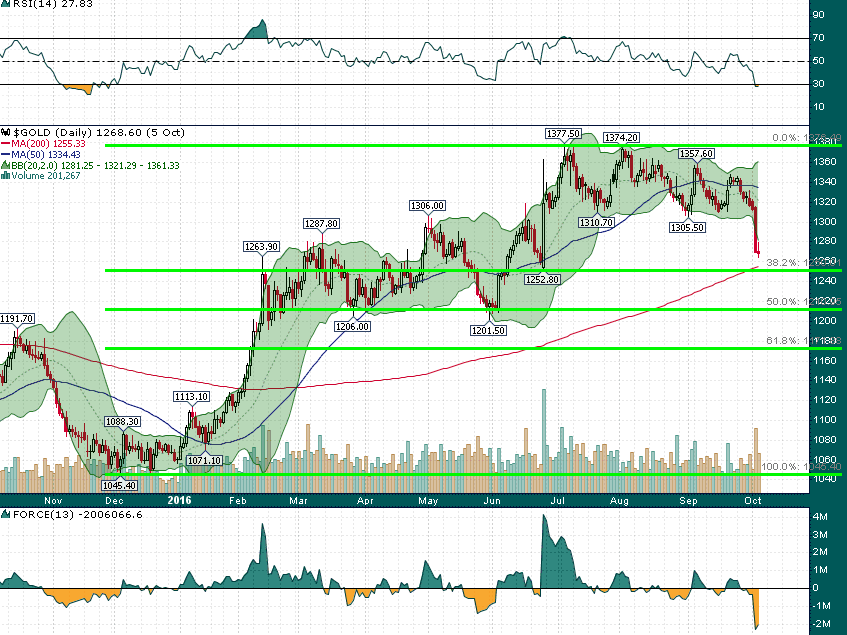

December gold futures have been as low as $1251.50 so far today. We have known that $1250 would be a big level in the event of a correction; the $1250 area served as resistance on numerous occasions throughout February and April, then it served as support from which a ~$125/oz rally launched following the BREXIT vote. The combination of significant support/resistance, the rising 200-day moving average, and the 38.2% Fibonacci retracement of the entire December 2015-July 2016 rally make today’s low potentially quite significant:

Gold (Daily)

The $1250 area is a likely spot from which an oversold relief rally could begin. However, as Bob Moriarty stated yesterday gold may need to still test down to at least $1200 before a real sustainable bottom is put in place.

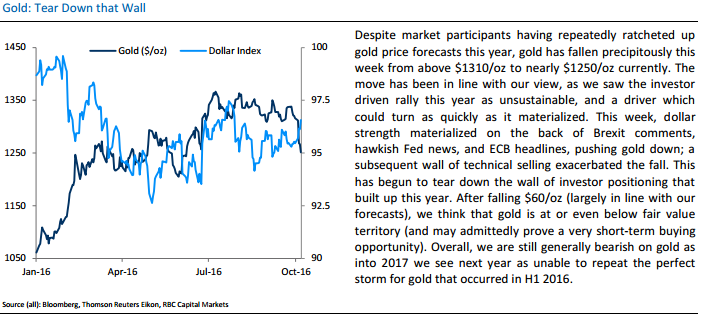

Another item of interest which supports the case for a bounce comes in the form of RBC venturing that gold may now be below ‘fair value’ after having seen gold as overvalued for the last several months:

While the trend is clearly down and it is too early to call for any sort of bottom, the $1250 level is certainly quite interesting from both a technical and psychological standpoint and one which investors should pay close attention to.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.