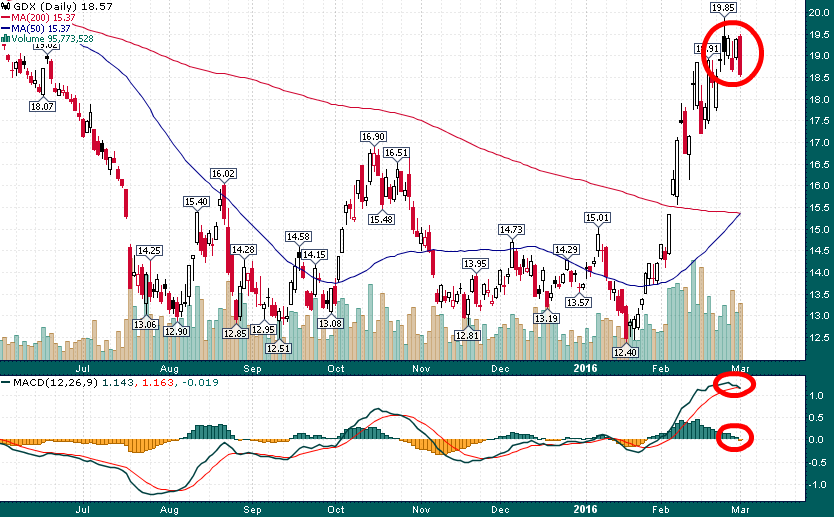

While GDX is on the verge of experiencing a ‘golden cross’ (50-day SMA crossing above 200-day SMA) today’s large bodied bearish engulfing candlestick combined with a bearish MACD cross offers a distinctly bearish flavor:

GDX (Daily)

Both the bearish MACD cross and the bearish engulfing candlestick generate mildly bearish backtest results over fairly large sample sizes.

However, perhaps more notable is that this rejection occurred at a key long-term support/resistance level which price spent a great deal of time gravitating towards during 2014 and 2015:

GDX (Weekly)

A pullback to major support near $17 looks quite reasonable and would be quite healthy given the celerity of the recent rise.