Scientific Metals (TSX-V:STM) is committed to becoming a key North American supplier of critical energy metals. Energy metals used in rechargeable batteries such as lithium, cobalt, graphite, nickel etc. are experiencing surging demand as Tesla ramps up its production schedule and other electric vehicle manufacturers follow suit.

Cobalt, in particular, faces a situation in which demand is expected to soar along with the growth of electric vehicle lithium ion batteries:

The situation is made all the more potentially turbulent given the fact that the Democratic Republic of Congo (DRC) is currently responsible for supplying more than 50% of the world’s mined cobalt. Moreover, Elon Musk has not made it a secret that Tesla is not open to sourcing its energy metals from outside North America.

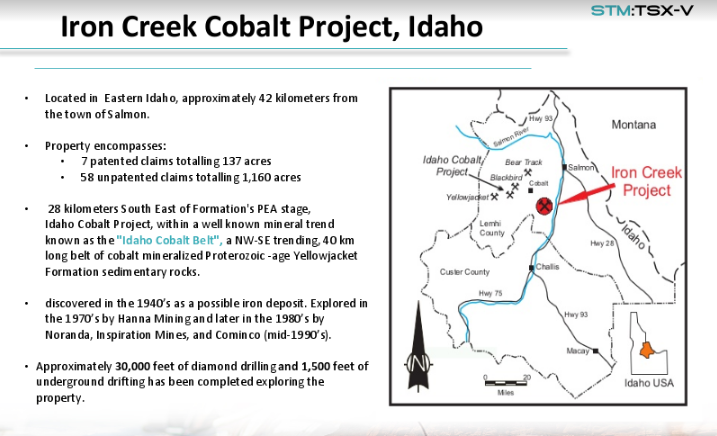

This increasingly unsustainable dynamic creates an urgent need for North American energy metal resources. Enter Scientific Metals, a company which recently acquired the Iron Creek cobalt property in the Idaho Cobalt Belt. The Idaho Cobalt Belt is the only prominent region of potential to develop Cobalt mines in the United States. In fact, there is only one other cobalt mine in the United States slated to move into production in the next few years, Formation Metals (which is located in the same Idaho Cobalt Belt as STM’s Iron Creek property).

Last month STM formalized a lease agreement with an option to acquire a 100-per-cent interest in Iron Creek – STM CEO Brian Kirwin offered the following comment regarding the Iron Creek acquisition:

“The signing of this lease agreement is an exciting step for STM. The addition of a significant cobalt asset to our growing lithium portfolio allows STM to strategically position the company to supply modern battery manufacturers with much needed metals. The Iron Creek cobalt property is an excellent opportunity with significant cobalt mineralization and substantial upside potential already identified. We look forward to bringing this property forward towards production.”

A substantial amount of historical work was completed at Iron Creek by Noranda in the 1980s before the implementation of NI 43-101. STM is committed to conducting its own drill program at Iron Creek over the coming months in order to estimate resources that are compliant with the estimates to current CIM definition standards. We recently connected with Mr. Kirwin to gain some additional color on Iron Creek and STM’s overall vision for being a key supplier of North American energy metals.

CEO Technician: Please tell us about Iron Creek and what STM’s next steps are.

Brian Kirwin: First of all, there’s a substantial amount of data which describes the cobalt deposits on Iron Creek. We have another trip to the site planned very soon (in the coming days, not weeks) which will include an author that will be tasked with producing a new 43-101. We’ll be able to produce a 43-101 report very soon and it will be able to codify everything that is known now.

There is a substantial amount of infrastructure already in place and with a little bit of road work we should be able to connect the drill roads to the existing road network. In addition, without a heck of a lot of work we should be able to open up two portals to be able to access the underground. Overall, the underground workings appear to be in pretty good shape.

On the private ground which is about 137 acres we can move fairly quickly in terms of cleaning up the roads and opening up the underground portals. On the surrounding public grounds there will be a permitting process involved. Once we get the roads cleaned up and the underground tunnels opened up the next step will be a drilling campaign. There are two primary objectives for the drilling campaign:

-

To infill and gain confidence in terms of resource classification; the data density appears to be nearly sufficient to support an inferred resource right now. We will go in with the objective of moving it up to at least an indicated category.

-

The 2nd objective will be to explore and expand the resource. The existing data indicates the potential to double the tonnage is sitting right in front of us.

Scott Armstrong: Tell us about cobalt and why it is so interesting from a resource development standpoint in North America right now.

Brian Kirwin: There is only one other cobalt project set to come online in North America and that is our neighbor Formation Metals’ Idaho Cobalt Project. Cobalt is primarily mined as a byproduct which is a problem for supply and partially what makes it a compelling opportunity from a resource development standpoint. Tesla has made it very clear that they will not consider minerals from Africa with question human rights records as a source of raw materials supply. This statement alone removes more than ½ of the global cobalt mine supply from the equation and makes North American cobalt projects much more attractive. The Iron Creek project positions STM to be able to develop the 2nd cobalt project in the United States to come online, Formation Metals is the only one ahead of us.

CEO Technician: What kind of timeline are we looking at in terms of permitting and construction at Iron Creek?

Brian Kirwin: We are planning at least two rounds of drilling which will take at over a year. Then at least two years for permitting and another 1-2 years for construction. So if all goes well, we are looking at production beginning during 2020-2021 just as global cobalt demand begins to turn parabolic.

Cobalt is perhaps the most interesting of the energy metals due to its extremely tenuous supply/demand picture over the next couple of decades.

If STM is able to move ahead with doubling the tonnage at Iron Creek while completing an updated 43-101 compliant report the company’s current C$9 million market cap doesn’t seem to do justice to what could quickly become only the 2nd producing cobalt mine in the United States. The company’s Deep Valley lithium resource in Alberta and Paradox Basin lithium resource in Utah then become free lithium call options for STM investors who now have three ways to win owning STM shares.

STM.V (Daily)

After surging higher in April and May, STM shares have spent the summer in a rangebound oscillation despite significant signs of accumulation on dips.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Scientific Metals is a high-risk venture stock and not suitable for most investors. Consult Scientific Metals Corp.’s SEDAR profile for important risk disclosures.

EnergyandGold has been paid to cover Scientific Metals and so some information may be biased. EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.