Kaminak Gold is one of the few junior gold explorers moving full speed ahead with its flagship Coffee Gold Project despite challenging market conditions; the economics at Coffee are simply too compelling.

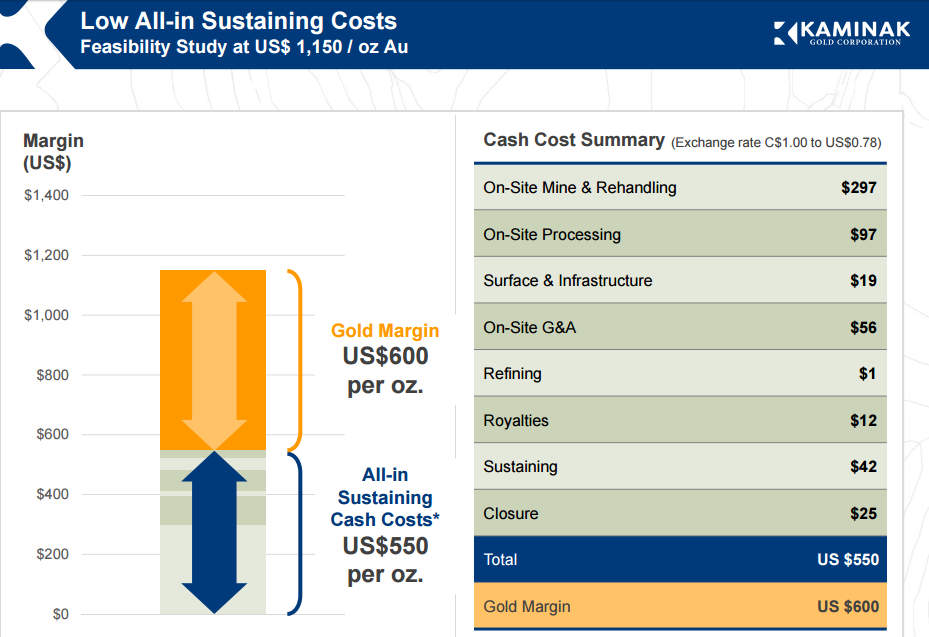

Last week Energy & Gold had the opportunity to catch up with Kaminak Gold (KAM.V) CEO Eira Thomas and VP of Corporate Development Tony Reda. Kaminak is unique in that the bear market in precious metals and junior resource equities hasn’t slowed the company down a bit. The company released an impressive feasibility study two weeks ago which demonstrated robust profitability, even at US$1,150/oz, for its flagship Coffee Gold Project in Canada’s Yukon. The feasibility study used a CAD/USD exchange rate of $.78 and the economics of the project significantly improve at the current lower exchange rate of $.69.

CEO Eira Thomas was also quick to point out that nearly half of Kaminak’s outstanding shares are held by strong hands which include mining investment luminaries Ross Beaty and Lukas Lundin (through his Zebra Holdings investment fund) who each hold an 8.29% stake in KAM. Without further ado here is Energy & Gold’s first CEO interview of 2016 with one of the premier gold exploration companies in the world.

CEO Technician: Please tell us about Kaminak and your plans for 2016.

Eira Thomas : We are focused on advancing our flagship Coffee Gold Project in the Canadian Yukon to production. Coffee is an open pit, heap leach gold project with impressive economics. We just released a feasibility study a couple of weeks ago and we will be focused on moving through the permitting process throughout 2016.

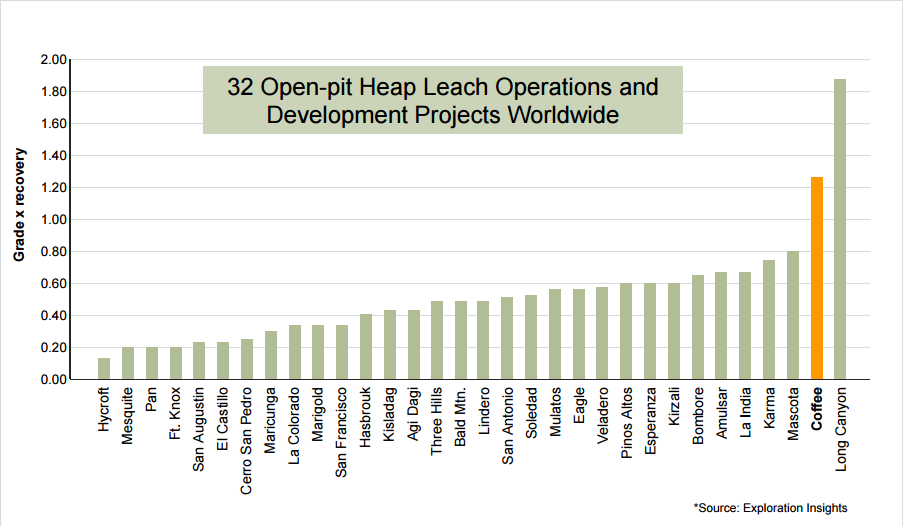

One of the things we like to emphasize with this project is the fact that there is significant resource expansion potential. We see good potential to actually expand well beyond the 10 years (projected mine life for Coffee), there are numerous targets in what we call the Coffee Gold District. Coffee is a world class heap leach, open pit gold project with the 2nd highest recovery grade of any open-pit heap leach project that is either in development or operation right now:

