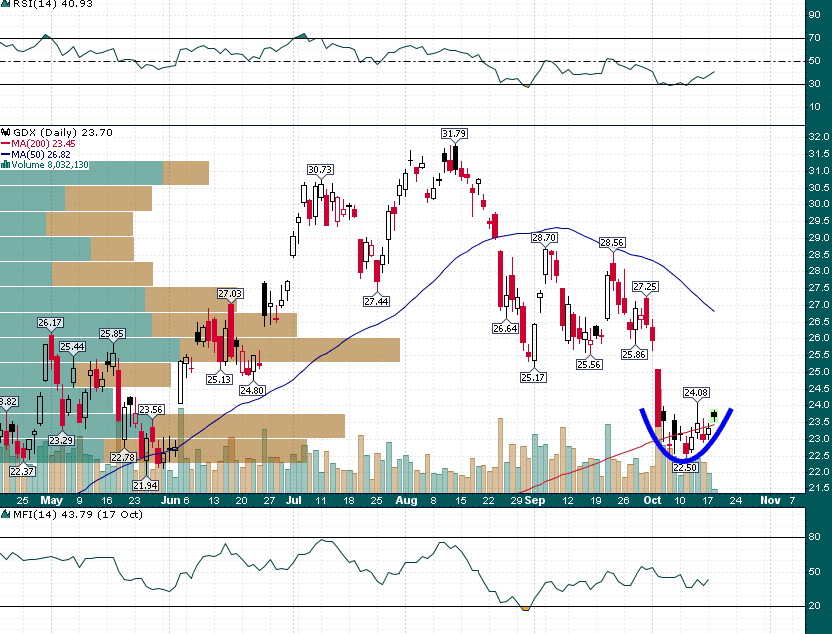

The gold mining sector as represented by the GDX has been working on a bottom for the last couple of weeks and there are some subtle, yet constructive signs that a larger rally may be close at hand:

GDX (Daily)

A series of higher lows have formed since the $22.50 low on October 11th. Moreover, bullish divergences in the form of a higher low in relative strength (RSI at top) and money flow (MFI at bottom) point to the possibility that the recent low was a ‘weak’ one and it might not require much buying interest to see price quickly reverse to the upside.

Above ~$24.00 the open gap up at $25.86 is a likely target with much stiffer resistance existing up in the $26-$27 area.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher ofEnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.