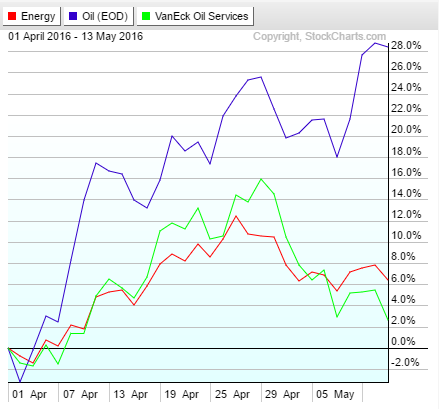

WTI crude oil has nearly doubled from its February low, meanwhile the performance of oil stocks has begun to lag noticeably:

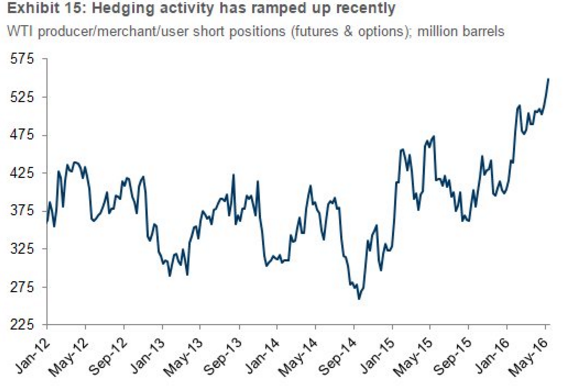

There are many reasons for this phenomenon, and many reasons why the oil/oil stock divergence has widened significantly in the last couple of weeks – the most notable of which is the large increase in producer hedging which means that many oil producers will not be benefiting much from further rises in the oil price over the near term:

There are also many other potential explanations for why oil stocks have begun to backpedal even as spot oil prices continue to rise:

- Companies are likely to use the improved market conditions and higher share prices to do dilutive financings which are likely to weigh on share prices.

- The oil services sector is still oversupplied with many firms still willing to work at cost just to avoid layoffs.

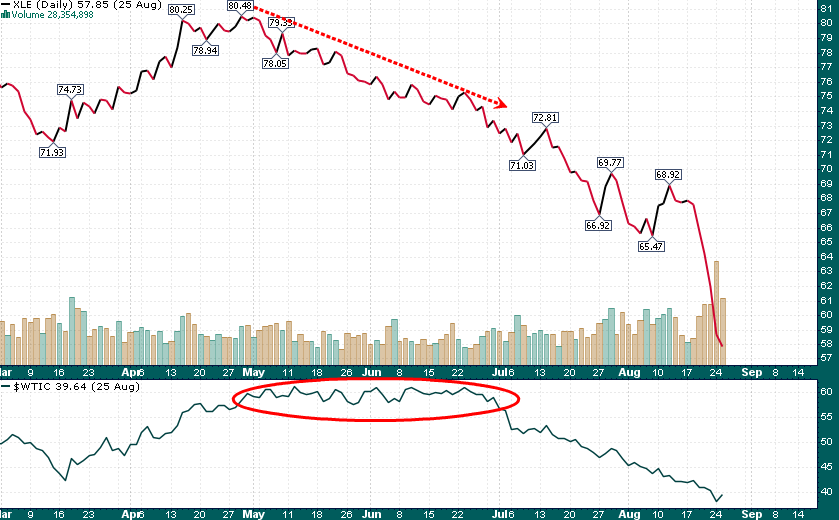

- Oil stocks could be bracing for an imminent turnaround in the oil price similar to what we saw last summer

Energy stocks were already well into a correction by the time that crude oil began to accelerate to the downside in July. Will this summer rhyme with last summer?

There is likely to be some mean reversion in the relationship between crude oil and energy stocks, the question is will it be in the form of a crude oil sell-off or and energy stock rally? Either way this is a relationship that investors should keep an eye on over the coming weeks.