CEO Technician: How much will it cost to complete the infrastructure at Coffee and bring the project up to full scale production?

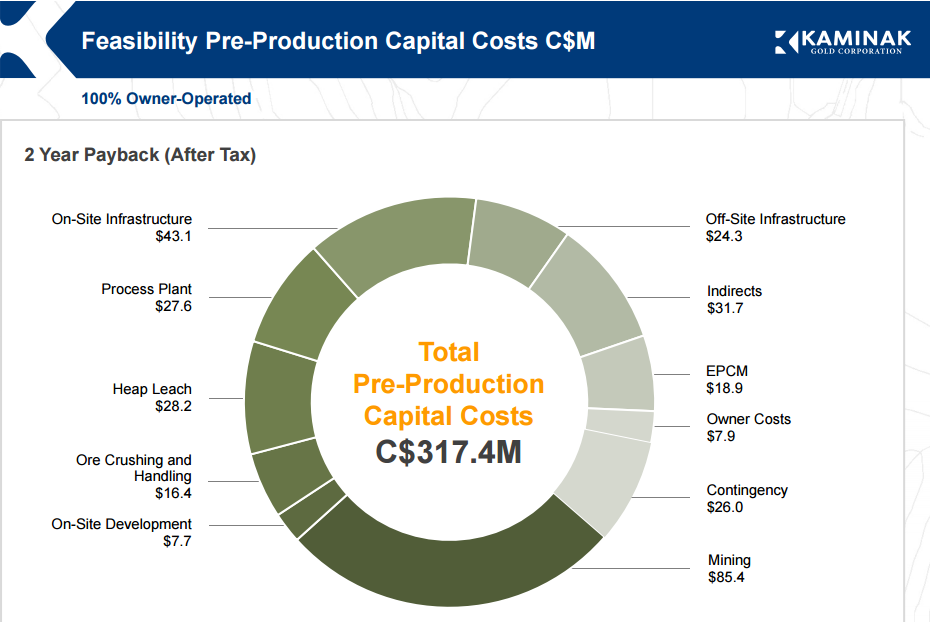

Eira Thomas: The infrastructure is a relatively minor component in our capital spend because we do benefit from having an existing network of road & trail that comes down from Dawson City. Of that 214 km route we only need to actually build 37 km of new road, the rest of it simply requires upgrading. So we are estimating roughly C$25 million to undertake that and we would expect to be able to complete that in advance of starting our construction in mid-2018.

Total capital of course is about C$291 million and that includes the C$25 million road. If you add a C$26 million contingency on that it brings the total capital required to about $C317 million.

CEO Technician: All of the figures you are quoting are in Canadian dollar terms so how has the recent 30%+ drop in the CAD/USD exchange rate affected the economics at the Coffee Project?

Eira Thomas: We have had a lot of questions about that. Suffice it to say it does help the project a lot. We used a .78 CAD/USD exchange rate in our study. About ⅓ of our capital is priced in USD or sensitive to USD so when we think about where we are at today (.71 CAD/USD) we are looking at about a C$25 million bump in capex from the deterioration in the Canadian dollar. However, when you look at the amount of value that’s added to the overall project it far outstrips that capex bump. You’re looking at more than C$100 million in value gain on the other end.

CEO Technician: So basically all of your spending needs are in Canadian dollar terms and the fact that your mining bi-product (gold) holds up well in CAD terms gives you a substantial benefit?

Eira Thomas: We are a Canadian company and we report in Canadian dollars. So we definitely derive a benefit from the Canadian dollar price of gold remaining fairly strong while our capex is in Canadian dollars.

CEO Technician: Do you have any plans for financing scheduled?

Eira Thomas: We have about 24 months of permitting ahead of us so we’re not in a rush to conclude financing arrangements. We are hopeful that this market will improve over that period of time and we will be able to do a fairly traditional form of financing using debt & equity (50% debt/50% equity) as the main components. When you look at our capex relative to our market cap this is a very doable opportunity for Kaminak; we have a market cap of C$150-$C160 million and a capex requirement of about C$300 million.

