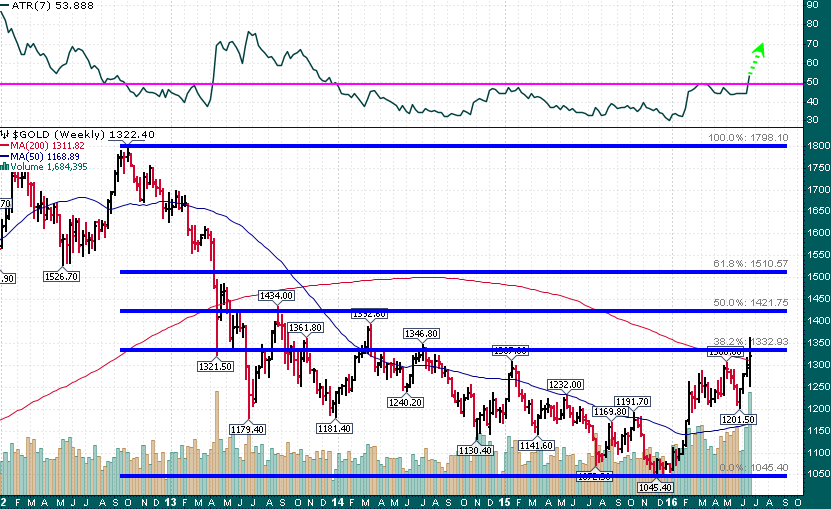

38 months ago, as the teeth of the cyclical bear market were sinking in deeper, gold tumbled more than $200/oz within the span of two trading sessions before putting in a short term low at $1321.50. In many ways gold finds itself in the exact opposite position (both technically and fundamentally) today after ending a historic week within $1 of the price level from which it initially bounced in April 2013:

Gold (Weekly)

Gold has rallied more than $150/oz (~12%) since the beginning of June and today’s surge up to as high as $1362.60 had all the hallmarks of a fear driven short squeeze which triggered panic buying (as opposed to the fear driven stop triggering panic liquidation of April 2013).

The 38.2% Fibonacci retracement of the entire October 2012 – November 2015 also happens to represent important support/resistance since the April 2013 crash low at $1321.50. It is no accident that gold closed near this important area of confluence after such a historic week. It is also worth pointing out that gold ended this week above its 200-week moving average for the first time in more than 3 years – on its descent during the 2012-2015 bear market the first time that gold fell through this moving average was during the crash on April 15th, 2013.

My takeaways from this week in gold:

- The resumption of the bull market which began at the end of last year entered a new, more volatile phase this week.

- Gold probably put in a short term peak above $1360 this week, a level which likely won’t be surpassed for at least a few weeks.

- Some consolidation around the major confluence between $1310 and $1350 seems likely.

- This is a bull market and dips are likely to be shallow and short lived as traders on the wrong side of the market cover shorts and bulls accumulate larger positions.

DISCLAIMER: The work included in this article is based on technical charts, current events, interviews, and corporate press releases. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.