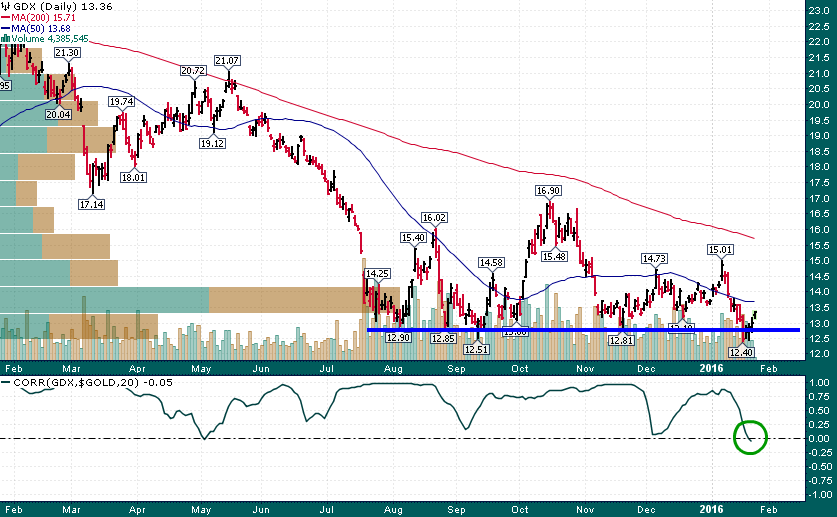

The gold miners (GDX) have spent 6 months bouncing along the bottom testing the ~$13 level:

GDX (Daily)

There are a few things that stand out about this chart:

- A huge amount of volume has been churned in the $13-$14 range in the last 6 months.

- Each time price has fallen below $13 it has rebounded quickly, including what appears to be a failed breakdown after last week’s fresh all-time low.

- The 20-day rolling correlation between GDX and gold has actually turned negative (-5%) – the last time the GDX/gold correlation went negative was late-October 2014, a couple of weeks before GDX put in a major short/medium term low.

The sheer amount of time spent and volume traded within a fairly narrow price band adds importance to any ensuing breakout/breakdown. The bulls have an opportunity to seize control after last week’s failed breakdown. A rally above $15 would go a long way toward confirming that the longest gold mining bear market in the last several decades has finally come to an end.