A lot of junior companies have struggled in this down market because the capex requirements have been way out of their reach in terms of what they could put together. We’re very cognizant that our commitment to our shareholders is to maximize value for our shareholders and that means securing financing in the least dilutive way possible.

CEO Technician: Most investors in the commodity space are very concerned about the long term viability of companies and their ability of navigate another couple years of depressed commodities prices. How much capital does Kaminak need to make it through 2016 and how confident are you that Kaminak will be able to navigate the remainder of this bear market and bring Coffee up to production?

Eira Thomas: I’m very confident. Our share price has sustained itself very well because this is a project that can deliver margins and work in today’s environment. I think we’re in a very strong position and as I said we have another 24 months from needing the C$300 million for capex. We have cash in the bank, we had C$28 million as of September 30th and updated financials will be coming out shortly. We expect to end the year with between C$20-C$25 million in cash and that is more than enough to get us through 2016 and quite likely most of 2017 as well. We are in the process of putting together a final budget for the permitting phase of the project and we will start to communicate that to the market towards the end of Q1 2016. So we’re well cashed up and not looking to do a financing on the heels of this feasibility study. Let’s continue to de-risk this project and get through the permitting process. We’ve got a little bit of flow-through money left in the Treasury that we will spend on exploration to keep the momentum going in the story and overall it should be a very successful 2016.

CEO Technician: One year from today what would you be happy to look back on having accomplished in 2016 and what should investors look forward to from Kaminak this year?

Eira Thomas: Kaminak is a company that has always tried to clearly articulate its strategy. In 2015 our big ambition was to complete our feasibility study on time and on budget and we were able to do that by delivering one of the best feasibility studies in the industry to date so we’re very pleased with that.

Our goals for 2016 are getting our permit applications in and going through adequacy; we do have a very specific plan around our permitting strategy and so we will be working to execute on that plan. At this stage because the market is not paying for exploration we don’t have plans to spend let’s say C$10 million on exploration because even with the best success we won’t necessarily be rewarded for it.

CEO Technician: Is a partnership with a senior or even a buyout on your radar as options for Kaminak? Have you been approached about either of these options?

Eira Thomas: Our objective is to maximize value for our shareholders. We happen to believe that moving this project forward and building it is the right way to do that. If we get an offer in front of us that represents significant value then obviously we would have to bring that back to our shareholders and test the waters. We do try to retain an open mind, however, at this stage it would have to be a pretty attractive offer. We are really comfortable because 43% of the stock is in very safe hands with strategic investors who are all value investors who really like the story and recognize that it’s one of the best gold assets out there right now.

KAM.V (Weekly)

Kaminak shares have held up very well despite the challenging market environment for junior gold explorers. A series of higher lows and higher highs remains intact from the summer low, however, resistance at C$1.00 continues to be formidable.

Kaminak shares have held up very well despite the challenging market environment for junior gold explorers. A series of higher lows and higher highs remains intact from the summer low, however, resistance at C$1.00 continues to be formidable.

CEO Technician: Can you share with us what you’re hearing from other gold mining CEOs and what is your overall outlook for the gold space?

Eira Thomas: From my perspective if we’re not at a bottom we are very close. It’s certainly not easy right now and most companies are thinking hard about risk (geopolitical, geological, etc.) and I think there’s a real focus on trying to find value i.e. where can we find the most value? I’m going to ask our VP of Corporate Development to also comment on this.

Tony Reda: I would say that we are bouncing along the bottom, however, this bottom could last years. Companies are now cutting their reserve grades by mining their highest grade portions and as a result they are depleting their reserves dramatically. So in doing that they then need to seek out new reserves. There’s going to be a supply crunch soon where major mining companies need to find new ounces and they’re going to go to the places that offer the least risk. What projects offer the greatest margin with the least risk? The first filter they’re going to do is going to have them focus on Canada. Canadian producers provide insulation in the form of the exchange rate; we’re producing a US product (gold) using local currency (CAD). I believe this dynamic is setting the stage for a great bull market for acquisitions in the gold mining sector.

Disclaimer:

The EnergyandGold.com employees are not Registered as an Investment Advisor in any jurisdiction whatsoever. EnergyandGold.com employees are not analysts and in no way making any projections or target prices. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a representation by the publisher nor a solicitation of the purchase or sale of any securities. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. The owner, publisher, editor and their associates are not responsible for errors and omissions. They may from time to time have a position in the securities mentioned herein and may increase or decrease. Please always do your own research. Copyright All images in this document are copyrighted by the concerning companies. Still, the owner, publisher, editor and their associates are not responsible for errors and omissions concerning this data. Important This document is distributed free of charge, and may in no circumstances be sold, reproduced, retransmitted or distributed, without written consent from EnergyandGold.com.