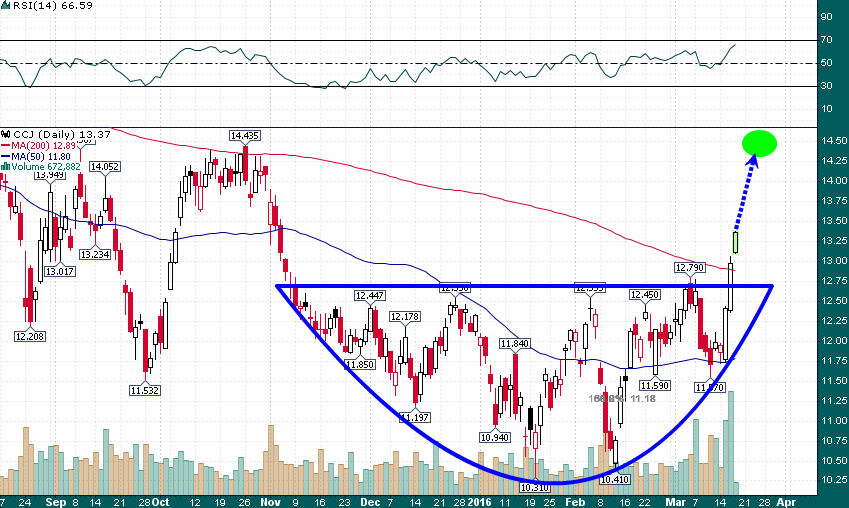

We are witnessing a powerful breakout in many energy names. Cameco (CCJ) is a name that we have been following for many weeks due to the chart pattern bottom that the stock has been forming. In the last couple of days CCJ has broken out from a multi-month basing pattern with force:

This pattern has morphed over the last few weeks, however, the simplest interpretation is that CCJ has formed a powerful rounding bottom pattern over the last 5 months and the breakout during the last couple of days has occurred with enormous force (volume, time, price). A retest of the October highs is a minimum short term target (~$14.50) with an eventual move back up to long term support/resistance in the $17 area.

The breakout in CCJ is made more interesting by the fact that spot uranium prices have tumbled by more than 10% in the last couple of weeks. The spot uranium price is admittedly a very imperfect gauge of the health of uranium supply & demand; the stock market is looking to the future and seeing something that spot uranium prices evidently aren’t factoring in…